- +91-7558644556

Bad Banks: Indian Economy

- Last Updated : 28-Oct-2023

Introduction

Describe a bad bank:, need of bad bank, bad bank in india, significance, any suggestions or correction in this article - please click here ( [email protected] ), related posts:, sebi act - indian economy .

- 11/Sep/2024

Investments In India: Indian Economy

- 02/Sep/2024

Integral Rural Development Program: Indian Economy

Sidbi: indian economy.

- 30/Aug/2024

Dual Government In Bengal (176

- 117964 Views

- 82575 Views

Civil Disobedience Movement

- 81018 Views

Human Values And Ethics

- 73983 Views

Ibrahim Shah (1402 To 1440 Ce)

Types of grasslands: environme, first phase of revolutionary a, equality – explained.

The ABCD of Bad Banks

Context: Budget 2021-22 recommended for setting up an Asset Reconstruction Company (ARC) Ltd and an Asset Management Company (AMC) for dealing with stressed debt, signals a green light for ‘Bad Bank’

Arguments favouring setting up of ‘Bad Banks’

- It benefits Commercial banks: by transferring their bad loans to bad banks and thereby reducing loan book risks and provisioning losses and allows them to refocus on their core business.

- Bad banks are bad, for good: It purchases distressed loans and sell the assets at a profit and thereby returns the money with capital gains to its shareholders.

Arguments against setting up of ‘Bad Banks’ in India

- Bad banks have never worked where industrial, corporate- and conglomerate-level bad loans predominate. E.g. failure of bad loan resolutions in Mexico, Brazil, Argentina.

- No clarity about protection to bank’s management for providing such discounts: especially in the case of Public Sector Banks (PSBs) where gross non-performing assets (NPAs) of 15%.

- PSBs constitute ‘the State’ under Article 12 of the constitution of India, and hence its actions will be scrutinised by the Parliament, the Central Vigilance Commission (CVC) etc.

- Bad banks are just recapitalisation schemes: thus, it cannot clean up the structure of commercial banks as previous recapitalisations of PSBs since 1992-93 failed to do so.

- Ownership issues: Government cannot own bad bank as they will be major sellers of bad debt. Hence equity holders of an entity that buys such debt should be any other party .

Conclusion: Many reforms are needed in law, legal procedures and in freeing PSBs from debilitating State oversight and investigations before the financial system can resolve distressed loans through bad banks.

Answer our survey to get FREE CONTENT

Feel free to get in touch! We will get back to you shortly

- Privacy Policy

- Terms of Service

- Quality Enrichment Program (QEP)

- Intensive News Analysis (INA)

- Topper's UPSC PYQ Answer

- Essay Enrichment Program

- NEEV GS + CSAT Foundation

- News-CRUX-10

- Daily Headlines

- Geo. Optional Monthly Editorials

- Past Papers

- © Copyright 2024 - theIAShub

Talk To Our Counsellor

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

UPSC Coaching, Study Materials, and Mock Exams

Enroll in ClearIAS UPSC Coaching Join Now Log In

Call us: +91-9605741000

Non-Performing Assets (NPA): How serious is India’s bad loan problem?

Last updated on October 10, 2023 by ClearIAS Team

In the best interest of our readers, we have come up with a comprehensive post on NPAs, in which analyze the entire issue in detail.

We will also list out the steps taken by the Government and RBI to counter the situation.

Also read: Infrastructure and Economic Development

Table of Contents

What is a Non-Performing Asset (NPA)?

- You may note that for a bank, the loans given by the bank is considered as its assets. So if the principle or the interest or both the components of a loan is not being serviced to the lender (bank), then it would be considered as a Non-Performing Asset (NPA).

- Any asset which stops giving returns to its investors for a specified period of time is known as Non-Performing Asset (NPA).

- Generally, that specified period of time is 90 days in most of the countries and across the various lending institutions. However, it is not a thumb rule and it may vary with the terms and conditions agreed upon by the financial institution and the borrower.

An example of NPA:

Suppose the State Bank of India (SBI) gives a loan of Rs. 10 crores to a company (Eg: Kingfisher Airlines). Consider that they agreed upon for an interest rate of say 10% per annum. Now suppose that initially everything was good and the market forces were working in support to the airline industry, therefore, Kingfisher was able to service the interest amount. Later, due to administrative, technical or corporate reasons suppose the company is not able to pay the interest rates for 90 days. In that case, a loan given to the Kingfisher Airlines is a good case for the consideration as NPA.

Also read: Loan Loss Provisions

NPAs definition by Reserve Bank of India (RBI)

- An asset, including a leased asset, becomes nonperforming when it ceases to generate income for the bank.

Technical definition by RBI on NPA on different cases

NPA is a loan or an advance where…

👉 Which year are YOU targeting for success in the IAS/IPS/IFS Exam? 🚀

(1) ⇒ UPSC 2025: Prelims cum Mains

(2) ⇒ UPSC 2026: Prelims cum Mains

(3) ⇒ UPSC 2027 Prelims cum Mains

Tip: Know more about ClearIAS Courses (Online/Offline)

- Interest and/ or instalment of principal remain overdue for a period of more than 90 day s in respect of a term loan.

- The account remains ‘ out of orde r’ in respect of an Overdraft/Cash Credit (OD/CC).

- The bill remains overdue for a period of more than 90 days in the case of bills purchased and discounted.

- The instalment of principal or interest thereon remains overdue for two crop seasons for short duration crops.

- The instalment of principal or interest thereon remains overdue for one crop season for long duration crops .

- The amount of liquidity facility remains outstanding for more than 90 days , in respect of a securitisation transaction undertaken in terms of guidelines on securitisation dated February 1, 2006.

- In respect of derivative transactions, the overdue receivables representing positive mark-to-market value of a derivative contract, if these remain unpaid for a period of 90 days from the specified due date for payment.

Categories of Non-Performing Assets (NPAs)

Based upon the period to which a loan has remained as NPA, it is classified into 3 types:

How serious is India’s NPA issue?

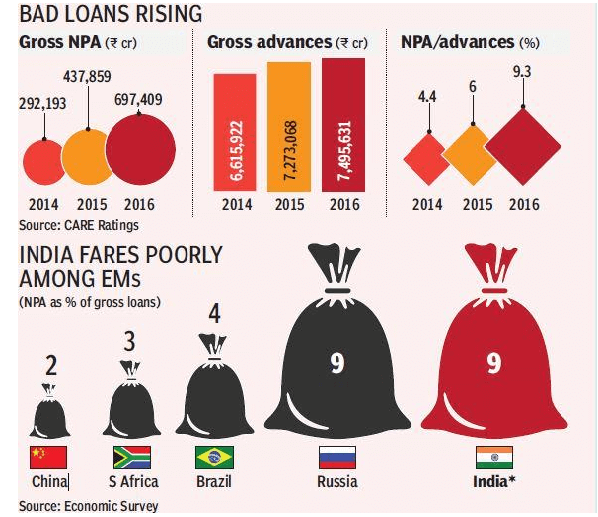

- More than Rs. 7 lakh crore worth loans are classified as Non-Performing Loans in India. This is a huge amount.

- The figure roughly translates to near 10% of all loans given.

- This means that about 10% of loans are never paid back, resulting in substantial loss of money to the banks.

- When restructured and unrecognised assets are added the total stress would be 15-20% of total loans.

- NPA crisis in India is set to worsen.

- Restructuring norms are being misused.

- This bad performance is not a good sign and can result in crashing of banks as happened in the sub-prime crisis of 2008 in the United States of America.

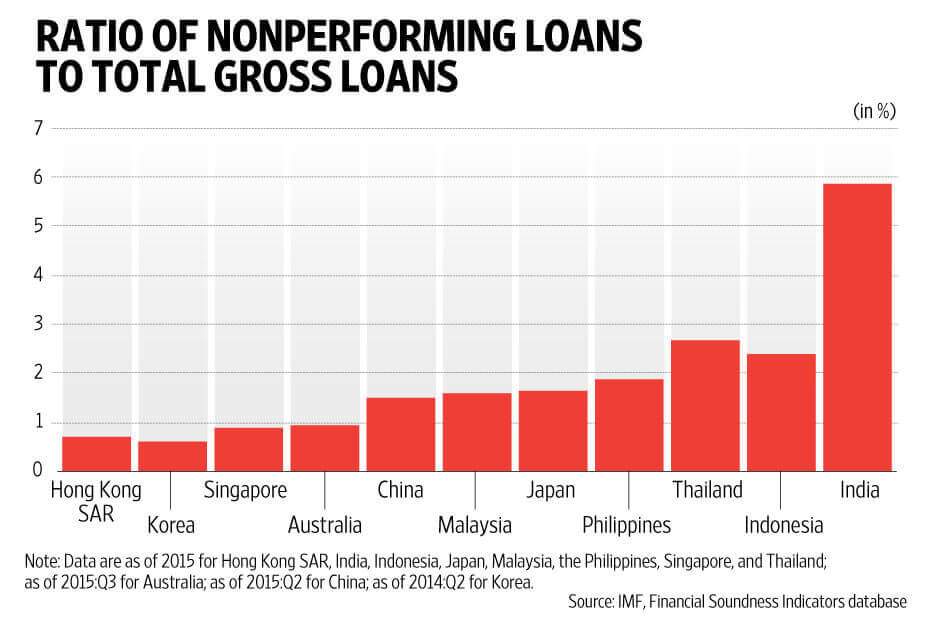

- Also, the NPA problem in India is worst when comparing other emerging economies in BRICS.

