Confirm opening of the external link

Financial projections use existing or estimated financial data to forecast your business’s future income and expenses. They often include different scenarios to see how changes to one aspect of your finances (such as higher sales or lower operating expenses) might affect your profitability.

If you need to create financial projections for a startup or existing business, this free, downloadable template includes all the necessary tools.

What Are Financial Projections Used for?

Financial projections are an essential business planning tool for several reasons.

- If you’re starting a business, financial projections help you plan your startup budget, assess when you expect the business to become profitable, and set benchmarks for achieving financial goals.

- If you’re already in business, creating financial projections each year can help you set goals and stay on track.

- When seeking outside financing, startups and existing businesses need financial projections to convince lenders and investors of the business’s growth potential.

What’s Included in Financial Projections?

This financial projections template pulls together several different financial documents, including:

- Startup expenses

- Payroll costs

- Sales forecast

- Operating expenses for the first 3 years of business

- Cash flow statements for the first 3 years of business

- Income statements for the first 3 years of business

- Balance sheet

- Break-even analysis

- Financial ratios

- Cost of goods sold (COGS), and

- Amortization and depreciation for your business.

You can use this template to create the documents from scratch or pull in information from those you’ve already made. The template also includes diagnostic tools to test the numbers in your financial projections and ensure they are within reasonable ranges.

These areas are closely related, so as you work on your financial projections, you’ll find that changes to one element affect the others. You may want to include a best-case and worst-case scenario for all possibilities. Make sure you know the assumptions behind your financial projections and can explain them to others.

Startup business owners often wonder how to create financial projections for a business that doesn’t exist yet. Financial forecasts are continually educated guesses. To make yours as accurate as possible, do your homework and get help. Use the information you unearthed in researching your business plans, such as statistics from industry associations, data from government sources, and financials from similar businesses. An accountant with experience in your industry can help fine-tune your financial projections. So can business advisors such as SCORE mentors.

Once you complete your financial projections, don’t put them away and forget about them. Compare your projections to your financial statements regularly to see how well your business meets your expectations. If your projections turn out to be too optimistic or too pessimistic, make the necessary adjustments to make them more accurate.

*NOTE: The cells with formulas in this workbook are locked. If changes are needed, the unlock code is "1234." Please use caution when unlocking the spreadsheets. If you want to change a formula, we strongly recommend saving a copy of this spreadsheet under a different name before doing so.

We recommend downloading the Financial Projections template in English or Spanish.

Do you need help creating your financial projections? Take SCORE’s online course on-demand on financial projections or connect with a SCORE mentor online or in your community today.

Simple Steps for Starting Your Business: Financial Projections In this online module, you'll learn the importance of financial planning, how to build your financial model, how to understand financial statements and more.

Business Planning & Financial Statements Template Gallery Download SCORE’s templates to help you plan for a new business startup or grow your existing business.

Why Projected Financial Statements Are Essential to the Future Success of Startups Financial statements are vital to the success of any company but particularly start-ups. SCORE mentor Sarah Hadjhamou shares why they are a big part of growing your start-up.

Copyright © 2024 SCORE Association, SCORE.org

Funded, in part, through a Cooperative Agreement with the U.S. Small Business Administration. All opinions, and/or recommendations expressed herein are those of the author(s) and do not necessarily reflect the views of the SBA.

- Search Please fill out this field.

- Building Your Business

How To Create Financial Projections for Your Business

Learn how to anticipate your business’s financial performance

:max_bytes(150000):strip_icc():format(webp)/ScreenShot2020-03-26at1.24.14PM-16d178cb2ee74d71946d658ab027e210.png)

- Understanding Financial Projections & Forecasting

Why Forecasting Is Critical for Your Business

Key financial statements for forecasting, how to create your financial projections, frequently asked questions (faqs).

Maskot / Getty Images

Just like a weather forecast lets you know that wearing closed-toe shoes will be important for that afternoon downpour later, a good financial forecast allows you to better anticipate financial highs and lows for your business.

Neglecting to compile financial projections for your business may signal to investors that you’re unprepared for the future, which may cause you to lose out on funding opportunities.

Read on to learn more about financial projections, how to compile and use them in a business plan, and why they can be crucial for every business owner.

Key Takeaways

- Financial forecasting is a projection of your business's future revenues and expenses based on comparative data analysis, industry research, and more.

- Financial projections are a valuable tool for entrepreneurs as they offer insight into a business's ability to generate profit, increase cash flow, and repay debts, which can be attractive to investors.

- Some of the key components to include in a financial projection include a sales projection, break-even analysis, and pro forma balance sheet and income statement.

- A financial projection can not only attract investors, but helps business owners anticipate fixed costs, find a break-even point, and prepare for the unexpected.

Understanding Financial Projections and Forecasting

Financial forecasting is an educated estimate of future revenues and expenses that involves comparative analysis to get a snapshot of what could happen in your business’s future.

This process helps in making predictions about future business performance based on current financial information, industry trends, and economic conditions. Financial forecasting also helps businesses make decisions about investments, financing sources, inventory management, cost control strategies, and even whether to move into another market.

Developing both short- and mid-term projections is usually necessary to help you determine immediate production and personnel needs as well as future resource requirements for raw materials, equipment, and machinery.

Financial projections are a valuable tool for entrepreneurs as they offer insight into a business's ability to generate profit, increase cash flow, and repay debts. They can also be used to make informed decisions about the business’s plans. Creating an accurate, adaptive financial projection for your business offers many benefits, including:

- Attracting investors and convincing them to fund your business

- Anticipating problems before they arise

- Visualizing your small-business objectives and budgets

- Demonstrating how you will repay small-business loans

- Planning for more significant business expenses

- Showing business growth potential

- Helping with proper pricing and production planning

Financial forecasting is essentially predicting the revenue and expenses for a business venture. Whether your business is new or established, forecasting can play a vital role in helping you plan for the future and budget your funds.

Creating financial projections may be a necessary exercise for many businesses, particularly those that do not have sufficient cash flow or need to rely on customer credit to maintain operations. Compiling financial information, knowing your market, and understanding what your potential investors are looking for can enable you to make intelligent decisions about your assets and resources.

The income statement, balance sheet, and statement of cash flow are three key financial reports needed for forecasting that can also provide analysts with crucial information about a business's financial health. Here is a closer look at each.

Income Statement

An income statement, also known as a profit and loss statement or P&L, is a financial document that provides an overview of an organization's revenues, expenses, and net income.

Balance Sheet

The balance sheet is a snapshot of the business's assets and liabilities at a certain point in time. Sometimes referred to as the “financial portrait” of a business, the balance sheet provides an overview of how much money the business has, what it owes, and its net worth.

The assets side of the balance sheet includes what the business owns as well as future ownership items. The other side of the sheet includes liabilities and equity, which represent what it owes or what others owe to the business.

A balance sheet that shows hypothetical calculations and future financial projections is also referred to as a “pro forma” balance sheet.

Cash Flow Statement

A cash flow statement monitors the business’s inflows and outflows—both cash and non-cash. Cash flow is the business’s projected earnings before interest, taxes, depreciation, and amortization ( EBITDA ) minus capital investments.

Here's how to compile your financial projections and fit the results into the three above statements.

A financial projections spreadsheet for your business should include these metrics and figures:

- Sales forecast

- Balance sheet

- Operating expenses

- Payroll expenses (if applicable)

- Amortization and depreciation

- Cash flow statement

- Income statement

- Cost of goods sold (COGS)

- Break-even analysis

Here are key steps to account for creating your financial projections.

