5 compelling examples of research projects

Last updated

3 April 2024

Reviewed by

Creative and innovative minds dream up big ideas that build the trends of tomorrow, but the research behind the scenes is often the secret sauce to company success. Businesses need a way to learn how their products or services will resonate with the market and where to invest their marketing efforts.

Market analysis template

Save time, highlight crucial insights, and drive strategic decision-making

- Research project examples

Data collected from research products can help you verify theories, understand customer behavior , and quantify KPIs for a clear picture of how to improve business practices.

Many types of research projects can help businesses find ways to fuel growth and adapt to market changes. These five examples of market research projects highlight the various ways businesses can use research and measurable data to grow successfully and avoid poor investments.

Example 1: Competitive analysis

It's important for businesses of all sizes to understand the competitive landscape and where they stand in comparison to direct competitors. By identifying your competitors and evaluating their strengths and weaknesses, you can find ways to position your company for greater success.

Competitive analysis can be used to better understand the market, improve marketing methods, and identify underserved customers.

The goals of competitive analysis may include:

Identifying your company's position in the market

Uncovering industry trends

Finding new marketing techniques

Identifying a new target customer base

Planning for new product innovation

Competitive research is conducted by identifying competitors and analyzing their performance. After identifying your direct competitors and gathering data about their products and services, you can dig deeper to learn more about how they serve customers. This may include gathering information about sales and marketing strategies, customer engagement , and social media strategies.

When analyzing direct competitors, organizing information about your competitors' attributes, strategies, strengths, and weaknesses will help you reveal themes that give you greater insight into the market.

Competitor analysis templates

Example 2: market segmentation.

Every business relies on customers for success. Researching your target audience and your potential position in the market is essential to developing strong marketing plans.

Market segmentation can be used to plan marketing campaigns, identify ideal product prices, and personalize your brand.

The goals of market segmentation research may include:

Identifying the target audience

Planning for new products or services

Expanding to a new location

Improving marketing efforts

Personalizing communications with customers

Improving customer satisfaction

There are many ways to collect and organize data for market segmentation research. Depending on your products and services, you might choose to divide your target population into groups based on demographics, location, behavior patterns, lifestyle aspects, etc. Organizing such data allows you to create buyer personas and test marketing strategies.

Example 3: New product development research

Companies must invest significant time and money into the development of a new product . Product development research is an important part of promoting a successful launch of a new product.

The goals of product development research may include:

Forecasting the usage of products

Identifying accurate pricing

How products compare to competitors

Potential barriers to success

How customers will respond to new or updated products

Product development research includes studies conducted during the planning phase all the way through prototype testing and market planning. Research may include online surveys to determine which demographics would be most interested in the product or how a new product might be used. Advanced studies can include product testing to gather feedback about issues customers are having or features that could be improved.

Example 4: Customer satisfaction

According to the CallMiner Churn Index 2020 , U.S. companies lose $168 billion per year due to avoidable consumer switching. Customer satisfaction leads to loyalty and repeat purchases. Furthermore, happy customers leave good reviews and act as natural brand ambassadors.

Findings from customer satisfaction surveys can help companies get a better understanding of the customer journey and develop new processes.

The goals of customer satisfaction research may include:

Understanding overall customer satisfaction

Finding bottlenecks or points along the customer journey that decrease the level of customer satisfaction

Measuring the level of likelihood to recommend to others ( Net Promoter Score )

Measuring customer satisfaction may include surveys to determine satisfaction with the company, opinions about the sales process, or about a specific process like the user-friendliness of an app or company website. This can be achieved by organizing data derived from customer interviews , customer satisfaction surveys , reviews, and customer loyalty programs.

Example 5: Brand research

No product or business is without competition. Establishing your brand in the market can help you stand out from the crowd. Brand research can help you understand whether your marketing campaigns are reaching their goals and how customers perceive your brand.

Some goals of brand research may include:

Positioning your brand more competitively in the marketplace

Measuring the effectiveness of brand marketing

Determining the public perception of your brand

Developing new marketing campaigns

Tracking brand success on a regular basis

There are a variety of ways to conduct research about how consumers perceive your brand. In-person focus groups can help you get an in-depth view of how your brand is perceived and why. Surveys can help you gather data surrounding brand preference, brand loyalty, and what people associate with your brand. Ongoing research in these areas can help you build your brand value over time and find ways to share your company mission and personality with consumers.

- How to find ideas for your next research project

Successfully running a business requires you to be well-informed on product development, branding, customer service, industry trends, marketing, sales, organizational processes, employee satisfaction , and more.

Various research products can help you stay informed and up-to-date in all these areas. However, determining where to focus your efforts and invest your capital can be challenging. These actions can help you find ideas for your next research project.

Identify problems or issues

Remember, research is conducted to satisfy a question or reach a goal. Identify problems that impact customer retention , sales, or company performance. Use these problems to determine which types of research topics are most likely to help your company achieve greater success. If performance is low, consider a research project to determine employee satisfaction levels and identify how to improve them. If sales are low, consider research into sales processes or customer satisfaction.

Confirm the potential for a new idea

New products or services help companies grow and attract more customers. However, they require a big upfront investment from your organization. You can prove that your next big idea will be a hit by developing research projects around the need for a new product and your target customers. Solid data is often needed to convince company leaders and stakeholders to invest in a new product or service.

Check out the competition

Where do you stand in comparison to your competitors? If you're unsatisfied with your position in the market, learning more about what your competitors are doing right can help you determine how to improve.

- Characteristics of a good market research idea

Shallow or vague research topics can lead to lackluster results that don't really add value to your studies. To conduct a successful research project, it's important to develop a plan that will yield productive data. When choosing a topic for your next research project, look for these characteristics.

The topic is relevant to your current position

The idea is manageable (research can be conducted with your resources and budget)

The project has a specific and focused goal

You can clearly define and outline the scope of the project

The subject matter isn't too broad or narrow to yield useful results

While research can be science-based or for academic purposes, market research is conducted for a variety of reasons to help businesses grow or reach new levels of success. Understanding market research goals is the key to developing highly effective research projects that yield useful data. By examining examples of different research projects and your organizational goals, you can more easily decide where to focus your efforts.

Which topic is best for a research project?

There isn't a single topic that provides the best research project for every researcher. The best research topics serve a purpose like gaining a deeper understanding of a specific phenomenon, solving problems, improving processes, generating ideas, etc. Finding the best topic for research requires an investigation into what type of research project is likely to yield the most effective results.

How do you structure a research project?