What can be the possible reasons for NPAs?

- Diversification of funds to unrelated business/fraud.

- Lapses due to diligence.

- Busines losses due to changes in business/regulatory environment.

- Lack of morale, particularly after government schemes which had written off loans.

- Global, regional or national financial crisis which results in erosion of margins and profits of companies, therefore, stressing their balance sheet which finally results into non-servicing of interest and loan payments. (For example, the 2008 global financial crisis).

- The general slowdown of entire economy for example after 2011 there was a slowdown in the Indian economy which resulted in the faster growth of NPAs.

- The slowdown in a specific industrial segment , therefore, companies in that area bear the heat and some may become NPAs.

- Unplanned expansion of corporate houses during the boom period and loan taken at low rates later being serviced at high rates, therefore, resulting in NPAs.

- Due to mal-administration by the corporates, for example, willful defaulters.

- Due to misgovernance and policy paralysis which hampers the timeline and speed of projects, therefore, loans become NPAs. For example the Infrastructure Sector.

- Severe competition in any particular market segment. For example the Telecom sector in India.

- Delay in land acquisition due to social, political, cultural and environmental reasons.

- A bad lending practice which is a non-transparent way of giving loans.

- Due to natural reasons such as floods, droughts, disease outbreak, earthquakes, tsunami etc.

- Cheap import due to dumping leads to business loss of domestic companies. For example the Steel sector in India.

What is the impact of NPAs?

- Lenders suffer a lowering of profit margins.

- Stress in banking sector causes less money available to fund other projects, therefore, negative impact on the larger national economy.

- Higher interest rates by the banks to maintain the profit margin.

- Redirecting funds from the good projects to the bad ones.

- As investments got stuck, it may result in it may result in unemployment.

- In the case of public sector banks, the bad health of banks means a bad return for a shareholder which means that the government of India gets less money as a dividend. Therefore it may impact easy deployment of money for social and infrastructure development and results in social and political cost .

- Investors do not get rightful returns.

- Balance sheet syndrome of Indian characteristics that is both the banks and the corporate sector have stressed balance sheet and causes halting of the investment-led development process.

- NPAs related cases add more pressure to already pending cases with the judiciary .

What are the various steps taken to tackle NPAs?

NPAs story is not new in India and there have been several steps taken by the GOI on legal, financial, policy level reforms. In the year 1991, Narsimham committee recommended many reforms to tackle NPAs. Some of them were implemented.

The Debt Recovery Tribunals (DRTs) – 1993

To decrease the time required for settling cases. They are governed by the provisions of the Recovery of Debt Due to Banks and Financial Institutions Act, 1993. However, their number is not sufficient therefore they also suffer from time lag and cases are pending for more than 2-3 years in many areas.

Credit Information Bureau – 2000

A good information system is required to prevent loan falling into bad hands and therefore prevention of NPAs. It helps banks by maintaining and sharing data of individual defaulters and willful defaulters.

Lok Adalats – 2001

They are helpful in tackling and recovery of small loans however they are limited up to 5 lakh rupees loans only by the RBI guidelines issued in 2001. They are positive in the sense that they avoid more cases into the legal system.

Compromise Settlement – 2001

It provides a simple mechanism for recovery of NPA for the advances below Rs. 10 Crores. It covers lawsuits with courts and DRTs (Debt Recovery Tribunals) however willful default and fraud cases are excluded.

SARFAESI Act – 2002

The Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002 – The Act permits Banks / Financial Institutions to recover their NPAs without the involvement of the Court, through acquiring and disposing of the secured assets in NPA accounts with an outstanding amount of Rs. 1 lakh and above. The banks have to first issue a notice. Then, on the borrower’s failure to repay, they can:

- Take ownership of security and/or

- Control over the management of the borrowing concern.

- Appoint a person to manage the concern.

Further, this act has been amended last year to make its enforcement faster.

ARC (Asset Reconstruction Companies)

The RBI gave license to 14 new ARCs recently after the amendment of the SARFAESI Act of 2002. These companies are created to unlock value from stressed loans. Before this law came, lenders could enforce their security interests only through courts, which was a time-consuming process.

Corporate Debt Restructuring – 2005

It is for reducing the burden of the debts on the company by decreasing the rates paid and increasing the time the company has to pay the obligation back.

5:25 rule – 2014

Also known as , Flexible Structuring of Long Term Project Loans to Infrastructure and Core Industries . It was proposed to maintain the cash flow of such companies since the project timeline is long and they do not get the money back into their books for a long time, therefore, the requirement of loans at every 5-7 years and thus refinancing for long term projects.

Joint Lenders Forum – 2014

It was created by the inclusion of all PSBs whose loans have become stressed. It is present so as to avoid loan to the same individual or company from different banks. It is formulated to prevent the instances where one person takes a loan from one bank to give a loan of the other bank.

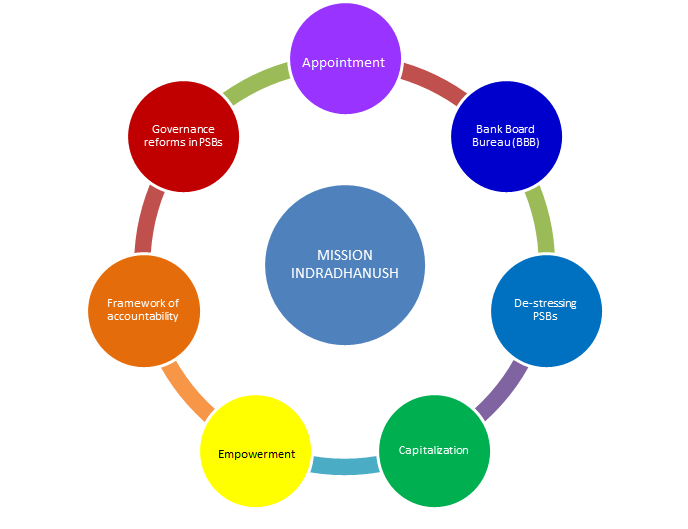

Mission Indradhanush – 2015

The Indradhanush framework for transforming the PSBs represents the most comprehensive reform effort undertaken since banking nationalization in the year 1970 to revamp the Public Sector Banks (PSBs) and improve their overall performance by ABCDEFG.

B-Bank Board Bureau : The BBB will be a body of eminent professionals and officials, which will replace the Appointments Board for the appointment of Whole-time Directors as well as non-Executive Chairman of PSBs

C-Capitalization: As per finance ministry, the capital requirement of extra capital for the next four years up to FY 2019 is likely to be about Rs.1,80,000 crore out of which 70000 crores will be provided by the GOI and the rest PSBs will have to raise from the market.

D-DEstressing: PSBs and strengthening risk control measures and NPAs disclosure.

E-Employment: GOI has said there will be no interference from Government and Banks are encouraged to take independent decisions keeping in mind the commercial the organizational interests.

F-Framework of Accountability: New KPI(key performance indicators) which would be linked with performance and also the consideration of ESOPs for top management PSBs.

G-Governance Reforms : For Example, Gyan Sangam, a conclave of PSBs and financial institutions. Bank board Bureau for transparent and meritorious appointments in PSBs.

Strategic debt restructuring (SDR) – 2015

Under this scheme banks who have given loans to a corporate borrower gets the right to convert the complete or part of their loans into equity shares in the loan taken company. Its basic purpose is to ensure that more stake of promoters in reviving stressed accounts and providing banks with enhanced capabilities for initiating a change of ownership in appropriate cases.

Asset Quality Review – 2015

Classify stressed assets and provisioning for them so as the secure the future of the banks and further early identification of the assets and prevent them from becoming stressed by appropriate action.

Sustainable structuring of stressed assets (S4A) – 2016

It has been formulated as an optional framework for the resolution of largely stressed accounts . It involves the determination of sustainable debt level for a stressed borrower and bifurcation of the outstanding debt into sustainable debt and equity/quasi-equity instruments which are expected to provide upside to the lenders when the borrower turns around.