Projecting Sales

The first step for a financial forecast starts with projecting your business’s sales, which are typically derived from past revenue as well as industry research. These projections allow businesses to understand what their risks are and how much they will need in terms of staffing, resources, and funding.

Sales forecasts also enable businesses to decide on important levels such as product variety, price points, and inventory capacity.

Income Statement Calculations

A projected income statement shows how much you expect in revenue and profit—as well as your estimated expenses and losses—over a specific time in the future. Like a standard income statement, elements on a projection include revenue, COGS, and expenses that you’ll calculate to determine figures such as the business’s gross profit margin and net income.

If you’re developing a hypothetical, or pro forma, income statement, you can use historical data from previous years’ income statements. You can also do a comparative analysis of two different income statement periods to come up with your figures.

Anticipate Fixed Costs

Fixed business costs are expenses that do not change based on the number of products sold. The best way to anticipate fixed business costs is to research your industry and prepare a budget using actual numbers from competitors in the industry. Anticipating fixed costs ensures your business doesn’t overpay for its needs and balances out its variable costs. A few examples of fixed business costs include:

- Rent or mortgage payments

- Operating expenses (also called selling, general and administrative expenses or SG&A)

- Utility bills

- Insurance premiums

Unfortunately, it might not be possible to predict accurately how much your fixed costs will change in a year due to variables such as inflation, property, and interest rates. It’s best to slightly overestimate fixed costs just in case you need to account for these potential fluctuations.

Find Your Break-Even Point

The break-even point (BEP) is the number at which a business has the same expenses as its revenue. In other words, it occurs when your operations generate enough revenue to cover all of your business’s costs and expenses. The BEP will differ depending on the type of business, market conditions, and other factors.

To find this number, you need to determine two things: your fixed costs and variable costs. Once you have these figures, you can find your BEP using this formula:

Break-even point = fixed expenses ➗ 1 – (variable expenses ➗ sales)

The BEP is an essential consideration for any projection because it is the point at which total revenue from a project equals total cost. This makes it the point of either profit or loss.

Plan for the Unexpected

It is necessary to have the proper financial safeguards in place to prepare for any unanticipated costs. A sudden vehicle repair, a leaky roof, or broken equipment can quickly derail your budget if you aren't prepared. Cash management is a financial management plan that ensures a business has enough cash on hand to maintain operations and meet short-term obligations.

To maintain cash reserves, you can apply for overdraft protection or an overdraft line of credit. Overdraft protection can be set up by a bank or credit card business and provides short-term loans if the account balance falls below zero. On the other hand, a line of credit is an agreement with a lending institution in which they provide you with an unsecured loan at any time until your balance reaches zero again.

How do you make financial projections for startups?

Financial projections for startups can be hard to complete. Historical financial data may not be available. Find someone with financial projections experience to give insight on risks and outcomes.

Consider business forecasting, too, which incorporates assumptions about the exponential growth of your business.

Startups can also benefit from using EBITDA to get a better look at potential cash flow.

What are the benefits associated with forecasting business finances?

Forecasting can be beneficial for businesses in many ways, including:

- Providing better understanding of your business cash flow

- Easing the process of planning and budgeting for the future based on income

- Improving decision-making

- Providing valuable insight into what's in their future

- Making decisions on how to best allocate resources for success

How many years should your financial forecast be?

Your financial forecast should either be projected over a specific time period or projected into perpetuity. There are various methods for determining how long a financial forecasting projection should go out, but many businesses use one to five years as a standard timeframe.

U.S. Small Business Administration. " Market Research and Competitive Analysis ."

Score. " Financial Projections Template ."

Related Articles

- Business Planning

Business Plan Financial Projections

Written by Dave Lavinsky

Financial projections are forecasted analyses of your business’ future that include income statements, balance sheets and cash flow statements. We have found them to be a crucial part of your business plan for the following reasons:

- They can help prove or disprove the viability of your business idea. For example, if your initial projections show your company will never make a sizable profit, your venture might not be feasible. Or, in such a case, you might figure out ways to raise prices, enter new markets, or streamline operations to make it profitable.

- Financial projections give investors and lenders an idea of how well your business is likely to do in the future. They can give lenders the confidence that you’ll be able to comfortably repay their loan with interest. And for equity investors, your projections can give them faith that you’ll earn them a solid return on investment. In both cases, your projections can help you secure the funding you need to launch or grow your business.

- Financial projections help you track your progress over time and ensure your business is on track to meet its goals. For example, if your financial projections show you should generate $500,000 in sales during the year, but you are not on track to accomplish that, you’ll know you need to take corrective action to achieve your goal.

Below you’ll learn more about the key components of financial projections and how to complete and include them in your business plan.

What Are Business Plan Financial Projections?

Financial projections are an estimate of your company’s future financial performance through financial forecasting. They are typically used by businesses to secure funding, but can also be useful for internal decision-making and planning purposes. There are three main financial statements that you will need to include in your business plan financial projections:

1. Income Statement Projection

The income statement projection is a forecast of your company’s future revenues and expenses. It should include line items for each type of income and expense, as well as a total at the end.

There are a few key items you will need to include in your projection:

- Revenue: Your revenue projection should break down your expected sales by product or service, as well as by month. It is important to be realistic in your projections, so make sure to account for any seasonal variations in your business.

- Expenses: Your expense projection should include a breakdown of your expected costs by category, such as marketing, salaries, and rent. Again, it is important to be realistic in your estimates.

- Net Income: The net income projection is the difference between your revenue and expenses. This number tells you how much profit your company is expected to make.

Sample Income Statement

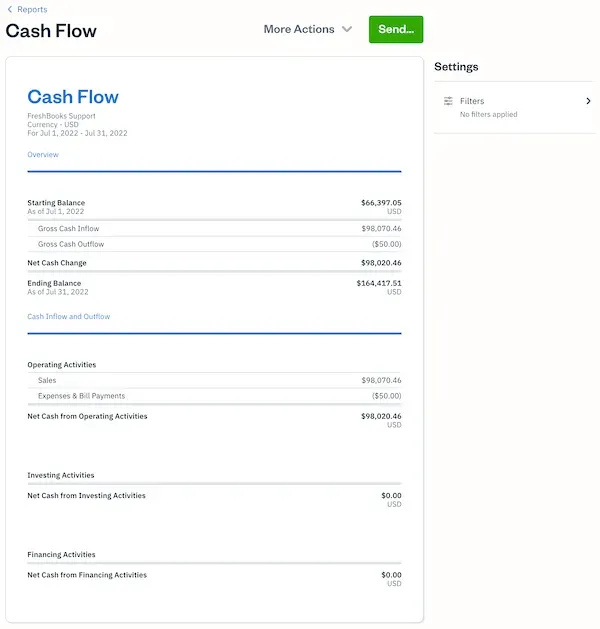

2. cash flow statement & projection.

The cash flow statement and projection are a forecast of your company’s future cash inflows and outflows. It is important to include a cash flow projection in your business plan, as it will give investors and lenders an idea of your company’s ability to generate cash.

There are a few key items you will need to include in your cash flow projection:

- The cash flow statement shows a breakdown of your expected cash inflows and outflows by month. It is important to be realistic in your projections, so make sure to account for any seasonal variations in your business.