The structure of your research project should clarify what you will investigate, why it is important, and how you will conduct your research. To get funding or approval for a research project, researchers are often required to submit a research proposal which acts as a blueprint and guide for a research plan. Any formal or informal research plan should include these features.

The identity and position of the researcher

An introduction of the topic and why it's relevant

The objective of the project and why you think the research is worth doing

An overview of existing knowledge on the topic

A detailed list of practical steps for how you will reach your objective, including gathering data and how you'll gain insights from the data you obtain

A clear timeline of the project and the planned project budget

What's the difference between a project and a research project?

A project is a planned set of activities with a specific outcome, while a research project is the investigation of data, sources, and facts to reach new conclusions. In a business context, a project may be the development of a marketing campaign, planning a new product or service, or establishing new policies. Research projects use relevant data to fuel business projects and activities.

What are some examples of practical research topics?

Practical research projects can range across a variety of subjects and purposes. Research is often conducted to further medical knowledge, change and adapt laws, address economic changes, advance academic studies, or improve business success. Here are a few examples.

How eating a diet high in fruits and vegetables affects advanced Crohn's disease

How to improve customer satisfaction by 20% in six weeks

The impact of increasing voter turnout by 25% on the presidential election

The percentage increase of new customers with the addition of online enrollment for banking services

The most effective way to improve employee retention in a company with 1,000 employees

Should you be using a customer insights hub?

Do you want to discover previous research faster?

Do you share your research findings with others?

Do you analyze research data?

Start for free today, add your research, and get to key insights faster

Editor’s picks

Last updated: 3 April 2024

Last updated: 17 October 2024

Last updated: 13 May 2024

Last updated: 22 July 2023

Last updated: 23 July 2024

Last updated: 14 November 2024

Last updated: 2 October 2024

Last updated: 12 September 2024

Last updated: 22 February 2024

Latest articles

Related topics, a whole new way to understand your customer is here, log in or sign up.

Get started for free

- Free Resources

14 Market Research Examples

This article was originally published in the MarketingSherpa email newsletter .

Example #1: National bank’s A/B testing

You can learn what customers want by conducting experiments on real-life customer decisions using A/B testing. When you ensure your tests do not have any validity threats, the information you garner can offer very reliable insights into customer behavior.

Here’s an example from Flint McGlaughlin, CEO of MarketingSherpa and MECLABS Institute, and the creator of its online marketing course .

A national bank was working with MECLABS to discover how to increase the number of sign-ups for new checking accounts.

Customers who were interested in checking accounts could click on an “Open in Minutes” link on the bank’s homepage.

Creative Sample #1: Anonymized bank homepage

After clicking on the homepage link, visitors were taken to a four-question checking account selector tool.

Creative Sample #2: Original checking account landing page — account recommendation selector tool

After filling out the selector tool, visitors were taken to a results page that included a suggested package (“Best Choice”) along with a secondary option (“Second Choice”). The results page had several calls to action (CTAs). Website visitors were able to select an account and begin pre-registration (“Open Now”) or find out more information about the account (“Learn More”), go back and change their answers (“Go back and change answers”), or manually browse other checking options (“Other Checking Options”).

Creative Sample #3: Original checking account landing page — account recommendation selector tool results page

After going through the experience, the MECLABS team hypothesized that the selector tool wasn’t really delivering on the expectation the customer had after clicking on the “Open in Minutes” CTA. They created two treatments (new versions) and tested them against the control experience.

In the first treatment, the checking selector tool was removed, and instead, customers were directly presented with three account options in tabs from which customers could select.

Creative Sample #4: Checking account landing page Treatment #1

The second treatment’s landing page focused on a single product and had only one CTA. The call-to-action was similar to the CTA customers clicked on the homepage to get to this page — “Open Now.”

Creative Sample #5: Checking account landing page Treatment #2

Both treatments increased account applications compared to the control landing page experience, with Treatment #2 generating 65% more applicants at a 98% level of confidence.

Creative Sample #6: Results of bank experiment that used A/B testing

You’ll note the Level of Confidence in the results. With any research tactic or tool you use to learn about customers, you have to consider whether the information you’re getting really represents most customers, or if you’re just seeing outliers or random chance.

With a high Level of Confidence like this, it is more likely the results actually represent a true difference between the control and treatment landing pages and that the results aren’t just a random event.

The other factor to consider is — testing in and of itself will not produce results. You have to use testing as research to actually learn about the customer and then make changes to better serve the customer.

In the video How to Discover Exactly What the Customer Wants to See on the Next Click: 3 critical skills every marketer must master , McGlaughlin discussed this national bank experiment and explained how to use prioritization, identification and deduction to discover what your customers want.

This example was originally published in Marketing Research: 5 examples of discovering what customers want .

Example #2: Consumer Reports’ market intelligence research from third-party sources

The first example covers A/B testing. But keep in mind, ill-informed A/B testing isn’t market research, it’s just hoping for insights from random guesses.

In other words, A/B testing in a vacuum does not provide valuable information about customers. What you are testing is crucial, and then A/B testing is a means to help better understand whether insights you have about the customer are either validated or refuted by actual customer behavior. So it’s important to start with some research into potential customers and competitors to inform your A/B tests.

For example, when MECLABS and MarketingExperiments (sister publisher to MarketingSherpa) worked with Consumer Reports on a public, crowdsourced A/B test, we provided a market intelligence report to our audience to help inform their test suggestions.

Every successful marketing test should confirm or deny an assumption about the customer. You need enough knowledge about the customer to create marketing messages you think will be effective.

For this public experiment to help marketers improve their split testing abilities, we had a real customer to work with — donors to Consumer Reports.

To help our audience better understand the customer, the MECLABS Marketing Intelligence team created the 26-page ConsumerReports Market Intelligence Research document (which you can see for yourself at that link).

This example was originally published in Calling All Writers and Marketers: Write the most effective copy for this Consumer Reports email and win a MarketingSherpa Summit package and Consumer Reports Value Proposition Test: What you can learn from a 29% drop in clickthrough .

Example #3: Virtual event company’s conversation

What if you don’t have the budget for A/B testing? Or any of the other tactics in this article?

Well, if you’re like most people you likely have some relationships with other human beings. A significant other, friends, family, neighbors, co-workers, customers, a nemesis (“Newman!”). While conducting market research by talking to these people has several validity threats, it at least helps you get out of your own head and identify some of your blind spots.

WebBabyShower.com’s lead magnet is a PDF download of a baby shower thank you card ‘swipe file’ plus some extras. “Women want to print it out and have it where they are writing cards, not have a laptop open constantly,” said Kurt Perschke, owner, WebBabyShower.com.