Insolvency and Bankruptcy code Act-2016

It has been formulated to tackle the Chakravyuaha Challenge ( Economic Survey ) of the exit problem in India. The aim of this law is to promote entrepreneurship, availability of credit, and balance the interests of all stakeholders by consolidating and amending the laws relating to reorganization and insolvency resolution of corporate persons, partnership firms and individuals in a time-bound manner and for maximization of value of assets of such persons and matters connected therewith or incidental thereto.

Pubic ARC vs. Private ARC – 2017

This debate is recently in the news which is about the idea of a Public Asset Reconstruction Companies (ARC) fully funded and administered by the government as mooted by this year’s Economic Survey Vs. the private ARC as advocated by the deputy governor of RBI Mr. Viral Acharya. Economic survey calls it as PARA (Public Asset Rehabilitation Agency) and the recommendation is based on a similar agency being used during the East Asian crisis of 1997 which was a success.

Bad Banks – 2017

Economic survey 16-17 , also talks about the formation of a bad bank which will take all the stressed loans and it will tackle it according to flexible rules and mechanism. It will ease the balance sheet of PSBs giving them the space to fund new projects and continue the funding of development projects.

The need of the hour to tackle NPAs is some urgent remedial measures. This should include:

- Technology and data analytics to identify the early warning signals.

- Mechanism to identify the hidden NPAs.

- Development of internal skills for credit assessment.

- Forensic audits to understand the intent of the borrower.

Article by: Nishant Raj. The author is an IIT Kharagpur Alumnus.

Best-Selling ClearIAS Courses

Upsc prelims cum mains (pcm) gs course: unbeatable batch 2025 (online), rs.75000 rs.29000, upsc prelims cum mains (pcm) gs course: ultimate batch 2025 (online), rs.95000 rs.49000, upsc prelims cum mains (pcm) gs course: ultimate batch 2026 (online), rs.115000 rs.59000, upsc prelims cum mains (pcm) gs course: ultimate batch 2027 (online), rs.125000 rs.69000.

About ClearIAS Team

ClearIAS is one of the most trusted learning platforms in India for UPSC preparation. Around 1 million aspirants learn from the ClearIAS every month.

Our courses and training methods are different from traditional coaching. We give special emphasis on smart work and personal mentorship. Many UPSC toppers thank ClearIAS for our role in their success.

Download the ClearIAS mobile apps now to supplement your self-study efforts with ClearIAS smart-study training.

Reader Interactions

June 11, 2017 at 5:13 am

Very Deeply Elaborated with Details

January 30, 2018 at 8:24 pm

This is “THE BASE” of Current economy, for technical background people.

June 29, 2018 at 1:13 am

In mission indradhnush It’s E for Empowerment not employment… Correct me if I am wrong

November 30, 2018 at 6:09 pm

January 2, 2019 at 11:08 am

Please seen that pic frnd it has represented the correct form..

February 27, 2020 at 10:25 am

Strict action should be taken against froud companies and hereafter loan amount should be deducted automatically from company account.Company and related person should not be allowed to open an account in other bank.Cash tranziction should be not be allowed.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Don’t lose out without playing the right game!

Follow the ClearIAS Prelims cum Mains (PCM) Integrated Approach.

Join ClearIAS PCM Course Now

UPSC Online Preparation

- Union Public Service Commission (UPSC)

- Indian Administrative Service (IAS)

- Indian Police Service (IPS)

- IAS Exam Eligibility

- UPSC Free Study Materials

- UPSC Exam Guidance

- UPSC Prelims Test Series

- UPSC Syllabus

- UPSC Online

- UPSC Prelims

- UPSC Interview

- UPSC Toppers

- UPSC Previous Year Qns

- UPSC Age Calculator

- UPSC Calendar 2025

- About ClearIAS

- ClearIAS Programs

- ClearIAS Fee Structure

- IAS Coaching

- UPSC Coaching

- UPSC Online Coaching

- ClearIAS Blog

- Important Updates

- Announcements

- Book Review

- ClearIAS App

- Work with us

- Advertise with us

- Privacy Policy

- Terms and Conditions

- Talk to Your Mentor

Featured on

and many more...

ClearIAS Programs: Admissions Open

Thank You 🙌

UPSC CSE 2025: On May 25, 2025

Subscribe ClearIAS YouTube Channel

Get free study materials. Don’t miss ClearIAS updates.

Subscribe Now

IAS/IPS/IFS Online Coaching: Target CSE 2025

Cover the entire syllabus of UPSC CSE Prelims and Mains systematically.

- Our Selections

- About NEXT IAS

- Director’s Desk

- Advisory Panel

- Faculty Panel

- General Studies Courses

- Optional Courses

- Interview Guidance Program

- Postal Courses

- Prelims Test Series

- Mains Test Series (GS & Optional)

- ANUBHAV (All India Open Mock Test)

- Daily Current Affairs

- Current Affairs MCQ

- Monthly Current Affairs Magazine

- Previous Year Papers

- Down to Earth

- Kurukshetra

- Union Budget

- Economic Survey

- Download NCERTs

- NIOS Study Material

- Beyond Classroom

- Toppers’ Copies

- Student Portal

- Recently, the Finance Ministry said that the National Asset Reconstruction Company Ltd. (NARCL), set up to take over large bad loans of more than 500 crore from banks, will pick up the first set of such non-performing assets (NPAs) in July.

- NARCL is a special purpose asset reconstruction company for taking over the large value NPA accounts (above 500 crore) from banks.

- Its formation was announced in the Union Budget for 2021-22 , is intended to resolve stressed loans amounting to about 2 lakh crore, of which fully provisioned assets of about 90,000 crore are expected to be transferred to it from lenders in the first phase.

- NARCL has shareholding from 15 Indian lenders and Canara Bank is the sponsor of this Asset Reconstruction Company (ARC).

- While public sector banks have taken a majority stake in NARCL , India Debt Resolution Company Ltd (IDRCL) will be majorly owned by private sector banks.

- Approvals granted : The NARCL, which will acquire the bad loans from banks, and the India Debt Resolution Company Ltd. which will then manage these assets and seek to enhance their value have secured necessary approvals and permissions.

What is a Bad Bank?

- A bad bank is simply an entity which specialises in handling bad loans or NPAs.

- It is basically an entity which buys the NPAs of commercial banks and tries to recover at least a part of the value of such NPAs.

- Usually, banks discount the book value of NPAs w hen they are transferred to a bad bank. After that, whatever recovery is possible from the bad loan becomes the earnings of the bad bank.

- Unlike commercial banks , bad banks do not undertake deposits, lending or other usual banking operations.

- Another name for a bad bank is Asset Reconstruction Company (ARC). It is a company which buys the bad loans of banks or any other financial institution, to let them clear their books and resume lending.

Rationale for a bad bank

- A bad bank can take over the bad loans of the bank, thereby freeing up the bank from the provisioning requirements.

- This means since the banks are not required to provision for the bad loans, the same money can be utilised for lending purposes.

- This deposit can be used towards lending.

- Similarly, not all advances banks make are withdrawn immediately from the accounts. Therefore, a fraction of such loans can be used to advance further credi t. Therefore, the more money banks have, the more they can advance to the needy.

- In contrast, banks are not in the business of recovery; therefore, their capability to resolve the loans is minimal.

- Economic slowdown : Reports have pointed to a potential increase in stressed assets due to economic slowdown in India. Combined with the COVID-induced lockdown, this may create a situation in which the NPAs might increase to an unsustainable limit.

- This requires a bullish sentiment in the economy.

- A bad bank can provide such an impetus to the industry by freeing up the books of banks.

- With the formation of a bad bank, it is expected that this amount can be utilised elsewhere, including towards public welfare and infrastructure creation.

Issues associated with the bad bank

- Shifting the problem : A bad bank is expected to take over the debts of commercial banks under it. However, to what extent it will be successful in resolving the NPA crisis is not clear. This is because almost all of the remedies which are available in the market have been tried by the existing commercial banks. Therefore, the bad bank can only be expected to aggregate, but not resolve the problem.

- Haircut for the banks : When the bad loans are being taken over by a bad bank, the banks are expected to transfer such a loan at a discount to its original value. In such a scenario, the value of discount might prove to be controversial as both the entities, i.e. commercial bank as well as the bad bank, are being financed by the exchequer and are subject to public scrutiny. Also, banks have been cautious of taking big hair cuts because of the scrutiny from the 3 Cs (CBI, CVC and CAG).

- Losses for the banks: Similar to the last point, the haircuts taken by the banks would reflect on its profit and loss account and affect its profitability. This might raise questions on both the management of the bank as well as its decision making regarding both earlier and future haircuts.

- Fear of unethical practices : Since there would be pressure on the bad bank to perform, it is possible that the employees might turn towards unethical practices to boost recovery out of a bad loan. This has been a continuing problem earlier as there have been reports of harassment of the banks’ clients , who were unable to pay their dues.

Way Forward

- Usually the cause of bad loans has been traced to reckless lending undertaken by the banks to meet their lending targets.