- Cash inflows should include items such as sales revenue, interest income, and capital gains. Cash outflows should include items such as salaries, rent, and marketing expenses.

- It is important to track your company’s cash flow over time to ensure that it is healthy. A healthy cash flow is necessary for a successful business.

Sample Cash Flow Statements

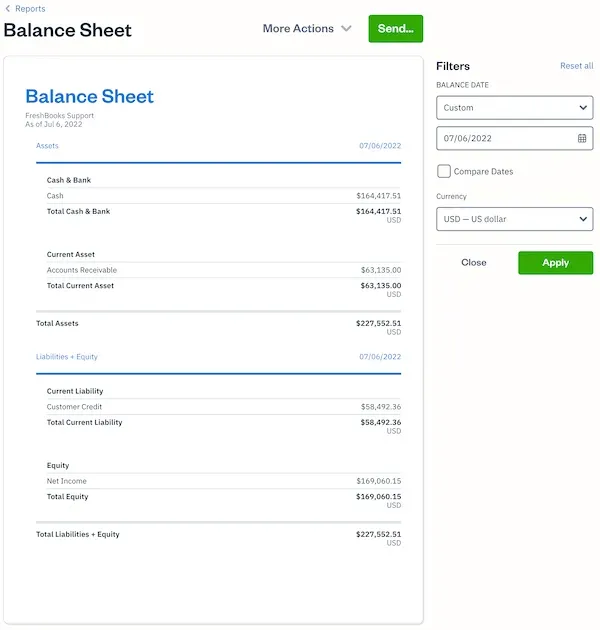

3. balance sheet projection.

The balance sheet projection is a forecast of your company’s future financial position. It should include line items for each type of asset and liability, as well as a total at the end.

A projection should include a breakdown of your company’s assets and liabilities by category. It is important to be realistic in your projections, so make sure to account for any seasonal variations in your business.

It is important to track your company’s financial position over time to ensure that it is healthy. A healthy balance is necessary for a successful business.

Sample Balance Sheet

How to create financial projections.

Creating financial projections for your business plan can be a daunting task, but it’s important to put together accurate and realistic financial projections in order to give your business the best chance for success.

Cost Assumptions

When you create financial projections, it is important to be realistic about the costs your business will incur, using historical financial data can help with this. You will need to make assumptions about the cost of goods sold, operational costs, and capital expenditures.

It is important to track your company’s expenses over time to ensure that it is staying within its budget. A healthy bottom line is necessary for a successful business.

Capital Expenditures, Funding, Tax, and Balance Sheet Items

You will also need to make assumptions about capital expenditures, funding, tax, and balance sheet items. These assumptions will help you to create a realistic financial picture of your business.

Capital Expenditures

When projecting your company’s capital expenditures, you will need to make a number of assumptions about the type of equipment or property your business will purchase. You will also need to estimate the cost of the purchase.

When projecting your company’s funding needs, you will need to make a number of assumptions about where the money will come from. This might include assumptions about bank loans, venture capital, or angel investors.

When projecting your company’s tax liability, you will need to make a number of assumptions about the tax rates that will apply to your business. You will also need to estimate the amount of taxes your company will owe.

Balance Sheet Items

When projecting your company’s balance, you will need to make a number of assumptions about the type and amount of debt your business will have. You will also need to estimate the value of your company’s assets and liabilities.

Financial Projection Scenarios

Write two financial scenarios when creating your financial projections, a best-case scenario, and a worst-case scenario. Use your list of assumptions to come up with realistic numbers for each scenario.

Presuming that you have already generated a list of assumptions, the creation of best and worst-case scenarios should be relatively simple. For each assumption, generate a high and low estimate. For example, if you are assuming that your company will have $100,000 in revenue, your high estimate might be $120,000 and your low estimate might be $80,000.

Once you have generated high and low estimates for all of your assumptions, you can create two scenarios: a best case scenario and a worst-case scenario. Simply plug the high estimates into your financial projections for the best-case scenario and the low estimates into your financial projections for the worst-case scenario.

Conduct a Ratio Analysis

A ratio analysis is a useful tool that can be used to evaluate a company’s financial health. Ratios can be used to compare a company’s performance to its industry average or to its own historical performance.

There are a number of different ratios that can be used in ratio analysis. Some of the more popular ones include the following:

- Gross margin ratio

- Operating margin ratio

- Return on assets (ROA)

- Return on equity (ROE)

To conduct a ratio analysis, you will need financial statements for your company and for its competitors. You will also need industry average ratios. These can be found in industry reports or on financial websites.

Once you have the necessary information, you can calculate the ratios for your company and compare them to the industry averages or to your own historical performance. If your company’s ratios are significantly different from the industry averages, it might be indicative of a problem.

Be Realistic

When creating your financial projections, it is important to be realistic. Your projections should be based on your list of assumptions and should reflect your best estimate of what your company’s future financial performance will be. This includes projected operating income, a projected income statement, and a profit and loss statement.

Your goal should be to create a realistic set of financial projections that can be used to guide your company’s future decision-making.

Sales Forecast

One of the most important aspects of your financial projections is your sales forecast. Your sales forecast should be based on your list of assumptions and should reflect your best estimate of what your company’s future sales will be.

Your sales forecast should be realistic and achievable. Do not try to “game” the system by creating an overly optimistic or pessimistic forecast. Your goal should be to create a realistic sales forecast that can be used to guide your company’s future decision-making.

Creating a sales forecast is not an exact science, but there are a number of methods that can be used to generate realistic estimates. Some common methods include market analysis, competitor analysis, and customer surveys.

Create Multi-Year Financial Projections

When creating financial projections, it is important to generate projections for multiple years. This will give you a better sense of how your company’s financial performance is likely to change over time.

It is also important to remember that your financial projections are just that: projections. They are based on a number of assumptions and are not guaranteed to be accurate. As such, you should review and update your projections on a regular basis to ensure that they remain relevant.

Creating financial projections is an important part of any business plan. However, it’s important to remember that these projections are just estimates. They are not guarantees of future success.

Business Plan Financial Projections FAQs

What is a business plan financial projection.

A business plan financial projection is a forecast of your company's future financial performance. It should include line items for each type of asset and liability, as well as a total at the end.

What are annual income statements?

The Annual income statement is a financial document and a financial model that summarize a company's revenues and expenses over the course of a fiscal year. They provide a snapshot of a company's financial health and performance and can be used to track trends and make comparisons with other businesses.

What are the necessary financial statements?

The necessary financial statements for a business plan are an income statement, cash flow statement, and balance sheet.

How do I create financial projections?

You can create financial projections by making a list of assumptions, creating two scenarios (best case and worst case), conducting a ratio analysis, and being realistic.

How to Create Financial Projections for Your Business Plan

Written by Dave Lavinsky

Financial projections, also known as financial models, are forecasts of your company’s expected financial performance, typically over the next 5 years.

Over the past 25+ years, we’ve created financial projections for thousands of startups and existing businesses. In doing so, we’ve found 3 key reasons why financial projections are important:

- They help you determine the viability of your new business ideas and/or your need to make modifications to them. For instance, if your initial financial projections show your business idea isn’t profitable, you’ll know that changes are needed (e.g., raising prices, serving new markets, figuring out how to reduce costs, etc.) to make it viable.

- They are crucial for raising funding. Lenders will always review your financial projections to ensure you can comfortably repay any business loans they issue you. Equity investors will nearly always review your projections in determining whether they can achieve their desired return on their investment in your business.