That is not a throwaway quote from Perschke. That is a brilliant insight, so I want to make sure we don’t overlook it. By better understanding customer behavior, you can better serve customers and increase results.

However, you are not your customer. So you must bridge the gap between you and them.

Often you hear marketers or business leaders review an ad or discuss a marketing campaign and say, “Well, I would never read that entire ad” or “I would not be interested in that promotion.” To which I say … who cares? Who cares what you would do? If you are not in the ideal customer set, sorry to dent your ego, but you really don’t matter. Only the customer does.

Perschke is one step ahead of many marketers and business leaders because he readily understands this. “Owning a business whose customers are 95% women has been a great education for me,” he said.

So I had to ask him, how did he get this insight into his customers’ behavior? Frankly, it didn’t take complex market research. He was just aware of this disconnect he had with the customer, and he was alert for ways to bridge the gap. “To be honest, I first saw that with my wife. Then we asked a few customers, and they confirmed it’s what they did also. Writing notes by hand is viewed as a ‘non-digital’ activity and reading from a laptop kinda spoils the mood apparently,” he said.

Back to WebBabyShower. “We've seen a [more than] 100% increase in email signups using this method, which was both inexpensive and evergreen,” Perschke said.

This example was originally published in Digital Marketing: Six specific examples of incentives that worked .

Example #4: Spiceworks Ziff Davis’ research-informed content marketing

Marketing research isn’t just to inform products and advertising messages. Market research can also give your brand a leg up in another highly competitive space – content marketing.

Don’t just jump in and create content expecting it to be successful just because it’s “free.” Conducting research beforehand can help you understand what your potential audience already receives and where they might need help but are currently being served.

When Spiceworks Ziff Davis (SWZD) published its annual State of IT report, it invested months in conducting primary market research, analyzing year-over-year trends, and finally producing the actual report.

“Before getting into the nuts and bolts of writing an asset, look at market shifts and gaps that complement your business and marketing objectives. Then, you can begin to plan, research, write, review and finalize an asset,” said Priscilla Meisel, Content Marketing Director, SWZD.

This example was originally published in Marketing Writing: 3 simple tips that can help any marketer improve results (even if you’re not a copywriter) .

Example #5: Business travel company’s guerilla research

There are many established, expensive tactics you can use to better understand customers.

But if you don’t have the budget for those tactics, and don’t know any potential customers, you might want to brainstorm creative ways you can get valuable information from the right customer target set.

Here’s an example from a former client of Mitch McCasland, Founding Partner and Director, Brand Inquiry Partners. The company sold a product related to frequent business flyers and was interested in finding out information on people who travel for a living. They needed consumer feedback right away.

“I suggested that they go out to the airport with a bunch of 20-dollar bills and wait outside a gate for passengers to come off their flight,” McCasland said. When people came off the flight, they were politely asked if they would answer a few questions in exchange for the incentive (the $20). By targeting the first people off the flight they had a high likelihood of reaching the first-class passengers.

This example was originally published in Guerrilla Market Research Expert Mitch McCasland Tells How You Can Conduct Quick (and Cheap) Research .

Example #6: Intel’s market research database

When conducting market research, it is crucial to organize your data in a way that allows you to easily and quickly report on it. This is especially important for qualitative studies where you are trying to do more than just quantify the data, but need to manage it so it is easier to analyze.

Anne McClard, Senior Researcher, Doxus worked with Shauna Pettit-Brown of Intel on a research project to understand the needs of mobile application developers throughout the world.

Intel needed to be able to analyze the data from several different angles, including segment and geography, a daunting task complicated by the number of interviews, interviewers, and world languages.

“The interviews were about an hour long, and pretty substantial,” McClard says. So, she needed to build a database to organize the transcripts in a way that made sense.

Different types of data are useful for different departments within a company; once your database is organized you can sort it by various threads.

The Intel study had three different internal sponsors. "When it came to doing the analysis, we ended up creating multiple versions of the presentation targeted to individual audiences," Pettit-Brown says.

The organized database enabled her to go back into the data set to answer questions specific to the interests of the three different groups.

This example was originally published in 4 Steps to Building a Qualitative Market Research Database That Works Better .

Example #7: National security survey’s priming

When conducting market research surveys, the way you word your questions can affect customers’ response. Even the way you word previous questions can put customers in a certain mindset that will skew their answers.

For example, when people were asked if they thought the U.S. government should spend money on an anti-missile shield, the results appeared fairly conclusive. Sixty-four percent of those surveyed thought the country should and only six percent were unsure, according to Opinion Makers: An Insider Exposes the Truth Behind the Polls .

But when pollsters added the option, "...or are you unsure?" the level of uncertainty leaped from six percent to 33 percent. When they asked whether respondents would be upset if the government took the opposite course of action from their selection, 59 percent either didn’t have an opinion or didn’t mind if the government did something differently.

This is an example of how the way you word questions can change a survey’s results. You want survey answers to reflect customer’s actual sentiments that are as free of your company’s previously held biases as possible.

This example was originally published in Are Surveys Misleading? 7 Questions for Better Market Research .

Example #8: Visa USA’s approach to getting an accurate answer

As mentioned in the previous example, the way you ask customers questions can skew their responses with your own biases.

However, the way you ask questions to potential customers can also illuminate your understanding of them. Which is why companies field surveys to begin with.

“One thing you learn over time is how to structure questions so you have a greater likelihood of getting an accurate answer. For example, when we want to find out if people are paying off their bills, we'll ask them to think about the card they use most often. We then ask what the balance was on their last bill after they paid it,” said Michael Marx, VP Research Services, Visa USA.

This example was originally published in Tips from Visa USA's Market Research Expert Michael Marx .

Example #9: Hallmark’s private members-only community

Online communities are a way to interact with and learn from customers. Hallmark created a private members-only community called Idea Exchange (an idea you could replicate with a Facebook or LinkedIn Group).

The community helped the greeting cards company learn the customer’s language.

“Communities…let consumers describe issues in their own terms,” explained Tom Brailsford, Manager of Advancing Capabilities, Hallmark Cards. “Lots of times companies use jargon internally.”

At Hallmark they used to talk internally about “channels” of distribution. But consumers talk about stores, not channels. It is much clearer to ask consumers about the stores they shop in than what channels they shop.

For example, Brailsford clarified, “We say we want to nurture, inspire, and lift one’s spirits. We use those terms, and the communities have defined those terms for us. So we have learned how those things play out in their lives. It gives us a much richer vocabulary to talk about these things.”

This example was originally published in Third Year Results from Hallmark's Online Market Research Experiment .