- Asset Quality Review: While the spike in NPAs was a result of RBI-mandated Asset Quality Review, it is to be understood that the process was a mere recognition of the extent of the problem facing the financial sector of India. It is important to gauge the extent of the issue if corrective actions are expected to yield results.

- It constitutes Recognition of NPAs, Resolution of bad loans and recovery of value from the assets, Recapitalisation of the banks by the government and Reforms in the banking sector.

- Apart from that, the government has also come up with various other schemes like Indradhanush plan and Gyan sangam (meeting between government officials and the bank officials to understand and resolve the issues plaguing banking sector.

| , on which both principal or interest is unpaid for a specified period of time. . : A sub-standard asset is one which is classified as an NPA for a period not exceeding twelve months. : A doubtful asset is one which has remained as an NPA for a period exceeding twelve months. A loss asset is one where loss has already been identified by the bank or an external institution, but it is not yet completely written off, due to its recovery value, however little it may be. |

Editorial Analysis

- Strengthening Industrial Safety

- India’s Widening Trade Deficit

- Enhancing Logistics Efficiency

- Deregulating Non-Subsidised Fertilisers in India

- India’s Demographic Dividend & Employment Challenges

Headlines of the Day

- Headlines of the Day 25-09-2024

- Headlines of the Day 24-09-2024

- Headlines of the Day 23-09-2024

- Headlines of the Day 21-09-2024

- Headlines of the Day 20-09-2024

Other News of the Day

- News In Short-24-09-2024

- Transit Oriented Development (TOD)

- Fifth Anniversary of Coalition for Disaster Resilient Infrastructure (CDRI)

- Wildlife Habitats Development Scheme

- Warren Hastings: First Governor General of Bengal and Pioneer of British India

- The Four Spheres of The Earth

- Rossby Waves

- 1. India: General Introduction

- COP26- Glasgow Conference

Bad Bank launched for stressed assets as a measure to clean up bank books

About Bad banks :

- A Bad Bank houses Bad loans or Non-Performing Assets (NPA). The idea of Bad Bank was implemented in countries like Sweden, Finland, France, Germany, Indonesia etc.

- Even with Bad Bank structure, the Non-Performing Assets (NPA) losses do not go away. It needs to be shared between investors, taxpayers of these banks in general and those of the bad bank.

- A bad bank conveys the impression that it will function as a bank but has bad assets to start with.

- Technically, a bad bank is an Asset Reconstruction Company (ARC) or an Asset Management Company (AMC) that takes over the bad loans of commercial banks, manages them and finally recovers the money over a period of time.

- The bad bank is not involved in lending and taking deposits, but helps commercial banks clean up their balance sheets and resolve bad loans.

- The takeover of bad loans is normally below the book value of the loan and the bad bank tries to recover as much as possible subsequently.

What are the functions of Bad banks?

Commercial and Public Sector Banks (PSBs) sell their NPAs to the bad bank. The bad bank manages the NPAs/bad loans and finally recovers the money over time. The takeover of bad loans is normally below the book value of them. These banks are not involved in activities like lending and taking deposits.

For example, consider a steel plant’s loan with SBI, turned into an NPA. Bad bank purchases this NPA from the SBI. After that, the bad bank appoints domain experts to manage the assets of the plant with an aim to maximize revenues and cut losses. This is called reconstruction and increases the economic value of the plant. When the bad bank sells this plant, it will recover more money.

Origin of Bad Bank Concept

The concept of a bad bank was pioneered at the Pittsburgh-headquartered Mellon Bank in 1988. Bad Bank would set up as a separate entity that would buy the Non-Performing Asset from other banks to free up their books for fresh lending. It is focused on the task of recovery.

A bank may accumulate a large portfolio of debts or other financial instruments which unexpectedly become at risk of partial or full default. A large volume of non-performing assets usually make it difficult for the bank to raise capital, for example through sales of bonds.

In these circumstances, the bank may wish to segregate its “good” assets from its “bad” assets through the creation of a bad bank.

Bad Bank Structure – IBA Proposal

The ‘Bad Bank’ will be a 2 tiered structure.

- There will be an Asset Reconstruction Company (ARC) backed by the Government which would buy bad loans from banks and issue Security Receipts to the Banks.

- As per RBI guidelines, ARC will hold Security Receipts of 15%.

- Banks will get 15% of the cash and will hold 85% of Security Receipts. Hence it is called 15:85 structure.

- There will be an Asset Management Company (AMC).

- AMC would be run by public and private bodies which includes banks as well.

- Turnaround professionals.

Need in India:

- With the pandemic hitting the banking sector, the RBI fears a spike in bad loans in the wake of a six-month moratorium it has announced to tackle the economic slowdown.

- Professionally-run bad banks, funded by the private lenders and supported by the government, can be an effective mechanism to deal with Non-Performing Assets (NPA).

- The presence of the government is seen as a means to speed up the clean-up process.

- Financial Stability Report (FSR) : The RBI noted in its recent FSR that the gross NPAs of the banking sector are expected to shoot up to 13.5% of advances by September 2021, from 7.5% in September 2020.

- The committee noted that companies in sectors such as retail trade, wholesale trade, roads and textiles are facing stress.

- Sectors that have been under stress pre-Covid include Non-Banking Financial Company (NBFC), power, steel, real estate and construction.

- International Precedents: Many other countries had set up institutional mechanisms to deal with a problem of stress in the financial system.

Disadvantages for establishing bad banks

- No takers: When there are no takers for bad assets, so why have a bad bank;

- Fire Sale Externality: The regular bank usually transfers the toxic assets to the bad bank at a discounted value. This lowers the market value of similar assets held by other banks. This forces the other banks to liquidate similar assets at lower prices thereby starting a vicious cycle which pushes prices below their fundamentals. This is known as fire sale externality.

- Reduces Bank’s efficiency: If banks become aware that there will always be a bad bank to takeover and manage their toxic assets, then banks will tend to be less careful while granting loans.

- Political Interference: Since toxic assets are held by bad banks, these bad banks are prone to political interferences by politicians supporting the chronic debtors. Unless the legislations creating the bad banks enact provisions to prevent such interferences, the functioning of the bad banks will be seriously jeopardized.

- Huge Costs: Huge costs are involved in the creation and running of bad banks, transfer of toxic assets from the regular bank to the bad bank, restructuring the toxic assets, eventual disposal of the toxic assets etc. Many of these costs can be avoided, if the toxic assets are left with the regular bank itself.

- Tight Fiscal Position: Why waste government resources when the Covid-19 crisis has put tremendous strain on resources. In an economy hit by the pandemic, it is hard to find buyers for distressed assets.

- Price Discovery: The price at which toxic assets will be transferred will not be market-determined and price discovery might not happen properly;

- Multiplicity of Agencies: ARCs are already there for the purpose.

- Lack of skilled staff: Sufficient number of skilled and specialized staff that is necessary to actively manage these stressed assets may not readily available. Even if available, engaging them would be a very costly affair.

- Not a Panacea: Creating Bad Bank is like shifting the problem from one head to other without addressing the structural and fundamental issues of NPA.

Advantages for establishing Bad Banks

- Revival of Regular Banks: If there are no takers for the assets, then it makes sense to let domain experts deal with toxic assets till these can be sold. The regular bank after transferring its toxic assets to the bad bank can focus on its long term core operations without worrying about those toxic assets.

- Good-books of stakeholders & agencies: Cleaning up of the balance sheet of the regular bank by transferring the toxic assets to the bad bank will have a positive impact about the regular bank in the eyes of the credit rating agencies, investors, lenders, borrowers and depositors.

- Growth of Business: Transfer of Toxic Assets would enable it to involve itself in profitable/growth oriented business activities.

- Centralization of bad assets: The ownership of the toxic assets and its collaterals are centralized in the bad bank thereby facilitating better management of those assets.

- Speedy Disposal of Assets: The bad bank, which is created as a specialized agency to deal with toxic assets, hires specialized personnel to manage those assets. This helps in the speedy disposal of those assets with minimum loss in the most efficient manner.

- Curbs risks of Failure: The good bank-good bank scheme minimizes contagion risks. Since the toxic assets of the regular bank are removed from its balance sheet and transferred to a new entity, the Non- performing assets of the regular bank are less exposed to risks of failure.

- Better Price Discovery: Price discovery is an important component of the deal and a bad bank is best suited for fixing price. A good bank should make additional provision in case the discovered cost is less than the book value and they want to retain it on its books.

Difference between Bad Bank and ARC (Asset Reconstruction Company):

| Bad Bank | Asset Reconstruction Company |

| A bad bank is simply a corporate structure that isolates liquidity and high-risk assets held by a bank or a financial organisation, or perhaps a group of such lenders. | ARCs are registered with RBI under Section-3 of the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002. |

| Bad Banks if established can take over all types of stressed assets | ARCs will only buy those pools of stressed assets if they see business-viability of those pools. |

| Currently the Bad banks are at conceptual stage and yet to be materialized | Currently, there are many licensed ARCs in India |

Source: Live Mint

You can find many articles on ECONOMY (part of GS III ) in our website. Go through these articles share with your friends and post your views in comment section.