- They help keep your business financially on track by giving you goals. For instance, if your financial projections state your company should generate 100 new clients this year, and the year is halfway done and you’re only at 30 clients, you’ll know you need to readjust your strategy to achieve your goals.

In the remainder of this article, you’ll learn more about financial projections, how to complete them, and how to incorporate them in your business plan.

Download our Ultimate Business Plan Template Here to Quickly & Easily Complete Your Business Plan & Financial Projections

What are Financial Projections?

Financial projections are financial forecasts or estimations of your company’s future revenues and expenses, serving as a crucial part of business planning. To complete them you must develop multiple assumptions with regards to items like future sales volumes, employee headcount and the cost of supplies and other expenses. Creating financial projections helps you develop better strategies to grow your business.

Your financial projections will be the most analyzed part of your business plan by investors and/or banks. While never a precise prediction of future performance, an excellent financial model outlines the core assumptions of your business and helps you and others evaluate capital requirements, risks involved, and rewards that successful execution will deliver.

Having a solid framework in place also will help you compare your performance to the financial projections and evaluate how your business is progressing. If your performance is behind your projections, you will have a framework in place to assess the effects of lowering costs, increasing prices, or even reimagining your model. In the happy case that you exceed your business projections, you can use your framework to plan for accelerated growth, new hires, or additional expansion investments.

Hence, the use of accurate financial projections is multi-fold and crucial for the success of any business. Your financial projections should include three core financial statements – the income statement, the cash flow statement, and the balance sheet. The following section explains each statement in detail.

Necessary Financial Statements

The three financial statements are the income statement, the cash flow statement, and the balance sheet. You will learn how to create each one in detail below.

Income Statement Projection

The projected income statement is also referred to as a profit and loss statement and showcases your business’s revenues and expenses for a specific period.

To create an income statement, you first will need to chart out a sales forecast by taking realistic estimates of units sold and multiplying them by price per unit to arrive at a total sales number. Then, estimate the cost of these units and multiply them by the number of units to get the cost of sales. Finally, calculate your gross margin by subtracting the cost of sales from your sales.

Once you have calculated your gross margin, deduct items like wages, rent, marketing costs, and other expenses that you plan to pay to facilitate your business’s operations. The resulting total represents your projected operating income, which is a critical business metric.

Plan to create an income statement monthly until your projected break-even, or the point at which future revenues outpace total expenses, and you reflect operating profit. From there, annual income statements will suffice.

Sample Income Statement

Consider a sample income statement for a retail store below:

Cash Flow Projection

As the name indicates, a cash flow statement shows the cash flowing in and out of your business. The cash flow statement incorporates cash from business operations and includes cash inflows and outflows from investment and financing activities to deliver a holistic cash picture of your company.

Investment activities include purchasing land or equipment or research & development activities that aren’t necessarily part of daily operations. Cash movements due to financing activities include cash flowing in a business through investors and/or banks and cash flowing out due to debt repayment or distributions made to shareholders.

You should total all these three components of a cash flow projection for any specified period to arrive at a total ending cash balance. Constructing solid cash flow projections will ensure you anticipate capital needs to carry the business to a place of sustainable operations.

Sample Cash Flow Statement

Below is a simple cash flow statement for the same retail store:

Balance Sheet Projections

A balance sheet shows your company’s assets, liabilities, and owner’s equity for a certain period and provides a snapshot in time of your business performance. Assets include things of value that the business owns, such as inventory, capital, and land. Liabilities, on the other hand, are legally bound commitments like payables for goods or services rendered and debt. Finally, owner’s equity refers to the amount that is remaining once liabilities are paid off. Assets must total – or balance – liabilities and equity.

Your startup financial documents should include annual balance sheets that show the changing balance of assets, liabilities, and equity as the business progresses. Ideally, that progression shows a reduction in liabilities and an increase in equity over time.

While constructing these varied business projections, remember to be flexible. You likely will need to go back and forth between the different financial statements since working on one will necessitate changes to the others.

Sample Balance Sheet

Below is a simple balance sheet for the retail store:

How to Finish Your Business Plan and Financial Projections in 1 Day!

Don’t you wish there was a faster, easier way to finish your plan and financial projections?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

How to Create Financial Projections

When it comes to financial forecasting, simplicity is key. Making financial projections does not have to be overly sophisticated and complicated to impress, and convoluted projections likely will have the opposite effect on potential investors. Keep your tables and graphs simple and fill them with credible or historical data that inspires confidence in your plan and vision. The below tips will help bolster your financial projections.

Create a List of Assumptions

Your financial projections should be tied to a list of assumptions. For example, one assumption will be the initial monthly cash sales you achieve. Another assumption will be your monthly growth rate. As you can imagine, changing either of these assumptions will significantly impact your financial projections.

As a result, tie your income statement, balance sheet, and cash flow statements to your assumptions. That way, if you change your assumptions, all of your financial projections automatically update.

Below are the key assumptions to include in your financial model:

For EACH essential product or service you offer:

- What is the number of units you expect to sell each month?

- What is your expected monthly sales growth rate?

- What is the average price that you will charge per product or service unit sold?

- How much do you expect to raise your prices each year?

- How much does it cost you to produce or deliver each unit sold?

- How much (if at all) do you expect your direct product costs to grow each year?

For EACH subscription/membership, you offer:

- What is the monthly/quarterly/annual price of your membership?

- How many members do you have now, or how many members do you expect to gain in the first month/quarter/year?

- What is your projected monthly/quarterly/annual growth rate in the number of members?

- What is your projected monthly/quarterly/annual member churn (the percentage of members that will cancel each month/quarter/year)?

- What is the average monthly/quarterly/annual direct cost to serve each member (if applicable)?

Cost Assumptions

- What is your monthly salary? What is the annual growth rate in your salary?

- What is your monthly salary for the rest of your team? What is the expected annual growth rate in your team’s salaries?

- What is your initial monthly marketing expense? What is the expected annual growth rate in your marketing expense?

- What is your initial monthly rent + utility expense? What is the expected annual growth rate in your rent + utility expense?

- What is your initial monthly insurance expense? What is the expected annual growth rate in your insurance expense?

- What is your initial monthly office supplies expense? What is the expected annual growth rate in your office supplies expense?

- What is your initial monthly cost for “other” expenses? What is the expected annual growth rate in your “other” expenses?

Capital Expenditures, Funding, Tax, and Balance Sheet Items

- How much money do you need for Capital Expenditures in your first year (to buy computers, desks, equipment, space build-out, etc.)?

- How much other funding do you need right now?

- What percent of the funding will be financed by Debt (versus equity)?

- What Corporate Tax Rate would you like to apply to company profits?

- What is your Current Liabilities Turnover (in the number of days)?

- What are your Current Assets, excluding cash (in the number of days)?

- What is your Depreciation rate?

- What is your Amortization number of Years?

- What is the number of years in which your debt (loan) must be paid back?

- What is your Debt Payback interest rate?

Create Two Financial Projection Scenarios

It would be best if you used your assumptions to create two sets of clear financial projections that exhibit two very different scenarios. One is your best-case scenario, and the other is your worst-case. Investors are usually very interested in how a business plan will play out in both these scenarios, allowing them to better analyze the robustness and potential profitability of a business.