Example #10: L'Oréal’s social media listening

If you don’t want the long-term responsibility that comes with creating an online community, you can use social media listening to understand how customers talking about your products and industry in their own language.

In 2019, L'Oréal felt the need to upgrade one of its top makeup products – L'Oréal Paris Alliance Perfect foundation. Both the formula and the product communication were outdated – multiple ingredients had emerged on the market along with competitive products made from those ingredients.

These new ingredients and products were overwhelming consumers. After implementing new formulas, the competitor brands would advertise their ingredients as the best on the market, providing almost magical results.

So the team at L'Oréal decided to research their consumers’ expectations instead of simply crafting a new formula on their own. The idea was to understand not only which active ingredients are credible among the audience, but also which particular words they use while speaking about foundations in general.

The marketing team decided to combine two research methods: social media listening and traditional questionnaires.

“For the most part, we conduct social media listening research when we need to find out what our customers say about our brand/product/topic and which words they use to do it. We do conduct traditional research as well and ask questions directly. These surveys are different because we provide a variety of readymade answers that respondents choose from. Thus, we limit them in terms of statements and their wording,” says Marina Tarandiuk, marketing research specialist, L'Oréal Ukraine.

“The key value of social media listening (SML) for us is the opportunity to collect people’s opinions that are as ‘natural’ as possible. When someone leaves a review online, they are in a comfortable environment, they use their ‘own’ language to express themselves, there is no interviewer standing next to them and potentially causing shame for their answer. The analytics of ‘natural’ and honest opinions of our customers enables us to implement the results in our communication and use the same language as them,” Tarandiuk said.

The team worked with a social media listening tool vendor to identify the most popular, in-demand ingredients discussed online and detect the most commonly used words and phrases to create a “consumer glossary.”

Questionnaires had to confirm all the hypotheses and insights found while monitoring social media. This part was performed in-house with the dedicated team. They created custom questionnaires aiming to narrow down all the data to a maximum of three variants that could become the base for the whole product line.

“One of our recent studies had a goal to find out which words our clients used to describe positive and negative qualities of [the] foundation. Due to a change in [the] product’s formula, we also decided to change its communication. Based on the opinions of our customers, we can consolidate the existing positive ideas that our clients have about the product,” Tarandiuk said.

To find the related mentions, the team monitored not only the products made by L'Oréal but also the overall category. “The search query contained both brand names and general words like foundation, texture, smell, skin, pores, etc. The problem was that this approach ended up collecting thousands of mentions, not all of which were relevant to the topic,” said Elena Teselko, content marketing manager, YouScan (L'Oréal’s social media listening tool).

So the team used artificial intelligence-based tagging that divided mentions according to the category, features, or product type.

This approach helped the team discover that customers valued such foundation features as not clogging pores, a light texture, and not spreading. Meanwhile, the most discussed and appreciated cosmetics component was hyaluronic acid.

These exact phrases, found with the help of social media monitoring, were later used for marketing communication.

Creative Sample #7: Marketing communicating for personal care company with messaging based on discoveries from market research

“Doing research and detecting audience’s interests BEFORE starting a campaign is an approach that dramatically lowers any risks and increases chances that the campaign would be appreciated by customers,” Teselko said.

This example was originally published in B2C Branding: 3 quick case studies of enhancing the brand with a better customer experience .

Example #11: Levi’s ethnographic research

In a focus group or survey, you are asking customers to explain something they may not even truly understand. Could be why they bought a product. Or what they think of your competitor.

Ethnographic research is a type of anthropology in which you go into customers’ homes or places of business and observe their actual behavior, behavior they may not understand well enough to explain to you.

While cost prohibitive to many brands, and simply unfeasible for others, it can elicit new insights into your customers.

Michael Perman, Senior Director Cultural Insights, Levi Strauss & Co. uses both quantitative and qualitative research on a broad spectrum, but when it comes to gathering consumer insight, he focuses on in-depth ethnographic research provided by partners who specialize in getting deep into the “nooks and crannies of consumer life in America and around the world.” For example, his team spends time in consumers’ homes and in their closets. They shop with consumers, looking for the reality of a consumer’s life and identifying themes that will enable designers and merchandisers to better understand and anticipate consumer needs.

Perman then puts together multi-sensory presentations that illustrate the findings of research. For example, “we might recreate a teenager’s bedroom and show what a teenage girl might have on her dresser.”

This example was originally published in How to Get Your Company to Pay Attention to Market Research Results: Tips from Levi Strauss .

Example #12: eBags’ ethnographic research

Ethnographic research isn’t confined to a physical goods brand like Levi’s. Digital brands can engage in this form of anthropology as well.

While usability testing in a lab is useful, it does miss some of the real-world environmental factors that play a part in the success of a website. Usability testing alone didn’t create a clear enough picture for Gregory Casey, User Experience Designer and Architect, eBags.

“After we had designed our mobile and tablet experience, I wanted to run some contextual user research, which basically meant seeing how people used it in the wild, seeing how people are using it in their homes. So that’s exactly what I did,” Gregory said.

He found consumers willing to open their home to him and be tested in their normal environment. This meant factors like the television, phone calls and other family members played a part in how they experienced the eBags mobile site.

“During these interview sessions, a lot of times we were interrupted by, say, a child coming over and the mother having to do something for the kid … The experience isn’t sovereign. It’s not something where they just sit down, work through a particular user flow and complete their interaction,” Gregory said.

By watching users work through the site as they would in their everyday life, Gregory got to see what parts of the site they actually use.

This example was originally published in Mobile Marketing: 4 takeaways on how to improve your mobile shopping experience beyond just responsive design .

Example #13: John Deere’s shift from product-centric market research to consumer-centric research

One of the major benefits of market research is to overcome company blind spots. However, if you start with your blind spots – i.e., a product focus – you will blunt the effectiveness of your market research.

In the past, “they’d say, Here’s the product, find out how people feel about it,” explained David van Nostrand, Manager, John Deere's Global Market Research. “A lot of companies do that.” Instead, they should be saying, “Let's start with the customers: what do they want, what do they need?”

The solution? A new in-house program called “Category Experts” brings the product-group employees over as full team members working on specific research projects with van Nostrand’s team.

These staffers handle items that don’t require a research background: scheduling, meetings, logistics, communication and vendor management. The actual task they handle is less important than the fact that they serve as human cross-pollinators, bringing consumer-centric sensibility back to their product- focused groups.

For example, if van Nostrand’s team is doing research about a vehicle, they bring in staffers from the Vehicles product groups. “The information about vehicle consumers needs to be out there in the vehicle marketing groups, not locked in here in the heads of the researchers.”