Share this:

- Click to share on Twitter (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on Telegram (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

- Click to email a link to a friend (Opens in new window)

- Click to share on X (Opens in new window)

- Personal Data Protection Bill 2019

- Andaman and Nicobar

Leave a Reply Cancel reply

Shopping Cart

No products in the cart.

Bad banks- How Viable is the Idea?

From Current Affairs Notes for UPSC » Editorials & In-depths » This topic

In the wake of economic contraction and the concerns of an upcoming spike in NPAs , the Indian Banks Association proposed setting up a bad bank with a capital of 10,000 crore INR . This idea has been coming up every time a financial crisis threatens the banking sector. This time, the RBI has agreed to look into the possibility of establishing a bad bank- inviting criticisms from some sectors but encouragement from others.

What is a bad bank?

- Bad bank is a bank set up to buy bad loans and stressed assets without liquidity from other financial institutions.

- It is basically an asset reconstruction company (ARC) or an asset management company (AMC) that buys up the bad loans from a bank or a financial institution that has high proportion of NPAs or non-performing assets.

- This purchase is usually at prices below the book value of the loan.

- This bad loan is then managed by the bad bank until it recovers the money over a time period.

- This process clears up the balance sheet of the selling bank. However, the bank is required to take a haircut in this process.

- Bad banks are not involved in taking deposits or in lending . Their sole purpose is to soak up the bad loans from other banks and resolve them. They have been described as a ‘neelkanth’ to absorb the ‘poisoned stressed assets’ .

- These are generally set up in times of crises in an attempt to recuperate financial institutions’ reputation and their wallet .

- The first such bad bank, Grant Street National Bank , was created in 1988 to clean up the Mellon Bank in the USA.

- The idea of bad bank was also famously used during the 2008 financial crisis to shore up private institutions with a lot of problematic assets .

- Bad banks have been formed elsewhere also. Eg: National Asset Management Agency of the Republic of Ireland , etc.

Express Learning Programme (ELP)

- Optional Notes

- Study Hacks

- Prelims Sureshots (Repeated Topic Compilations)

- Current Affairs (Newsbits, Editorials & In-depths)

- Ancient Indian History

- Medieval Indian History

- Modern Indian History

- Post-Independence Indian History

- World History

- Art & Culture

- Geography (World & Indian)

- Indian Society & Social Justice

- Indian Polity

- International Relations

- Indian Economy

- Environment

- Agriculture

- Internal Security

- Disasters & its Management

- General Science – Biology

- General Studies (GS) 4 – Ethics

- Syllabus-wise learning

- Political Science

- Anthropology

- Public Administration

SIGN UP NOW

How did the idea originate in India?

- This idea was mooted as a PPP (public private partnership) in the 2016-17 Economic Survey as a way to tackle the ‘twin balance sheet’ problem .

- It was put forth in 2018 too but it didn’t take shape.

- The Sunil Mehta panel proposed a 5 pronged approach for bad loan resolution. It also proposed a ‘Sashakt India Asset Management Company’ to manage large NPAs .

- The idea often comes up for debate especially when the banking sector is looking at a projected rise in stress in the near term.

- The current pandemic -induced crisis has increased concerns about an impending recession , bringing with it the idea of bad bank into debate.

Prelims Sureshots – Most Probable Topics for UPSC Prelims

A Compilation of the Most Probable Topics for UPSC Prelims, including Schemes, Freedom Fighters, Judgments, Acts, National Parks, Government Agencies, Space Missions, and more. Get a guaranteed 120+ marks!

Why is it a good idea?

- The entity will help bring in an expert and objective view of the stressed asset problem.

- This could help prevent depositors from losing money .

- In previous asset quality review of banks conducted by the RBI , several banks were found to hide bad loans to show a healthy balance sheet . This practice can be discouraged if a bad bank is set up to clean up the balance sheets.

- It will enable banks to focus more on credit flow instead of focusing just on loan recovery. It will increase banks’ confidence to lend more and take risks.

- It could help boost credit growth – especially in the aftermath of the pandemic.

- It could also reduce the recapitalization requirement of public sector banks .

- The bad bank concept would not only help the financial service ecosystem survive but could also contribute to the growth aspirations and growth potential of India.

- Asset quality improvement has been led by write offs according to the Trends and Progress of Banking in India , an annual report from RBI. Over the last 5 years , a lot of NPAs have been written off. Many of these are still in the recovery process and don’t show up as gross NPAs. For example, the banks have written off 37 trillion INR in FY20 .

- In addition to this, the NPAs could reach 8% according to RBI projections.

- Exploring bad bank idea could help the banking sector tide through such a scenario.

Why is it a bad idea?

- Concerns have been raised about certain points in the proposal for bad banks. Eg: uptake of fraudulent assets , buying of the stressed assets at book value instead of a discounted value, etc. This has led some to consider the idea as simply escaping responsibility .

- Some opine that the idea of bad bank is like ‘kicking the can somewhere else’ i.e. shifting the decision making task on stressed assets to some other entity’s shoulder. This tendency, especially among public sector banks , arises from the fear of investigations by the 4Cs :

- Raghuram Rajan , in his book I Do What I Do , criticised the idea as just ‘ shifting loans from one government pocket to another’. He questioned how this strategy could improve matters.

- The bad loan problem in India is not a new one, we have been struggling with it for 3 decades And the use of bad bank solves the NPA issue only from the bank management point of view – not the economy’s point of view.

- Previous attempts, like the Industrial Reconstruction Bank of India (IRBI) that was created to help out sick industries, have failed in India. This failure was mainly due to procedural issues .

- The idea of bad bank would work best if India has a deep debt market with ARCs competing against each other to enable good pricing. Unfortunately, India doesn’t have this.

- Though the bad bank idea can protect the depositor money, the shareholders and bondholders stand to lose money. In case of the bad bank being in the public sector , the taxpayer money would be lost.

- Critics have argued that these banks could lead to a moral hazard as it may encourage financial institutions to take undue risks knowing that a bad bank bailout would serve as a safety net.

- In some countries, the idea has resulted in encouraging reckless lending .

- Some say that setting up a bad bank now would be too premature as the true picture of NPAs is yet to be seen- given that the Supreme Court-ordered standstill on NPA recognition is still in place.

- If the economy were to rebound in the first half of FY21, in a V shaped curve as suggested by the RBI, the situation may not be dire enough to require a bad bank.

- Even prior to the COVID-induced economic downturn, the bank balance sheets were beginning to improve with regards to asset quality.

- In such a case, capitalizing bad banks generously could be an alarmist reaction according to some critics.

- This would be especially deleterious given the current financial constraints .

- If the post-COVID investment appetite is low, parking public money in bad banks instead of investing it to spur demand would turn out to be a bad call.

Are there any successful examples?

- The TARP or Troubled Asset Relief Program that was introduced after the Lehman Crisis in the USA is considered a success story.

- The Malaysia set up the Danaharta , a government backed ARC in the aftermath of the Asian crisis . It purchased stressed assets from financial institutions and imposed additional provisioning if the banks don’t sell their assets.

- The recovered cash was returned to the original financial institutions. It allowed for broad consolidation , recapitalization and accountability . It also allowed structural reform of the financial institutions which then went on to facilitate the country’s recovery from the Asian crisis.

- The Danaharta experience is widely considered a successful example of a bad bank. It managed a 58. 7% asset recovery – highest among the Asian countries.

What is the way forward?

- The idea was discussed at the Financial Stability and Development Council meeting in 2020, but didn’t find favour. The government stand has been that bad loan resolution should be market-led .

- The RBI was in favour of the ARCs in 2002 but rejected the bad bank idea a few years back. However, the idea is being considered by the central bank.

- If it were to be set up, certain things have to be considered going forward.

- RBI should have an effective oversight over the initiative.

- If India chooses to set up a bad bank, it should be a one-time move .

- Improvement of governance must be mandated. The bank boards – especially of the public sector banks- must be made truly independent to address the issue of governance. The banks must be given the confidence to take bona fide commercial decision .

- Several Indian experts have also highlighted the need to have experienced professionals , equipped with sufficient skills to ascertain a unit’s viability , manage this initiative. This requires knowledge of the unit’s sector and many bankers are deficient with regards to this.

- Irrespective of whether or not India opts for the bad bank route, developing better capacity for sector appraisal and analytical skills among the lenders is vital.

- Also the system that initially gave rise to the NPA problem originally must be reformed for pulling out the issue by its root. This structural reform must be simultaneously implemented along with the bad bank.