Conduct a Ratio Analysis

Gain an understanding of average industry financial ratios, including operating ratios, profitability ratios, return on investment ratios, and the like. You can then compare your own estimates with these existing ratios to evaluate costs you may have overlooked or find historical financial data to support your projected performance. This ratio analysis helps ensure your financial projections are neither excessively optimistic nor excessively pessimistic.

Be Realistic

It is easy to get carried away when dealing with estimates and you end up with very optimistic financial projections that will feel untenable to an objective audience. Investors are quick to notice and question inflated figures. Rather than excite investors, such scenarios will compromise your legitimacy.

Create Multi-Year Financial Projections

The first year of your financial projections should be presented on a granular, monthly basis. For subsequent years, annual projections will suffice. It is advised to have three- or five-year projections ready when you start attracting investors. Since your plan needs to be succinct, you can add yearly projections as appendices to your main plan.

You should now know how to create financial projections for your business plan. In addition to creating your full projections as their own document, you will need to insert your financial projections into your plan. In your executive summary, Insert your topline projections, that is, just your sales, gross margins, recurring expenses, EBITDA (earnings before interest, taxes, depreciation, and amortization), and net income). In the financial plan section of your plan, insert your key assumptions and a little more detail than your topline projections. Include your full financial model in the appendix of your plan.

Other Helpful Business Plan Articles & Templates

Contact us: [email protected]

Get Started Now!

Country/region

- Australia AUD $

- Austria EUR €

- Belgium EUR €

- Canada CAD $

- Czechia CZK Kč

- Denmark DKK kr.

- Finland EUR €

- France EUR €

- Germany EUR €

- Hong Kong SAR HKD $

- Ireland EUR €

- Israel ILS ₪

- Italy EUR €

- Japan JPY ¥

- Malaysia MYR RM

- Netherlands EUR €

- New Zealand NZD $

- Norway USD $

- Poland PLN zł

- Portugal EUR €

- Singapore SGD $

- South Korea KRW ₩

- Spain EUR €

- Sweden SEK kr

- Switzerland CHF CHF

- United Arab Emirates AED د.إ

- United Kingdom GBP £

- United States USD $

Item added to your cart

How to create and write financial projections for a business plan: step-by-step guide.

If you're writing a business plan, one of the most important sections you'll need to create is the financial projections . Financial projections are essential for demonstrating to lenders, investors, or other stakeholders that your business is financially viable. A well-prepared financial section not only makes your business plan complete, but it also gives you a roadmap for managing your business in the coming years.

In this blog post, we’ll walk you through how to write financial projections for a business plan , step-by-step. We’ll cover everything from revenue forecasts , cost of goods sold (COGS) , operating expenses , cash flow projections , and profit and loss statements , to break-even analysis . Throughout this guide, we’ll also embed some of the most searched SEO long-tail keywords related to financial projections and business plans to help drive traffic and visibility for your website.

By the end of this article, you’ll have the knowledge needed to create accurate financial projections, but if you want to save time and ensure accuracy, consider purchasing one of our already used and funded business plans . These come complete with financial projections that have been tested and proven successful.

What Are Financial Projections?

Before diving into the specifics of how to create your projections, it’s important to understand what financial projections are. Financial projections are estimates of how much money your business will make and spend in the future. They are based on your current financial data , market research , and educated guesses about the future performance of your business. The typical timeframe for financial projections is three to five years.

For new businesses, financial projections are a key tool to estimate startup costs , revenues , and expenses . They also help business owners understand how much capital they will need to launch and grow their operations. For established businesses, projections are used to track financial health and forecast future growth.

Why Are Financial Projections Important?

The financial projection section of your business plan is one of the most scrutinized sections by lenders and investors. It shows that you have done your homework and have a clear understanding of your business’s financial future . Good financial projections will help you:

- Secure funding from investors or lenders

- Determine your break-even point

- Guide decision-making for future growth

- Plan for the unexpected by creating contingency plans

If writing these projections seems overwhelming, don’t worry. We'll break down every part of the financial section, and by the end of this post, you’ll have a clear understanding of how to create financial projections for your business plan.

Step-by-Step Guide to Writing Financial Projections

Now, let’s walk through the step-by-step process of writing the financial projections section of your business plan . This includes revenue projections , cost of goods sold (COGS) , operating expenses , cash flow projections , profit and loss statements , and break-even analysis .

1. Revenue Projections: Estimating Your Income

The first step in writing financial projections is to estimate your revenue . This is a forecast of how much money your business will generate from sales. For startups, estimating revenue can be tricky, but it’s important to make educated guesses based on market research, competitor performance, and your business model.

Identify Revenue Streams : Start by identifying all potential revenue streams. For example, if you’re starting a copier and fax store , you might have revenue from copying services , faxing , and office supplies sales.

Estimate Sales Volume : How many units or services do you expect to sell in a month or a year? For example, if you offer commercial fax and copy services , estimate how many customers will use your services regularly.

Set Prices : Assign prices to each of your products or services. It’s crucial to set a competitive price by considering market research and the prices charged by your competitors.

Calculate Revenue : Multiply the estimated number of units sold by the price per unit. This gives you a total revenue estimate for a given period, typically monthly and yearly.

Example of Revenue Projection:

- Product : Copying Services

- Units Sold per Month : 2,000 copies

- Price per Unit : $0.25

- Monthly Revenue : 2,000 x $0.25 = $500

- Annual Revenue : $500 x 12 = $6,000

2. Cost of Goods Sold (COGS): Calculating Direct Costs

The next step is to calculate your cost of goods sold (COGS) . This represents the direct costs associated with producing your product or delivering your service. In other words, COGS are the expenses that vary depending on how much you sell.

For example, in a fax and copy service , COGS might include the cost of paper, toner, and maintenance for your copy machines .

Identify Direct Costs : List all direct costs related to producing your product or service. For instance, a copier and faxing business would have costs for ink, paper, and machine upkeep.

Calculate COGS per Unit : Divide the total cost of goods by the number of units sold. This will give you the COGS per unit .

Total COGS : Multiply the COGS per unit by the total number of units sold.

Example of COGS Calculation:

- COGS per Copy : $0.05 (including paper, ink, and machine maintenance)

- Monthly COGS : 2,000 x $0.05 = $100

- Annual COGS : $100 x 12 = $1,200

By understanding your COGS, you can better price your products and determine your overall profitability.

3. Operating Expenses (OPEX): Accounting for Overheads

Operating expenses (OPEX) are the costs incurred in the day-to-day running of your business. Unlike COGS, these expenses remain relatively constant regardless of your sales volume. OPEX includes things like rent, utilities, salaries, and marketing costs .

List Fixed and Variable Costs : Begin by listing your fixed expenses (like rent and salaries) and your variable expenses (like utilities and marketing). If you’re operating a small business copier and fax service , your fixed costs might include equipment leasing fees, while your variable costs might include marketing efforts and promotional discounts.

Estimate Monthly and Annual OPEX : Add up your monthly operating expenses, then multiply by 12 to get your annual operating costs.

Plan for Unexpected Costs : Include a small percentage for contingencies, as there are always unexpected expenses in any business.

Example of Operating Expenses:

- Rent : $1,000 per month

- Utilities : $200 per month

- Salaries : $3,500 per month

- Marketing : $500 per month

- Monthly OPEX : $1,000 + $200 + $3,500 + $500 = $5,200

- Annual OPEX : $5,200 x 12 = $62,400

By accurately calculating your OPEX, you’ll know how much money you need to cover day-to-day operations.