This example was originally published in How John Deere Increased Mass Consumer Market Share by Revamping its Market Research Tactics .

Example #14: LeapFrog’s market research involvement throughout product development (not just at the beginning and the end)

Market research is sometimes thought of as a practice that can either inform the development of a product, or research consumer attitudes about developed products. But what about the middle?

Once the creative people begin working on product designs, the LeapFrog research department stays involved.

They have a lab onsite where they bring moms and kids from the San Francisco Bay area to test preliminary versions of the products. “We do a lot of hands-on, informal qualitative work with kids,” said Craig Spitzer, VP Marketing Research, LeapFrog. “Can they do what they need to do to work the product? Do they go from step A to B to C, or do they go from A to C to B?”

When designing the LeapPad Learning System, for example, the prototype went through the lab “a dozen times or so,” he says.

A key challenge for the research department is keeping and building the list of thousands of families who have agreed to be on call for testing. “We've done everything from recruiting on the Internet to putting out fliers in local schools, working through employees whose kids are in schools, and milking every connection we have,” Spitzer says.

Kids who test products at the lab are compensated with a free, existing product rather than a promise of the getting the product they're testing when it is released in the future.

This example was originally published in How LeapFrog Uses Marketing Research to Launch New Products .

Related resources

The Marketer’s Blind Spot: 3 ways to overcome the marketer’s greatest obstacle to effective messaging

Get Your Free Test Discovery Tool to Help Log all the Results and Discoveries from Your Company’s Marketing Tests

Marketing Research: 5 examples of discovering what customers want

Online Marketing Tests: How do you know you’re really learning anything?

Improve Your Marketing

Join our thousands of weekly case study readers.

Enter your email below to receive MarketingSherpa news, updates, and promotions:

Note: Already a subscriber? Want to add a subscription? Click Here to Manage Subscriptions

Get Better Business Results With a Skillfully Applied Customer-first Marketing Strategy

The customer-first approach of MarketingSherpa’s agency services can help you build the most effective strategy to serve customers and improve results, and then implement it across every customer touchpoint.

Get headlines, value prop, competitive analysis, and more.

Marketer Vs Machine

Marketer Vs Machine: We need to train the marketer to train the machine.

Free Marketing Course

Become a Marketer-Philosopher: Create and optimize high-converting webpages (with this free online marketing course)

Project and Ideas Pitch Template

A free template to help you win approval for your proposed projects and campaigns

Six Quick CTA checklists

These CTA checklists are specifically designed for your team — something practical to hold up against your CTAs to help the time-pressed marketer quickly consider the customer psychology of your “asks” and how you can improve them.

Infographic: How to Create a Model of Your Customer’s Mind

You need a repeatable methodology focused on building your organization’s customer wisdom throughout your campaigns and websites. This infographic can get you started.

Infographic: 21 Psychological Elements that Power Effective Web Design

To build an effective page from scratch, you need to begin with the psychology of your customer. This infographic can get you started.

Receive the latest case studies and data on email, lead gen, and social media along with MarketingSherpa updates and promotions.

- Your Email Account

- Customer Service Q&A

- Search Library

- Content Directory:

Questions? Contact Customer Service at [email protected]

© 2000-2024 MarketingSherpa LLC, ISSN 1559-5137 Editorial HQ: MarketingSherpa LLC, PO Box 50032, Jacksonville Beach, FL 32240

The views and opinions expressed in the articles of this website are strictly those of the author and do not necessarily reflect in any way the views of MarketingSherpa, its affiliates, or its employees.

How to Do Market Research: The Complete Guide

Learn how to do market research with this step-by-step guide, complete with templates, tools and real-world examples.

Access best-in-class company data

Get trusted first-party funding data, revenue data and firmographics

Market research is the systematic process of gathering, analyzing and interpreting information about a specific market or industry.

What are your customers’ needs? How does your product compare to the competition? What are the emerging trends and opportunities in your industry? If these questions keep you up at night, it’s time to conduct market research.

Market research plays a pivotal role in your ability to stay competitive and relevant, helping you anticipate shifts in consumer behavior and industry dynamics. It involves gathering these insights using a wide range of techniques, from surveys and interviews to data analysis and observational studies.

In this guide, we’ll explore why market research is crucial, the various types of market research, the methods used in data collection, and how to effectively conduct market research to drive informed decision-making and success.

What is market research?

The purpose of market research is to offer valuable insight into the preferences and behaviors of your target audience, and anticipate shifts in market trends and the competitive landscape. This information helps you make data-driven decisions, develop effective strategies for your business, and maximize your chances of long-term growth.

Why is market research important?

By understanding the significance of market research, you can make sure you’re asking the right questions and using the process to your advantage. Some of the benefits of market research include:

- Informed decision-making: Market research provides you with the data and insights you need to make smart decisions for your business. It helps you identify opportunities, assess risks and tailor your strategies to meet the demands of the market. Without market research, decisions are often based on assumptions or guesswork, leading to costly mistakes.

- Customer-centric approach: A cornerstone of market research involves developing a deep understanding of customer needs and preferences. This gives you valuable insights into your target audience, helping you develop products, services and marketing campaigns that resonate with your customers.

- Competitive advantage: By conducting market research, you’ll gain a competitive edge. You’ll be able to identify gaps in the market, analyze competitor strengths and weaknesses, and position your business strategically. This enables you to create unique value propositions, differentiate yourself from competitors, and seize opportunities that others may overlook.

- Risk mitigation: Market research helps you anticipate market shifts and potential challenges. By identifying threats early, you can proactively adjust their strategies to mitigate risks and respond effectively to changing circumstances. This proactive approach is particularly valuable in volatile industries.

- Resource optimization: Conducting market research allows organizations to allocate their time, money and resources more efficiently. It ensures that investments are made in areas with the highest potential return on investment, reducing wasted resources and improving overall business performance.

- Adaptation to market trends: Markets evolve rapidly, driven by technological advancements, cultural shifts and changing consumer attitudes. Market research ensures that you stay ahead of these trends and adapt your offerings accordingly so you can avoid becoming obsolete.

As you can see, market research empowers businesses to make data-driven decisions, cater to customer needs, outperform competitors, mitigate risks, optimize resources and stay agile in a dynamic marketplace. These benefits make it a huge industry; the global market research services market is expected to grow from $76.37 billion in 2021 to $108.57 billion in 2026 . Now, let’s dig into the different types of market research that can help you achieve these benefits.