- Certain learnings from the Danaharta experience could be noted for emulation:

- It wound down in 2005 i.e. didn’t last for perpetuity .

- A single entity was the sole owner of a stressed asset instead of the asset being coordinated among several creditors. This helped in expediting decision making and resolutions . Sometimes, these were accompanied by legislative changes .

- The Danaharta employed experienced industry professionals – both from the domestic sector and from foreign industry . They also included distressed debt specialists .

- Liquidation route was used only when all other efforts failed and restructuring was used wherever viable.

- There are also other alternatives :

- Many argue that the IBC framework has removed the need for a bad bank. The IBC itself provides a process that is transparent and open- enough for resolving insolvencies. However, this system is still settling in and moreover, has been put in abeyance.

| Via IBC | 42.5% |

| Via | 14.5% |

| Via | 5.3% |

| Via Tribunals | 3.5% |

- Viral Acharya , former Deputy Governor of RBI, proposed 2 ways of resolving bad loans:

- A private asset management company (PAMC) – could be used if the stress is such that the assets could recover economic value in the short run itself with just a moderate level of debt forgiveness .

- A national asset management company (NAMC)- could be used if the issue is not just excess capacity but also economic unviability of the assets. Eg: Power sector . The NAMC raises debt to finance the asset and the government would have a minority equity stake in it. Then asset managers could be brought in to revive the asset.

Whether or not the RBI decides to establish a bad bank, there is a pressing need for supporting the financial ecosystem in India if it hopes to come out of the pandemic induced crisis to hit the ground running. The IBC is a viable route in the long run. But to address things in these extraordinary time, a temporary establishment of bad banks can be considered- but with appropriate attempts at reformation, restraints and oversights.

Practice question for mains

NPAs in India could rise as high as 14% as a result of the pandemic induced economic crisis. In this context, examine the need for setting up a bad bank. (250 words)

https://www.youtube.com/watch?v=DKVe3b5x4a8

https://www.youtube.com/watch?v=oaVmJRySkwA

https://www.investopedia.com/terms/badbank.asp

https://www.livemint.com/budget/news/bad-bank-is-a-good-idea-11611105653371.html

https://www.livemint.com/companies/people/lenders-say-this-is-the-right-time-to-create-a-bad-bank-11591894871744.html

https://indianexpress.com/article/explained/npa-bad-bank-balance-sheet-loan-rbi-shaktikanta-das-7151841/

https://www.thehindubusinessline.com/opinion/editorial/beyond-bad-banks/article33650455.ece

https://www.cnbctv18.com/views/why-indias-financial-system-needs-a-neelkanth-to-absorb-poisoned-stressed-assets-4074771.htm

https://m.economictimes.com/industry/banking/finance/banking/sunil-mehta-panel-incorporates-sashakt-india-amc-for-large-npas/articleshow/66637519.cms

https://economictimes.indiatimes.com/news/economy/policy/no-bad-bank-now-panel-suggests-5-point-plan-to-deal-with-npas-says-fm-piyush-goyal/articleshow/64831084.cms

https://www.newindianexpress.com/business/2019/feb/19/india-beats-italy-to-have-worlds-worst-non-performing-loan-ratio-1940897.html

https://www.businesstoday.in/opinion/columns/why-bad-bank-concept-cant-work-in-india-banking-sector-npas/story/425833.html

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.

GET MONTHLY COMPILATIONS

Related Posts

Monetary Policy in India – Objectives, Framework, Committee, Instrumen...

IL&FS/NBFC Crisis – The Need for Financial Sector Reforms

Integration of Credit Card to Unified Payments Interface (UPI) – Need,...

There was a problem reporting this post.

Block Member?

Please confirm you want to block this member.

You will no longer be able to:

- See blocked member's posts

- Mention this member in posts

Please allow a few minutes for this process to complete.

Answer Writing Practice

- Insights IAS Brochure |

- OUR CENTERS Bangalore Delhi Lucknow Mysuru --> Srinagar Dharwad Hyderabad

Call us @ 08069405205

Search Here

- An Introduction to the CSE Exam

- Personality Test

- Annual Calendar by UPSC-2025

- Common Myths about the Exam

- About Insights IAS

- Our Mission, Vision & Values

- Director's Desk

- Meet Our Team

- Our Branches

- Careers at Insights IAS

- Daily Current Affairs+PIB Summary

- Insights into Editorials

- Insta Revision Modules for Prelims

- Current Affairs Quiz

- Static Quiz

- Current Affairs RTM

- Insta-DART(CSAT)

- Insta 75 Days Revision Tests for Prelims 2024

- Secure (Mains Answer writing)

- Secure Synopsis

- Ethics Case Studies

- Insta Ethics

- Weekly Essay Challenge

- Insta Revision Modules-Mains

- Insta 75 Days Revision Tests for Mains

- Secure (Archive)

- Anthropology

- Law Optional

- Kannada Literature

- Public Administration

- English Literature

- Medical Science

- Mathematics

- Commerce & Accountancy

- Monthly Magazine: CURRENT AFFAIRS 30

- Content for Mains Enrichment (CME)

- InstaMaps: Important Places in News

- Weekly CA Magazine

- The PRIME Magazine

- Insta Revision Modules-Prelims

- Insta-DART(CSAT) Quiz

- Insta 75 days Revision Tests for Prelims 2022

- Insights SECURE(Mains Answer Writing)

- Interview Transcripts

- Previous Years' Question Papers-Prelims

- Answer Keys for Prelims PYQs

- Solve Prelims PYQs

- Previous Years' Question Papers-Mains

- UPSC CSE Syllabus

- Toppers from Insights IAS

- Testimonials

- Felicitation

- UPSC Results

- Indian Heritage & Culture

- Ancient Indian History

- Medieval Indian History

- Modern Indian History

- World History

- World Geography

- Indian Geography

- Indian Society

- Social Justice

- International Relations

- Agriculture

- Environment & Ecology

- Disaster Management

- Science & Technology

- Security Issues

- Ethics, Integrity and Aptitude

- Insights IAS Brochure

- Indian Heritage & Culture

- Enivornment & Ecology

GS Paper 3:

Topics Covered: Inclusive growth and issues arising from it.

A key proposal announced in this year’s (2021) Budget, a bad bank to deal with stressed assets in the loss-laden banking system, has received all regulatory approvals.

What is NARCL?

- Setting up of NARCL, the proposed bad bank for taking over stressed assets of lenders, was announced in the Budget for 2021-22.

- The plan is to create a bad bank to house bad loans of ₹500 crore and above, in a structure that will contain an asset reconstruction company (ARC) and an asset management company (AMC) to manage and recover dud assets.

- Majority-owned by state-owned banks, the NARCL will be assisted by the India Debt Resolution Company Ltd (IDRCL), in turn majority-owned by private banks, in resolution process in the form of a Principal-Agent basis.

How is NARCL different from existing ARCs? How can it operate differently?

- The proposed bad bank will have a public sector character since the idea is mooted by the government and majority ownership is likely to rest with state-owned banks.

- At present, ARCs typically seek a steep discount on loans. With the proposed bad bank being set up, the valuation issue is unlikely to come up since this is a government initiative.

- The government-backed ARC will have deep pockets to buy out big accounts and thus free up banks from carrying these accounts on their books.

What is an Asset Reconstruction Company (ARC)?

It is a specialized financial institution that buys the Non-Performing Assets (NPAs) from banks and financial institutions so that they can clean up their balance sheets. This helps banks to concentrate on normal banking activities.

- The asset reconstruction companies or ARCs are registered under the RBI.

Legal Basis:

The Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act , 2002 provides the legal basis for the setting up of ARCs in India.

Capital Needs for ARCs:

- As per amendment made in the SARFAESI Act in 2016, an ARC should have a minimum net owned fund of Rs. 2 crores. The RBI raised this amount to Rs. 100 crores in 2017.

- The ARCs also have to maintain a capital adequacy ratio of 15% of its risk weighted assets.

The total stress in the banking system would be in excess of Rs 15 lakh crore. The banks burdened with stressed assets and limited capital will find it difficult to manage the NPAs. There is also limited capital that the government can provide. This is where the bad bank model would step in and help both the government and banks.

Insta Curious:

The Supreme Court, in 2020, held that the cooperative banks involved in the activities related to banking are covered within the meaning of ‘banking company’ and Parliament has legislative competence to provide for procedure for recovery of loan under the Sarfaesi Act. Read here .

InstaLinks:

Prelims Link:

- What are ARCs?

- What is SARFAESI Act?

- Sudarshan Sen committee is related to?

- About NARCL.

Mains Link:

Discuss the roles and functions of ARCs.

Sources: the Hindu.