4. Cash Flow Projections: Managing Cash Inflows and Outflows

A cash flow projection is an estimate of how much money your business will bring in and spend over a certain period. It's critical to track cash inflows (like revenue) and cash outflows (like expenses) to ensure you always have enough money to cover your operating costs.

Estimate Cash Inflows : Your cash inflows include your revenue from sales, loans, or other forms of income.

Estimate Cash Outflows : Outflows are your operating expenses, debt payments, and other financial obligations.

Adjust for Seasonal Fluctuations : If your business is seasonal, be sure to account for changes in sales volume during peak and off-peak months.

Example of Cash Flow Projection:

- Monthly Inflow : $6,000

- Monthly Outflow : $5,200

- Net Cash Flow : $6,000 - $5,200 = $800

5. Profit and Loss Statement: Measuring Profitability

The profit and loss statement (P&L) is the most important part of your financial projections. It summarizes your revenue, COGS, and operating expenses to show whether your business is making a profit or a loss over a specific time period.

Calculate Gross Profit : Subtract your COGS from your total revenue. This gives you your gross profit .

Subtract Operating Expenses : Once you’ve calculated your gross profit, subtract your operating expenses to determine your net profit .

Example of Profit and Loss Statement:

- Revenue : $6,000

- COGS : $1,200

- Gross Profit : $6,000 - $1,200 = $4,800

- Operating Expenses : $5,200

- Net Loss : $4,800 - $5,200 = -$400

This statement helps you understand how well your business is performing financially and whether adjustments are needed.

6. Break-Even Analysis: Knowing When You’ll Be Profitable

A break-even analysis shows you how much revenue you need to cover your costs. This is important because it tells you the minimum amount of sales needed to avoid a loss.

Calculate Fixed Costs : Start by adding up your total fixed costs , such as rent and salaries.

Determine Contribution Margin : Your contribution margin is the difference between your sales price and the cost to produce the product (COGS).

Calculate Break-Even Point : Divide your fixed costs by your contribution margin to find the number of units you need to sell to break even.

Example of Break-Even Analysis:

- Fixed Costs : $5,200

- Contribution Margin : $0.20 per unit

- Break-Even Point : $5,200 / $0.20 = 26,000 units

Knowing your break-even point helps you set sales targets and pricing strategies to ensure profitability.

Conclusion: Save Time by Purchasing a Ready-to-Use Business Plan

Creating financial projections can be time-consuming and challenging, but they are crucial for building a strong business plan. By following the steps outlined in this guide, you can write accurate and professional financial projections that will help you secure funding and manage your business effectively.

However, if you want to save time and avoid the hassle of writing your own financial projections, consider purchasing one of our already used and funded business plans . These plans come complete with financial projections, startup costs, cash flow statements, and break-even analysis—everything you need to get started immediately.

Let us help you get your business off the ground with a plan that’s been tested and proven to work. Visit our website and purchase your Copier & Fax Store Business Plan or any other industry-specific plan today!

- Choosing a selection results in a full page refresh.

- Opens in a new window.

End 2024 strong 💪 75% o ff for 3 months. Buy Now & Save

75% off for 3 months Buy Now & Save

Wow clients with professional invoices that take seconds to create

Quick and easy online, recurring, and invoice-free payment options

Automated, to accurately track time and easily log billable hours

Reports and tools to track money in and out, so you know where you stand

Easily log expenses and receipts to ensure your books are always tax-time ready

Tax time and business health reports keep you informed and tax-time ready

Automatically track your mileage and never miss a mileage deduction again

Time-saving all-in-one bookkeeping that your business can count on

Track project status and collaborate with clients and team members

Organized and professional, helping you stand out and win new clients

Set clear expectations with clients and organize your plans for each project

Client management made easy, with client info all in one place

Pay your employees and keep accurate books with Payroll software integrations

- Team Management

FreshBooks integrates with over 100 partners to help you simplify your workflows

Send invoices, track time, manage payments, and more…from anywhere.

- Freelancers

- Self-Employed Professionals

- Businesses With Employees

- Businesses With Contractors

- Marketing & Agencies

- Construction & Trades

- IT & Technology

- Business & Prof. Services

- Accounting Partner Program

- Collaborative Accounting™

- Accountant Hub

- Reports Library

- FreshBooks vs QuickBooks

- FreshBooks vs HoneyBook

- FreshBooks vs Harvest

- FreshBooks vs Wave

- FreshBooks vs Xero

- Partners Hub

- Help Center

- 1-888-674-3175

- All Articles

- Productivity

- Project Management

- Bookkeeping

How to Make Financial Projections for Business

Writing a solid business plan should be the first step for any business owner looking to create a successful business.

As a small business owner, you will want to get the attention of investors, partners, or potential highly skilled employees. It is, therefore, important to have a realistic financial forecast incorporated into your business plan.

We’ll break down a financial projection and how to utilize it to give your business the best start possible.

Key Takeaways

Accurate financial projections are essential for businesses to succeed. In this article, we’ll explain everything you need to know about creating financial projections for your business. Here’s what you need to know about financial projections:

- A financial projection is a group of financial statements that are used to forecast future performance

- Creating financial projections can break down into 5 simple steps: sales projections, expense projections, balance sheet projections, income statement projections, and cash flow projections

- Financial projections can offer huge benefits to your business, including helping with forecasting future performance, ensuring steady cash flow, and planning key moves around the growth of the business

Here’s What We’ll Cover:

What Is a Financial Projection?

How to Create a Financial Projection

What goes into a financial projection, what are financial projections used for.

Financial Projections Advantages

Frequently Asked Questions

What Is Financial Projection?

A financial projection is essentially a set of financial statements . These statements will forecast future revenues and expenses.

Any projection includes your cash inflows and outlays, your general income, and your balance sheet.

They are perfect for showing bankers and investors how you plan to repay business loans. They also show what you intend to do with your money and how you expect your business to grow.

Most projections are for the first 3-5 years of business, but some include a 10-year forecast too.

Either way, you will need to develop a short and mid-term projection broken down month by month.

As you are just starting out with your business, you won’t be expected to provide exact details. Most financial projections are rough guesses. But they should also be educated guesses based on market trends, research, and looking at similar businesses.

It’s incredibly important for financial statements to be realistic. Most investors will be able to spot a fanciful projection from a mile away.

In general, most people would prefer to be given realistic projections, even if they’re not as impressive.

Financial projections are created to help business owners gain insight into the future of their company’s financials.

The question is, how to create financial projections? For business plan purposes, it’s important that you follow the best practices of financial projection closely. This will ensure you get accurate insight, which is vital for existing businesses and new business startups alike.

Here are the steps for creating accurate financial projections for your business.

1. Start With A Sales Projection

For starters, you’ll need to project how much your business will make in sales. If you’re creating a sales forecast for an existing business, you’ll have past performance records to project your next period. Past data can provide useful information for your financial projection, such as if your sales do better in one season than another.

Be sure also to consider external factors, such as the economy at large, the potential for added tariffs and taxes in the future, supply chain issues, or industry downturns.

The process is almost the same for new businesses, only without past data to refer to. Business startups will need to do more research on their industry to gain insight into potential future sales.

2. Create Your Expense Projection

Next, create an expense projection for your business. In a sense, this is an easier task than a sales projection since it seems simpler to predict your own behaviors than your customers. However, it’s vital that you expect the unexpected.