Types of market research

- Qualitative research

- Quantitative research

- Exploratory research

- Descriptive research

- Causal research

- Cross-sectional research

- Longitudinal research

Despite its advantages, 23% of organizations don’t have a clear market research strategy. Part of developing a strategy involves choosing the right type of market research for your business goals. The most commonly used approaches include:

1. Qualitative research

Qualitative research focuses on understanding the underlying motivations, attitudes and perceptions of individuals or groups. It is typically conducted through techniques like in-depth interviews, focus groups and content analysis — methods we’ll discuss further in the sections below. Qualitative research provides rich, nuanced insights that can inform product development, marketing strategies and brand positioning.

2. Quantitative research

Quantitative research, in contrast to qualitative research, involves the collection and analysis of numerical data, often through surveys, experiments and structured questionnaires. This approach allows for statistical analysis and the measurement of trends, making it suitable for large-scale market studies and hypothesis testing. While it’s worthwhile using a mix of qualitative and quantitative research, most businesses prioritize the latter because it is scientific, measurable and easily replicated across different experiments.

3. Exploratory research

Whether you’re conducting qualitative or quantitative research or a mix of both, exploratory research is often the first step. Its primary goal is to help you understand a market or problem so you can gain insights and identify potential issues or opportunities. This type of market research is less structured and is typically conducted through open-ended interviews, focus groups or secondary data analysis. Exploratory research is valuable when entering new markets or exploring new product ideas.

4. Descriptive research

As its name implies, descriptive research seeks to describe a market, population or phenomenon in detail. It involves collecting and summarizing data to answer questions about audience demographics and behaviors, market size, and current trends. Surveys, observational studies and content analysis are common methods used in descriptive research.

5. Causal research

Causal research aims to establish cause-and-effect relationships between variables. It investigates whether changes in one variable result in changes in another. Experimental designs, A/B testing and regression analysis are common causal research methods. This sheds light on how specific marketing strategies or product changes impact consumer behavior.

6. Cross-sectional research

Cross-sectional market research involves collecting data from a sample of the population at a single point in time. It is used to analyze differences, relationships or trends among various groups within a population. Cross-sectional studies are helpful for market segmentation, identifying target audiences and assessing market trends at a specific moment.

7. Longitudinal research

Longitudinal research, in contrast to cross-sectional research, collects data from the same subjects over an extended period. This allows for the analysis of trends, changes and developments over time. Longitudinal studies are useful for tracking long-term developments in consumer preferences, brand loyalty and market dynamics.

Each type of market research has its strengths and weaknesses, and the method you choose depends on your specific research goals and the depth of understanding you’re aiming to achieve. In the following sections, we’ll delve into primary and secondary research approaches and specific research methods.

Primary vs. secondary market research

Market research of all types can be broadly categorized into two main approaches: primary research and secondary research. By understanding the differences between these approaches, you can better determine the most appropriate research method for your specific goals.

Primary market research

Primary research involves the collection of original data straight from the source. Typically, this involves communicating directly with your target audience — through surveys, interviews, focus groups and more — to gather information. Here are some key attributes of primary market research:

- Customized data: Primary research provides data that is tailored to your research needs. You design a custom research study and gather information specific to your goals.

- Up-to-date insights: Because primary research involves communicating with customers, the data you collect reflects the most current market conditions and consumer behaviors.

- Time-consuming and resource-intensive: Despite its advantages, primary research can be labor-intensive and costly, especially when dealing with large sample sizes or complex study designs. Whether you hire a market research consultant, agency or use an in-house team, primary research studies consume a large amount of resources and time.

Secondary market research

Secondary research, on the other hand, involves analyzing data that has already been compiled by third-party sources, such as online research tools, databases, news sites, industry reports and academic studies.

Here are the main characteristics of secondary market research:

- Cost-effective: Secondary research is generally more cost-effective than primary research since it doesn’t require building a research plan from scratch. You and your team can look at databases, websites and publications on an ongoing basis, without needing to design a custom experiment or hire a consultant.

- Leverages multiple sources: Data tools and software extract data from multiple places across the web, and then consolidate that information within a single platform. This means you’ll get a greater amount of data and a wider scope from secondary research.

- Quick to access: You can access a wide range of information rapidly — often in seconds — if you’re using online research tools and databases. Because of this, you can act on insights sooner, rather than taking the time to develop an experiment.

So, when should you use primary vs. secondary research? In practice, many market research projects incorporate both primary and secondary research to take advantage of the strengths of each approach.

One rule of thumb is to focus on secondary research to obtain background information, market trends or industry benchmarks. It is especially valuable for conducting preliminary research, competitor analysis, or when time and budget constraints are tight. Then, if you still have knowledge gaps or need to answer specific questions unique to your business model, use primary research to create a custom experiment.

Market research methods

- Surveys and questionnaires

- Focus groups

- Observational research

- Online research tools

- Experiments

- Content analysis

- Ethnographic research

How do primary and secondary research approaches translate into specific research methods? Let’s take a look at the different ways you can gather data:

1. Surveys and questionnaires

Surveys and questionnaires are popular methods for collecting structured data from a large number of respondents. They involve a set of predetermined questions that participants answer. Surveys can be conducted through various channels, including online tools, telephone interviews and in-person or online questionnaires. They are useful for gathering quantitative data and assessing customer demographics, opinions, preferences and needs. On average, customer surveys have a 33% response rate , so keep that in mind as you consider your sample size.

2. Interviews

Interviews are in-depth conversations with individuals or groups to gather qualitative insights. They can be structured (with predefined questions) or unstructured (with open-ended discussions). Interviews are valuable for exploring complex topics, uncovering motivations and obtaining detailed feedback.

3. Focus groups

The most common primary research methods are in-depth webcam interviews and focus groups. Focus groups are a small gathering of participants who discuss a specific topic or product under the guidance of a moderator. These discussions are valuable for primary market research because they reveal insights into consumer attitudes, perceptions and emotions. Focus groups are especially useful for idea generation, concept testing and understanding group dynamics within your target audience.

4. Observational research

Observational research involves observing and recording participant behavior in a natural setting. This method is particularly valuable when studying consumer behavior in physical spaces, such as retail stores or public places. In some types of observational research, participants are aware you’re watching them; in other cases, you discreetly watch consumers without their knowledge, as they use your product. Either way, observational research provides firsthand insights into how people interact with products or environments.

5. Online research tools

You and your team can do your own secondary market research using online tools. These tools include data prospecting platforms and databases, as well as online surveys, social media listening, web analytics and sentiment analysis platforms. They help you gather data from online sources, monitor industry trends, track competitors, understand consumer preferences and keep tabs on online behavior. We’ll talk more about choosing the right market research tools in the sections that follow.