- Our Mission, Vision & Values

- Director’s Desk

- Commerce & Accountancy

- Previous Years’ Question Papers-Prelims

- Previous Years’ Question Papers-Mains

- Environment & Ecology

- Science & Technology

- Classroom Programme

- Interview Guidance

- Online Programme

- Drishti Store

- My Bookmarks

- My Progress

- Change Password

- From The Editor's Desk

- How To Use The New Website

- Help Centre

Achievers Corner

- Topper's Interview

- About Civil Services

- UPSC Prelims Syllabus

- GS Prelims Strategy

- Prelims Analysis

- GS Paper-I (Year Wise)

- GS Paper-I (Subject Wise)

- CSAT Strategy

- Previous Years Papers

- Practice Quiz

- Weekly Revision MCQs

- 60 Steps To Prelims

- Prelims Refresher Programme 2020

Mains & Interview

- Mains GS Syllabus

- Mains GS Strategy

- Mains Answer Writing Practice

- Essay Strategy

- Fodder For Essay

- Model Essays

- Drishti Essay Competition

- Ethics Strategy

- Ethics Case Studies

- Ethics Discussion

- Ethics Previous Years Q&As

- Papers By Years

- Papers By Subject

- Be MAINS Ready

- Awake Mains Examination 2020

- Interview Strategy

- Interview Guidance Programme

Current Affairs

- Daily News & Editorial

- Daily CA MCQs

- Sansad TV Discussions

- Monthly CA Consolidation

- Monthly Editorial Consolidation

- Monthly MCQ Consolidation

Drishti Specials

- To The Point

- Important Institutions

- Learning Through Maps

- PRS Capsule

- Summary Of Reports

- Gist Of Economic Survey

Study Material

- NCERT Books

- NIOS Study Material

- IGNOU Study Material

- Yojana & Kurukshetra

- Chhatisgarh

- Uttar Pradesh

- Madhya Pradesh

Test Series

- UPSC Prelims Test Series

- UPSC Mains Test Series

- UPPCS Prelims Test Series

- UPPCS Mains Test Series

- BPSC Prelims Test Series

- RAS/RTS Prelims Test Series

- Daily Editorial Analysis

- YouTube PDF Downloads

- Strategy By Toppers

- Ethics - Definition & Concepts

- Mastering Mains Answer Writing

- Places in News

- UPSC Mock Interview

- PCS Mock Interview

- Interview Insights

- Prelims 2019

- Product Promos

- Daily Updates

Indian Economy

Make Your Note

New Bad Bank Structure

- 17 Sep 2021

- GS Paper - 3

- Monetary Policy

- Banking Sector & NBFCs

Why in News

Recently, the Union Cabinet approved the Rs 30,600 crore guarantee to back Security Receipts issued by National Asset Reconstruction Company Limited (NARCL) for acquiring stressed loan assets.

- The NARCL is a part of a new Bad bank structure that was announced in the Budget 2021.

- NPA refers to a classification for loans or advances that are in default or in arrears.

- NARCL will acquire stressed assets worth about Rs 2 lakh crore from various commercial banks in different phases.

- Public Sector Banks (PSBs) will maintain 51% ownership in NARCL.

- PSBs and Public Financial Institutes (FIs) will hold a maximum of 49% stake in IDRCL. The remaining 51% stake will be with private-sector lenders.

- The NARCL-IDRCL structure is the new bad bank structure.

- Existing ARCs have been helpful in the resolution of stressed assets, especially for smaller value loans.

- Various available resolution mechanisms, including Insolvency and Bankruptcy Code (IBC) , have proved to be useful.

- However, considering the large stock of legacy NPAs , additional options/alternatives are needed and thus, the NARCL-IRDCL structure was announced in the Union Budget 2021.

- The NARCL will first purchase bad loans from banks.

- It will pay 15% of the agreed price in cash and the remaining 85% will be in the form of “Security Receipts”.

- When the assets are sold, with the help of IDRCL, the commercial banks will be paid back the rest.

- The difference between what the commercial bank was supposed to get and what the bad bank was able to raise will be paid from the Rs 30,600 crore that has been provided by the government.

- This guarantee is extended for a period of five years.

- Security receipts are defined under section 2(1) (zg) of SARFAESI Act .

- It means a receipt or other security, issued by an asset reconstruction company to any qualified buyer pursuant to a scheme, evidencing the purchase or acquisition by the holder, thereof, of an undivided right, title or interest in the financial asset involved in securitization.

- The bad bank is an Asset Reconstruction Company (ARC) or an Asset Management Company (AMC) that takes over the bad loans of commercial banks, manages them and finally recovers the money over a period of time.

- The bad bank is not involved in lending and taking deposits, but helps commercial banks clean up their balance sheets and resolve bad loans.

- The takeover of bad loans is normally below the book value of the loan and the bad bank tries to recover as much as possible subsequently.

- That’s because such a bank will get rid of all its toxic assets, which were reducing its profits, in one quick move.

- When the recovery money is paid back, it will further improve the bank’s position. Meanwhile, it can start lending again.

- While recapitalisation and such guarantees are often designated as “reforms”, they are band aids at best.

- The only sustainable solution is to improve the lending operation in PSBs.

- The plan of bailing out commercial banks will collapse if the bad bank is unable to sell such impaired assets in the market. The burden indeed will fall upon the taxpayer.

Orenburg Satellite Map

Popular Destinations in Urals

Explore these curated destinations.

- Visit Our Blog about Russia to know more about Russian sights, history

- Check out our Russian cities and regions guides

- Follow us on Twitter and Facebook to better understand Russia

- Info about getting Russian visa , the main airports , how to rent an apartment

- Our Expert answers your questions about Russia, some tips about sending flowers

Russian regions

- Bashkortostan republic

- Chuvashia republic

- Kirov oblast

- Mari El republic

- Mordovia republic

- Nizhegorodskaya oblast

- Orenburg oblast

- Penza oblast

- Samara oblast

- Saratov oblast

- Tatarstan republic

- Udmurt republic

- Ulyanovsk oblast

- Map of Russia

- All cities and regions

- Blog about Russia

- News from Russia

- How to get a visa

- Flights to Russia

- Russian hotels

- Renting apartments

- Russian currency

- FIFA World Cup 2018

- Submit an article

- Flowers to Russia

- Ask our Expert

Orenburg Oblast, Russia

The capital city of Orenburg oblast: Orenburg .

Orenburg Oblast - Overview

Orenburg Oblast is a federal subject of Russia located on the border of Europe and Asia, in the middle reaches of the Ural River, in the Volga Federal District. Orenburg is the capital city of the region.

The population of Orenburg Oblast is 1,925,000 (2022), the area - 123,702 sq. km.

Orenburg oblast flag

Orenburg oblast coat of arms.

Orenburg oblast map, Russia

Orenburg oblast latest news and posts from our blog:.

22 February, 2024 / The Dolgiye Mountains - One of the Most Beautiful Places in Orenburg Oblast .

4 April, 2019 / Cities of Russia at Night - the Views from Space .

15 March, 2014 / Novotroitsk - industrial city .

History of Orenburg Oblast

About 4,000 years ago, this region was part of the so-called Great Steppe. The nomadic tribes of the Scythians and Sarmatians lived here. They left behind numerous burial mounds. A lot of them have survived to the present day. Archaeologists found hundreds of mounds near Orsk, in Ileksky and Sharlyksky districts.

In 1911, in the mound near the village of Prokhorovka in Sharlyksky district, archaeologists found a silver plate dating from early 3,000 B.C. and other ancient items. Today, some of them are exhibited in regional museums of local study.

From the 1730s, when the Kazakh and Bashkir tribes voluntarily joined the Russian Empire, the territory of the present Orenburg region was rapidly populated by settlers from the central regions of the country.

In 1743, the frontier fortress of Orenburg was founded. It became the administrative center of Orenburg gubernia (province) that included part of present Bashkortostan, Tatarstan, Chelyabinsk and Samara regions, Kazakhstan. The region had an advantageous geographical location, between Europe and Asia.

On December 7, 1934, Orenburg Oblast was formed. After it, an active industrial development of the region began. Kaspiysk-Orsk oil pipeline was constructed, large plants of non-ferrous metallurgy, heavy machine building and chemical industry were built. In 1938-1957, the region was called Chkalov Oblast.

The 1960s and 1970s were a special period in developing of industrial Orenburg region, especially of heavy industry, light and food industries. In 1967, a unique Orenburg gas condensate deposit was discovered.

Beautiful nature of Orenburg Oblast

Sunset in the Orenburg region

Author: B.Yartsev

Orenburg Oblast nature

Author: Ignatenko S.P.

Camping in Orenburg Oblast

Author: Shepelev Sergei

Orenburg Oblast - Features

Orenburg Oblast occupies the south-eastern edge of the East European Plain, the southern part of the Urals and Southern Trans-Urals. The length of the region from west to east is 755 km, from north to south - 425 km. In the south, it borders with the Republic of Kazakhstan. The length of the state border is 1,876 km.