Optimism is great, but the worst-case scenario must be considered and accounted for in your expense projection. From accidents in the workplace to natural disasters, rising trade prices, to unexpected supply disruptions, you need to consider these large expenses in your projection.

Something always comes up, so we suggest you add a 10-15% margin on your expense projection.

3. Create Your Balance Sheet Projection

A balance sheet projection is used to get a clear look at your business’s financial position related to assets, liabilities , and equity, giving you a more holistic view of the company’s overall financial health.

For startup businesses, this can prove to be a lot of work since you won’t have existing records of past performance to pull from. This will need to be factored into your industry research to create an accurate financial projection.

For existing businesses, it will be more straightforward. Use your past and current balance sheets to predict your business’s position in the next 1-3 years. If you use a cloud-based, online accounting software with the feature to generate balance sheets, such as the one offered by FreshBooks, you’ll be able to quickly create balance sheets for your financial projection within the app.

Click here to learn more about the features of FreshBooks accounting software.

4. Make Your Income Statement Projection

Next up, create an income statement projection. An income statement is used to declare the net income of a business after all expenses have been made. In other words, it states the profits of a business.

For currently operating businesses, you can use your past income statements and the changes between them to create accurate predictions for the next 1-3 years. You can also use accounting software to generate your income statements automatically.

You’ll need to work on rough estimates for new businesses or those still in the planning phase. It’s vital that you stay realistic and do your utmost to create an accurate, good-faith projection of future income.

5. Finally, Create Your Cash Flow Projection

Last but not least is to generate your projected cash flow statement. A cash flow projection forecasts the movement of all money to and from your business. It’s intertwined with a business’s balance sheet and income statement, which is no different when creating projections.

If your business has been operating for six months or more, you can create a fairly accurate cash flow projection with your past cash flow financial statements. For new businesses, you’ll need to factor in this step of creating a financial forecast when doing your industry research.

It needs to include five elements to ensure an accurate, useful financial forecast for your business. These financial statements come together to provide greater insight into the projected future of a business’s financial health. These include:

Income Statement

A standard income statement summarizes your company’s revenues and expenses over a period. This is normally done either quarterly or annually.

The income statement is where you will do the bulk of your forecasting.

On any income statement, you’re likely to find the following:

- Revenue: Your revenue earned through sales.

- Expenses: The amount you’ve spent, including your product costs and your overheads.

- Pre-Tax Earnings: This is your income before you’ve paid tax.

- Net Income: The total revenues minus your total expenses.

Net income is the most important number. If the number is positive, then you’re earning a profit, if it’s negative, it means your expenses outweigh your revenue and you’re making a loss.

Cash Flow Statement

Your cash flow statement will show any potential investor whether you are a good credit risk. It also shows them if you can successfully repay any loans you are granted.

You can break a cash flow statement into three parts:

- Cash Revenues: An overview of your calculated cash sales for a given time period.

- Cash Disbursements: You list all the cash expenditures you expect to pay.

- Net Cash Revenue: Take the cash revenues minus your cash disbursements.

Balance Sheet

Your balance sheet will show your business’s net worth at a given time.

A balance sheet is split up into three different sections:

- Assets: An asset is a tangible object of value that your company owns. It could be things like stock or property such as warehouses or offices.

- Liabilities: These are any debts your business owes.

- Equity: Your equity is the summary of your assets minus your liabilities.

Looking for an easy-to-use yet capable online accounting software? FreshBooks accounting software is a cloud-based solution that makes financial projections simple. With countless financial reporting features and detailed guides on creating accurate financial forecasts, FreshBooks can help you gain the insight you need to let your business thrive. Click here to give FreshBooks a try for free.

Financial projections have many uses for current business owners and startup entrepreneurs. Provided your financial forecasting follows the best practices for an accurate projection, your data will be used for:

- Internal planning and budgeting – Your finances will be the main factor in whether or not you’ll be able to execute your business plan to completion. Financial projections allow you to make it happen.

- Attracting investors and securing funding – Whether you’re receiving financing from bank loans, investors, or both, an accurate projection will be essential in receiving the funds you need.

- Evaluating business performance and identifying areas for improvement – Financial projections help you keep track of your business’s financial health, allowing you to plan ahead and avoid unwelcome surprises.

- Making strategic business decisions – Timing is important in business, especially when it comes to major expenditures (new product rollouts, large-scale marketing, expansion, etc.). Financial projections allow you to make an informed strategy for these big decisions.

Financial Projections Advantages

Creating clear financial projections for your business startup or existing company has countless benefits. Focusing on creating (and maintaining) good financial forecasting for your business will:

- Help you make vital financial decisions for the business in the future

- Help you plan and strategize for growth and expansion

- Demonstrate to bankers how you will repay your loans

- Demonstrate to investors how you will repay financing

- Identify your most essential financing needs in the future

- Assist in fine-tuning your pricing

- Be helpful when strategizing your production plan

- Be a useful tool for planning your major expenditures strategically

- Help you keep an eye on your cash flow for the future

Your financial forecast is an essential part of your business plan, whether you’re still in the early startup phases or already running an established business. However, it’s vital that you follow the best practices laid out above to ensure you receive the full benefits of comprehensive financial forecasting.

If you’re looking for a useful tool to save time on the administrative tasks of financial forecasting, FreshBooks can help. With the ability to instantly generate the reports you need and get a birds-eye-view of your business’s past performance and overall financial help, it will be easier to create useful financial projections that provide insight into your financial future.

FAQs on Financial Projections

More questions about financial forecasting, projections, and how these processes fit into your business plan? Here are some frequently asked questions by business owners.

Why are financial projections important?

Financial projections allow you to gain insight into your business’s economic trajectory. This helps business owners make financial decisions, secure funding, and more. Additionally, financial projections provide early warning of roadblocks and challenges that may lay ahead for the company, making it easier to plan for a clear course of action.

What is an example of a financial projection?

A projection is an overall look at a business’s forecasted performance. It’s made up of several different statements and reports, such as a cash flow statement, income statement, profit and loss statement, and sales statement. You can find free templates and examples of many of these reports via FreshBooks. Click here to view our selection of accounting templates.

Are financial forecasts and financial projections the same?

Technically, there is a difference between forecasting and projections, though many use the terms interchangeably. Financial forecasting often refers to shorter-term (<1 year) predictions of financial performance, while financial projections usually focus on a larger time scale (2-3 years).

What is the most widely used method for financial forecasting?

The most common method of accurate forecasting is the straight-line forecasting method. It’s most often used for projecting the growth of a business’s revenue growth over a set period. If you notice that your records indicate a 4% growth of revenue per year for five years running, it would be reasonable to assume that this will continue year-over-year.

What is the purpose of a financial projection?

Projection aims to get deeper, more nuanced insight into a business’s financial health and viability. It allows business owners to anticipate expenses and profit growth, giving them the tools to secure funding and loans and strategize major business decisions. It’s an essential accounting process that all business owners should prioritize in their business plans.

Michelle Alexander, CPA

About the author

Michelle Alexander is a CPA and implementation consultant for Artificial Intelligence-powered financial risk discovery technology. She has a Master's of Professional Accounting from the University of Saskatchewan, and has worked in external audit compliance and various finance roles for Government and Big 4. In her spare time you’ll find her traveling the world, shopping for antique jewelry, and painting watercolour floral arrangements.

RELATED ARTICLES

From Idea to Foundation

Master the Essentials: Laying the Groundwork for Lasting Business Success.

Funding and Approval Toolkit

Shape the future of your business, business moves fast. stay informed..