6. Experiments

Market research experiments are controlled tests of variables to determine causal relationships. While experiments are often associated with scientific research, they are also used in market research to assess the impact of specific marketing strategies, product features, or pricing and packaging changes.

7. Content analysis

Content analysis involves the systematic examination of textual, visual or audio content to identify patterns, themes and trends. It’s commonly applied to customer reviews, social media posts and other forms of online content to analyze consumer opinions and sentiments.

8. Ethnographic research

Ethnographic research immerses researchers into the daily lives of consumers to understand their behavior and culture. This method is particularly valuable when studying niche markets or exploring the cultural context of consumer choices.

How to do market research

- Set clear objectives

- Identify your target audience

- Choose your research methods

- Use the right market research tools

- Collect data

- Analyze data

- Interpret your findings

- Identify opportunities and challenges

- Make informed business decisions

- Monitor and adapt

Now that you have gained insights into the various market research methods at your disposal, let’s delve into the practical aspects of how to conduct market research effectively. Here’s a quick step-by-step overview, from defining objectives to monitoring market shifts.

1. Set clear objectives

When you set clear and specific goals, you’re essentially creating a compass to guide your research questions and methodology. Start by precisely defining what you want to achieve. Are you launching a new product and want to understand its viability in the market? Are you evaluating customer satisfaction with a product redesign?

Start by creating SMART goals — objectives that are specific, measurable, achievable, relevant and time-bound. Not only will this clarify your research focus from the outset, but it will also help you track progress and benchmark your success throughout the process.

You should also consult with key stakeholders and team members to ensure alignment on your research objectives before diving into data collecting. This will help you gain diverse perspectives and insights that will shape your research approach.

2. Identify your target audience

Next, you’ll need to pinpoint your target audience to determine who should be included in your research. Begin by creating detailed buyer personas or stakeholder profiles. Consider demographic factors like age, gender, income and location, but also delve into psychographics, such as interests, values and pain points.

The more specific your target audience, the more accurate and actionable your research will be. Additionally, segment your audience if your research objectives involve studying different groups, such as current customers and potential leads.

If you already have existing customers, you can also hold conversations with them to better understand your target market. From there, you can refine your buyer personas and tailor your research methods accordingly.

3. Choose your research methods

Selecting the right research methods is crucial for gathering high-quality data. Start by considering the nature of your research objectives. If you’re exploring consumer preferences, surveys and interviews can provide valuable insights. For in-depth understanding, focus groups or observational research might be suitable. Consider using a mix of quantitative and qualitative methods to gain a well-rounded perspective.

You’ll also need to consider your budget. Think about what you can realistically achieve using the time and resources available to you. If you have a fairly generous budget, you may want to try a mix of primary and secondary research approaches. If you’re doing market research for a startup , on the other hand, chances are your budget is somewhat limited. If that’s the case, try addressing your goals with secondary research tools before investing time and effort in a primary research study.

4. Use the right market research tools

Whether you’re conducting primary or secondary research, you’ll need to choose the right tools. These can help you do anything from sending surveys to customers to monitoring trends and analyzing data. Here are some examples of popular market research tools:

- Market research software: Crunchbase is a platform that provides best-in-class company data, making it valuable for market research on growing companies and industries. You can use Crunchbase to access trusted, first-party funding data, revenue data, news and firmographics, enabling you to monitor industry trends and understand customer needs.

- Survey and questionnaire tools: SurveyMonkey is a widely used online survey platform that allows you to create, distribute and analyze surveys. Google Forms is a free tool that lets you create surveys and collect responses through Google Drive.

- Data analysis software: Microsoft Excel and Google Sheets are useful for conducting statistical analyses. SPSS is a powerful statistical analysis software used for data processing, analysis and reporting.

- Social listening tools: Brandwatch is a social listening and analytics platform that helps you monitor social media conversations, track sentiment and analyze trends. Mention is a media monitoring tool that allows you to track mentions of your brand, competitors and keywords across various online sources.

- Data visualization platforms: Tableau is a data visualization tool that helps you create interactive and shareable dashboards and reports. Power BI by Microsoft is a business analytics tool for creating interactive visualizations and reports.

5. Collect data

There’s an infinite amount of data you could be collecting using these tools, so you’ll need to be intentional about going after the data that aligns with your research goals. Implement your chosen research methods, whether it’s distributing surveys, conducting interviews or pulling from secondary research platforms. Pay close attention to data quality and accuracy, and stick to a standardized process to streamline data capture and reduce errors.

6. Analyze data

Once data is collected, you’ll need to analyze it systematically. Use statistical software or analysis tools to identify patterns, trends and correlations. For qualitative data, employ thematic analysis to extract common themes and insights. Visualize your findings with charts, graphs and tables to make complex data more understandable.

If you’re not proficient in data analysis, consider outsourcing or collaborating with a data analyst who can assist in processing and interpreting your data accurately.

7. Interpret your findings

Interpreting your market research findings involves understanding what the data means in the context of your objectives. Are there significant trends that uncover the answers to your initial research questions? Consider the implications of your findings on your business strategy. It’s essential to move beyond raw data and extract actionable insights that inform decision-making.

Hold a cross-functional meeting or workshop with relevant team members to collectively interpret the findings. Different perspectives can lead to more comprehensive insights and innovative solutions.

8. Identify opportunities and challenges

Use your research findings to identify potential growth opportunities and challenges within your market. What segments of your audience are underserved or overlooked? Are there emerging trends you can capitalize on? Conversely, what obstacles or competitors could hinder your progress?

Lay out this information in a clear and organized way by conducting a SWOT analysis, which stands for strengths, weaknesses, opportunities and threats. Jot down notes for each of these areas to provide a structured overview of gaps and hurdles in the market.

9. Make informed business decisions

Market research is only valuable if it leads to informed decisions for your company. Based on your insights, devise actionable strategies and initiatives that align with your research objectives. Whether it’s refining your product, targeting new customer segments or adjusting pricing, ensure your decisions are rooted in the data.

At this point, it’s also crucial to keep your team aligned and accountable. Create an action plan that outlines specific steps, responsibilities and timelines for implementing the recommendations derived from your research.

10. Monitor and adapt

Market research isn’t a one-time activity; it’s an ongoing process. Continuously monitor market conditions, customer behaviors and industry trends. Set up mechanisms to collect real-time data and feedback. As you gather new information, be prepared to adapt your strategies and tactics accordingly. Regularly revisiting your research ensures your business remains agile and reflects changing market dynamics and consumer preferences.

Online market research sources

As you go through the steps above, you’ll want to turn to trusted, reputable sources to gather your data. Here’s a list to get you started:

- Crunchbase: As mentioned above, Crunchbase is an online platform with an extensive dataset, allowing you to access in-depth insights on market trends, consumer behavior and competitive analysis. You can also customize your search options to tailor your research to specific industries, geographic regions or customer personas.