The national composition according to the 2010 census: Russians (75.9)%, Tatars (7.6%), Kazakhs (6%), Ukrainians (2.5%), Bashkirs (2.3%), Mordva (1.9%). The largest cities and towns are Orenburg (572,300), Orsk (223,300), Novotroitsk (81,200), Buzuluk (85,800), Buguruslan (46,900).

The climate is continental. The average temperature in January is about minus 11.8 degrees Celsius, in July - plus 22.3 degrees Celsius.

Orenburg Oblast is rich in mineral resources. In total, more than 2,500 deposits of 75 different raw materials have been discovered and developed. Oil, charcoal, ferrous and non-ferrous metals are key resources. The largest in Russia gas condensate deposit is located here. Oil is extracted (in the Ural area), iron ore (Khalilovskoye deposit), copper (Guyskoye deposit) and nickel ores, asbestos (Kiyembayevskoye deposit).

The leading industries of the local economy are fuel, ferrous and non-ferrous metallurgy, chemical, oil chemical and food industries. Agriculture is presented by crops growing and cattle breeding. Orenburg oblast has about 5.5% of all Russian farmland, it is considered as one of the main granaries of Russia. More than 3 million tons of grain crops are grown annually here.

Orenburg Oblast is located at the crossroads of numerous railroads and highways making it a major transportation hub. Russia’s major gas and oil pipelines, connecting Siberian gas and oil fields to the European part of the country and other European countries, pass through the territory of this region.

Attractions of Orenburg Oblast

- Sol-Iletsk - a small town and spa resort located on the border with Kazakhstan,

- Gai - a mud-bath resort located about 40 km from Orsk,

- Orenburg downy shawls plant,

- Urtazymskie rocks in Kvarkensky district, 6.5 km south of the village of Urtazym - a geological, geomorphological and botanical monument of nature,

- Mount Zmeinaya (Khan Mountain, Khan’s Tomb) in Sol-Iletsk district, 1.5 km to the southeast of the village of Mikhailovka - a geological (paleontological) natural monument,

- Karagachskaya steppe in Adamovsky district, 12 km south-east of the village of Aydyrlinsky - a landscape and botanical natural monument,

- Starobelogorskie chalk mountains and Korsch-Urman oak forest in Novosergiyevsky district, south-western outskirts of the village of Staraya Belogorka - a landscape monument of nature,

- Camel Rock in Svetlinsky district - a geological and geomorphological natural monument,

- Karagayskiy forest and a gorge on the Guberlya River in Kuvandyksky district, 1.5 km north-west of the village of Karagay-Pokrovka - a geological and geomorphological, landscape monument of nature,

- Three hundred years pine trees in the national park “Buzuluk coniferous forest” in Buzuluk district, 2 km north of the village of Zapovedniy,

- Red Stones in Sorochinsky district, 2 km south-east of the village of Pervokrasnoe - a geomorphological natural monument,

- Mount Verblyuzhka (Dyuyatash) in Belyaevsky district, 3 km west of the village of Donskoye - a landscape, geological and geomorphological natural monument, 329.4 meters,

- Koskol lakes in Belyaevsky district, 13 km south-west of the village of Burlyksky - a hydrological, landscape and ornithological natural monument, two large karst lakes,

- Podstepinskaya rock in Gaisky district, 8.5 km west of the village of Guberlya - a geological and geomorphological natural monument, one of the most original rock-sculptures remnant of the Orenburg region,

- Mount Tasuba (Tas-Tube) in Akbulaksky district, 5 km north-west from the village of Yurievskiy - a geological and geomorphological natural monument.

Orenburg oblast of Russia photos

Orenburg Oblast scenery

Wooden church in Orenburg Oblast

Colorful sunset in Orenburg Oblast

Pictures of the Orenburg region

Orenburg Oblast view

Orenburg Oblast landscape

Field road in Orenburg Oblast

Author: Metik Sergey

- Currently 2.96/5

Rating: 3.0 /5 (191 votes cast)

IMAGES

VIDEO

COMMENTS

What is a Bad Bank? A bad bank is a financial entity set up to buy Non-Performing Assets (NPAs), or Bad Loans, from banks.; The aim of setting up a bad bank is to help ease the burden on banks by taking bad loans off their balance sheets and get them to lend again to customers without constraints.; After the purchase of a bad loan from a bank, the bad bank may later try to restructure and sell ...

Introduction. Bad banks, formally called Asset Reconstruction Companies (ARC), are specialized financial institutions that buy the stressed and non-performing assets (NPA) of the bank to help clean up their balance sheet. Establishment and Regulations of ARC. Incorporated under the Companies Act and registered with RBI under the Securitization ...

Why in News. Recently, the Reserve Bank of India (RBI) Governor has agreed to look at a proposal for creating a Bad Bank.. Key Points. About: A bad bank conveys the impression that it will function as a bank but has bad assets to start with.; Technically, a bad bank is an Asset Reconstruction Company (ARC) or an Asset Management Company (AMC) that takes over the bad loans of commercial banks ...

Bad bank: Context: The Indian Banks' Association (IBA) has begun identifying bad loans which can be transferred to the Centre's proposed bad bank. The IBA has written to banks asking them for a list of all bad loans worth Rs 500 crore and above to "identify magnitude of the problem" and "get clarity over initial capital required for ...

The idea of Bad Bank is not new. Currently, this is in the news due to the problem caused by COVID-19. Earlier the topic of Bad Bank was a matter of debate in the banking and finance circles when former Interim Finance Minister Piyush Goyal had put forward the idea when a committee headed by Sunil Mehta was formed to study the feasibility of ...

Arguments For Bad Banks. Providing Lending Leverage to Banks: The benefits of bad bank include the recovered value, and significant lending leverage because of three factors: Capital being freed up from less than fully provisioned bad assets. Capital freed up from security receipts because of a sovereign guarantee.

A bad bank is a business that trades in risky and illiquid assets owned by banks, other financial institutions, or a collection of banks. By moving subpar loans, it is meant to help banks balance their books and free them up to concentrate on their main activities of accepting deposits and lending money. Let's look at the definition of a "bad ...

ECONOMY/ GOVERNANCE Topic: GS-3: Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment. GS-2: Government policies and interventions for development in various sectors and issues arising out of their design and implementation. Bad Bank Context: With commercial banks set to witness a spike in NPAs, or bad loans, in the…

A Bad Bank is a financial institution created to hold and manage toxic or NPAs of troubled banks or financial institutions.. This topic of the "Bad Bank" is important from the perspective of the UPSC IAS Examination which falls under General Studies Paper 3 (Mains) and General Studies Paper 1 (Prelims) and particularly in the Economy. In this article, we shall discuss Bad Banks, the ...

Context: Budget 2021-22 recommended for setting up an Asset Reconstruction Company (ARC) Ltd and an Asset Management Company (AMC) for dealing with stressed debt, signals a green light for 'Bad Bank' Arguments favouring setting up of 'Bad Banks' It benefits Commercial banks: by transferring their bad loans to bad banks and thereby reducing loan book risks and provisioning losses and ...

This means that about 10% of loans are never paid back, resulting in substantial loss of money to the banks. When restructured and unrecognised assets are added the total stress would be 15-20% of total loans. NPA crisis in India is set to worsen. Restructuring norms are being misused.

Government's Guarantee: The GoI Guarantee of up to Rs 30,600 crore will back Security Receipts (SRs) issued by NARCL. The guarantee will be valid for 5 years. If the bad bank is unable to sell the bad loan, or has to sell it at a loss, then the government guarantee will be invoked. The guarantee shall cover the shortfall between the face ...

A bad bank is technically an asset reconstruction company that buys bad loans (NPAs) from the commercial banks at a discount and tries to recover the money from the defaulter by providing a systematic solution over a period of time. The idea of a bad bank seeks to reduce the NPAs in the banking sector and then revive lending and credit growth.

A bad bank is simply an entity which specialises in handling bad loans or NPAs. It is basically an entity which buys the NPAs of commercial banks and tries to recover at least a part of the value of such NPAs. Usually, banks discount the book value of NPAs when they are transferred to a bad bank. After that, whatever recovery is possible from ...

A Bad Bank houses Bad loans or Non-Performing Assets (NPA). The idea of Bad Bank was implemented in countries like Sweden, Finland, France, Germany, Indonesia etc. ... About UPSC. About UPSC Exam; Syllabus; Reference Books ; PT 365 Current Affairs. History; Art and Culture; Geography; ... Previous Year Papers; General Studies III Banking ...

In the wake of economic contraction and the concerns of an upcoming spike in NPAs, the Indian Banks Association proposed setting up a bad bank with a capital of 10,000 crore INR. This idea has been coming up every time a financial crisis threatens the banking sector. This time, the RBI has agreed to look into the possibility of establishing a bad bank- inviting criticisms from some sectors but ...