Discover the Best Tools for Business Plans

Learn from the business planning experts, resources to help you get ahead, financial projections, table of contents.

Financial projections are not just a component of your business plan; they are the beating heart of strategic thinking and analysis in both startups and established businesses. These projections serve as a vital tool for setting targets, assessing key results, and understanding the reasons behind meeting or not meeting these targets. They enable businesses to recalibrate their strategies effectively, ensuring agility and responsiveness to market dynamics.

Essential for Diverse Business Needs

Apart from their critical role in internal analysis and strategy setting, financial projections are indispensable for a variety of external purposes:

- Raising Capital: Whether you’re a startup aiming for seed funding or an established business seeking expansion capital, clear and well-structured financial projections can significantly increase your chances of securing investment .

- Regulatory and Legal Compliance: Specific employment and investment visas, licensing, certification, and accreditation processes often require detailed financial projections to demonstrate the viability and potential of your business.

- Understanding Audiences: Depending on the audience—whether investors, regulatory bodies, or partners—the nature and detail of the financial projections can vary. Our “Understanding Audiences” page provides in-depth insights into tailoring your projections for different stakeholders.

Versatility in Application

Financial projections can be a standalone document or part of a comprehensive business plan. Their structure and emphasis may vary based on the business’s objectives:

- Debt Financing: For new businesses seeking loans , financial projections within a business plan help in demonstrating the capacity to repay the loan.

- Equity-Based Financing: For businesses in stages like pre-seed, seed , or series A funding, standalone financial projections are crucial. They provide clarity on startup requirements, burn-rate , and runway , which are key factors investors evaluate.

Foundations of Effective Financial Projections

Crafting impactful financial projections is a detailed and systematic process, grounded in deep research and thorough data collection. To create a robust foundation for these projections, two distinct approaches are recommended, each suited to different types of businesses and their unique needs:

- Ideal for New and Innovative Ventures: The Pre-Planning Process , detailed under Core Cost Analysis and Startup & Operational Costs in the “Get Started” section of Businessplan.com, is particularly beneficial for businesses that are in their nascent stages or are pioneering new markets.

- First-Movers and Fast-Followers: For ventures that aim to be first-movers or fast-followers in emerging industries, this comprehensive approach is crucial to understand the uncharted market dynamics.

- Startups Eyeing Investment Capital: Additionally, startups that plan to seek investment capital will find this process instrumental in laying a solid groundwork for their financial projections, giving potential investors a clear view of the business’s potential.

- Tailored for Established Industries: Businesses operating within well-established industries, where market dynamics are relatively known and stable, will benefit significantly from using a Model-Based Planning® Worksheet .

- Focus on Speed and Efficiency: This approach is designed for ventures where rapid planning and execution are prioritized. It provides a streamlined, industry-specific framework that accelerates the planning process.

- Customized to Specific Business Models: The Worksheet is customized for a wide range of business models and industries, ensuring that the financial projections are relevant and aligned with industry standards and expectations.

By choosing the approach that best aligns with your business’s stage, industry, and goals, you can ensure that your financial projections are not only realistic and well-informed but also highly effective in guiding your business towards success.

Key Sections of Financial Projections

Key assumptions.

In financial planning for businesses, especially startups, the creation of key assumptions is critical. These assumptions form the backbone of your financial projections, influencing every aspect from revenue forecasting to cost management. Their accuracy and realism are crucial for developing a financial model that truly reflects the potential of your business.

The Role of Key Assumptions

Key assumptions serve multiple purposes:

- Simplifying Complexity : By categorizing diverse products or services into manageable units, Key Assumptions help in creating a more readable and practical financial model .

- Guiding Strategic Decisions: These assumptions are instrumental in shaping business strategies, from marketing to product development.

- Facilitating Communication: Clear and concise assumptions make your financial projections more understandable to stakeholders, including investors and team members.

Creating Effective Key Assumptions

To craft meaningful and effective Key Assumptions, consider the following steps:

- Understand Your Business Model: Grasp the intricacies of your business, including product/service offerings, customer behavior, and market trends.

- Use Averages and Ratios: Simplify complex product lines or service offerings into average sales figures or ratios.

- Research and Validate: Ground your assumptions in market research or historical data, ensuring they are realistic and defendable.

- Think Creatively and Contextually: Tailor your assumptions to the unique context of your business, avoiding one-size-fits-all templates.

Personnel Plan

A comprehensive personnel plan is an essential component of your business’s financial projections. It not only outlines the staffing requirements but also encapsulates the associated costs, playing a significant role in the overall financial health of your enterprise.

Part 1: Personnel Forecast

The Personnel Forecast is a detailed table that includes the following elements:

- Specific Roles/Positions: Identify the various roles and positions needed within your company. This could range from managerial positions to operational staff.

- Average Salary or Hourly Rate: For each position, determine the average salary or hourly wage. This should be based on industry standards, regional salary averages, and the level of expertise required.

- Headcount: Specify the number of individuals needed for each role. This will depend on the scale of your operations and business needs.

- Total Payroll per Position: Calculate the total payroll for each position by multiplying the average salary or hourly rate by the headcount.

- Total Payroll: Summarize the total payroll expenses, combining the costs from all positions.

Part 2: Personnel-Related Notes for Other Financial Tables

In addition to the Personnel Forecast, certain personnel-related expenses will be input into other financial tables:

- Pre-Launch Training: Costs associated with training employees before the business launch should be included in the ‘ Sources & Uses of Funds ‘ under ‘Startup Expenses’.

- Ongoing or Post-Launch Training: Regular training or development costs incurred after the launch should be accounted for in the ‘Expenses’ section of the Pro Forma Profit & Loss statement.

- Total Benefits: Include costs related to sick leave, vacation, 401K match, health insurance, etc., in the Pro Forma Profit & Loss statement. These benefits form a significant part of employee compensation and affect the overall financial planning.

- Payroll Taxes: Calculate and include payroll taxes based on state and federal rates in the Pro Forma Profit & Loss statement. These taxes are a mandatory financial obligation and an integral part of payroll expenses.

Projecting Revenue

Projecting revenue is one of the most challenging aspects of business planning, primarily due to the uncertainties inherent in predicting future market behavior. However, strategic tools like Total Addressable Market (TAM) , Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) can significantly aid in this process.

Understanding TAM, SAM, and SOM

- Total Addressable Market (TAM): TAM refers to the total market demand for a product or service. It’s the maximum revenue opportunity available for a product or service, assuming 100% market share.

- S erviceable Available Market (SAM): SAM is the segment of the TAM targeted by your products and services that is within your geographical reach. It’s more realistic than TAM as it considers the market that is actually serviceable.

- Serviceable Obtainable Market (SOM): SOM, the most immediate and practical measure, is the portion of SAM that you can capture. It considers factors like competition, your unique value proposition, pricing strategy, and operational capacity. SOM is what you realistically aim to achieve in the short to medium term.

Utilizing Industry Reports for Revenue Projection

Industry reports, like those from IBISWorld , are invaluable in this process. They provide detailed insights, including a section on Cost Structure which outlines the average percentage of revenue spent on various expenses in your industry. Here’s how you can use this data:

- Estimate Revenue Based on Personnel Costs: Given the detailed personnel plan you have, use the “Wages” percentage from the IBISWorld report. By dividing your total annual personnel costs by this percentage, you get an estimate of the annual revenue required to support your staff.