- Academic databases: Academic databases, such as ProQuest and JSTOR , are treasure troves of scholarly research papers, studies and academic journals. They offer in-depth analyses of various subjects, including market trends, consumer preferences and industry-specific insights. Researchers can access a wealth of peer-reviewed publications to gain a deeper understanding of their research topics.

- Government and NGO databases: Government agencies, nongovernmental organizations and other institutions frequently maintain databases containing valuable economic, demographic and industry-related data. These sources offer credible statistics and reports on a wide range of topics, making them essential for market researchers. Examples include the U.S. Census Bureau , the Bureau of Labor Statistics and the Pew Research Center .

- Industry reports: Industry reports and market studies are comprehensive documents prepared by research firms, industry associations and consulting companies. They provide in-depth insights into specific markets, including market size, trends, competitive analysis and consumer behavior. You can find this information by looking at relevant industry association databases; examples include the American Marketing Association and the National Retail Federation .

- Social media and online communities: Social media platforms like LinkedIn or Twitter (X) , forums such as Reddit and Quora , and review platforms such as G2 can provide real-time insights into consumer sentiment, opinions and trends.

Market research examples

At this point, you have market research tools and data sources — but how do you act on the data you gather? Let’s go over some real-world examples that illustrate the practical application of market research across various industries. These examples showcase how market research can lead to smart decision-making and successful business decisions.

Example 1: Apple’s iPhone launch

Apple ’s iconic iPhone launch in 2007 serves as a prime example of market research driving product innovation in tech. Before the iPhone’s release, Apple conducted extensive market research to understand consumer preferences, pain points and unmet needs in the mobile phone industry. This research led to the development of a touchscreen smartphone with a user-friendly interface, addressing consumer demands for a more intuitive and versatile device. The result was a revolutionary product that disrupted the market and redefined the smartphone industry.

Example 2: McDonald’s global expansion

McDonald’s successful global expansion strategy demonstrates the importance of market research when expanding into new territories. Before entering a new market, McDonald’s conducts thorough research to understand local tastes, preferences and cultural nuances. This research informs menu customization, marketing strategies and store design. For instance, in India, McDonald’s offers a menu tailored to local preferences, including vegetarian options. This market-specific approach has enabled McDonald’s to adapt and thrive in diverse global markets.

Example 3: Organic and sustainable farming

The shift toward organic and sustainable farming practices in the food industry is driven by market research that indicates increased consumer demand for healthier and environmentally friendly food options. As a result, food producers and retailers invest in sustainable sourcing and organic product lines — such as with these sustainable seafood startups — to align with this shift in consumer values.

The bottom line? Market research has multiple use cases and is a critical practice for any industry. Whether it’s launching groundbreaking products, entering new markets or responding to changing consumer preferences, you can use market research to shape successful strategies and outcomes.

Market research templates

You finally have a strong understanding of how to do market research and apply it in the real world. Before we wrap up, here are some market research templates that you can use as a starting point for your projects:

- Smartsheet competitive analysis templates : These spreadsheets can serve as a framework for gathering information about the competitive landscape and obtaining valuable lessons to apply to your business strategy.

- SurveyMonkey product survey template : Customize the questions on this survey based on what you want to learn from your target customers.

- HubSpot templates : HubSpot offers a wide range of free templates you can use for market research, business planning and more.

- SCORE templates : SCORE is a nonprofit organization that provides templates for business plans, market analysis and financial projections.

- SBA.gov : The U.S. Small Business Administration offers templates for every aspect of your business, including market research, and is particularly valuable for new startups.

Strengthen your business with market research

When conducted effectively, market research is like a guiding star. Equipped with the right tools and techniques, you can uncover valuable insights, stay competitive, foster innovation and navigate the complexities of your industry.

Throughout this guide, we’ve discussed the definition of market research, different research methods, and how to conduct it effectively. We’ve also explored various types of market research and shared practical insights and templates for getting started.

Now, it’s time to start the research process. Trust in data, listen to the market and make informed decisions that guide your company toward lasting success.

Related Articles

- Entrepreneurs

- 15 min read

What Is Competitive Analysis and How to Do It Effectively

Rebecca Strehlow, Copywriter at Crunchbase

17 Best Sales Intelligence Tools for 2024

- Market research

- 10 min read

How to Do Market Research for a Startup: Tips for Success

Jaclyn Robinson, Senior Manager of Content Marketing at Crunchbase

Search less. Close more.

Grow your revenue with Crunchbase, the all-in-one prospecting solution. Start your free trial.

20 Top Market Research Companies (2024)

Self-serve market research are helpful when you need answers fast.

But a market research company can be a great asset when you need data on a more personalized or granular level.

The data collected by a top market research firm can help you optimize your product marketing, communications strategy, customer experience, online user experience, and more.

From completely bespoke services to expert reporting on the topics that matter most to your audience, these are 20 of the best consumer and B2B market research companies.

Ipsos is a market research company that connects businesses with online communities.

When you work with Ipsos, you'll be matched with a community of people that share traits with your ideal customers. These similarities help you figure out what your ideal customer or user may respond to.

Ipsos’ wide range of services covers multiple industries, including retail, healthcare, transportation, politics, and automotive.

With Ipsos, you can do things such as:

- Assemble custom panels of consumers

- Record interviews and mystery shopper journeys that document retail experiences

- View reports about key consumer insights and demographics

- Run brand, packaging, and product testing

- Conduct message testing for public affairs projects

- Develop studies measuring the quality of healthcare and patient satisfaction

- Engage in public opinion polling

You can also work with an Ipsos strategist to get further insights about your market.

Ipsos recruits its panel and community members through a variety of advertising channels, and participants aren’t paid for their involvement. Instead, members receive points they can later redeem for prizes.

Because Ipsos services are so customizable, you’ll need to get in touch with their sales team to discuss your needs and receive a price quote.

2. Edelman DXI

Edelman Data & Intelligence (DXI) provides its customers with insights related to their target markets, customer behaviors, and broader economic trends .

The company is part of the Edelman global communications firm. By working with their DXI unit, you can get help with:

- Social listening and analysis

- Competitive market analysis

- Content auditing

- Paid media planning

- Risk forecasting

- Workforce analytics

Edelman DXI has offices throughout the world, so they can provide insights across a wide variety of global markets and audiences.

Because Edelman DXI services will be unique to each client, you’ll need to get in touch with the company to learn more about how much it will cost to become a client.

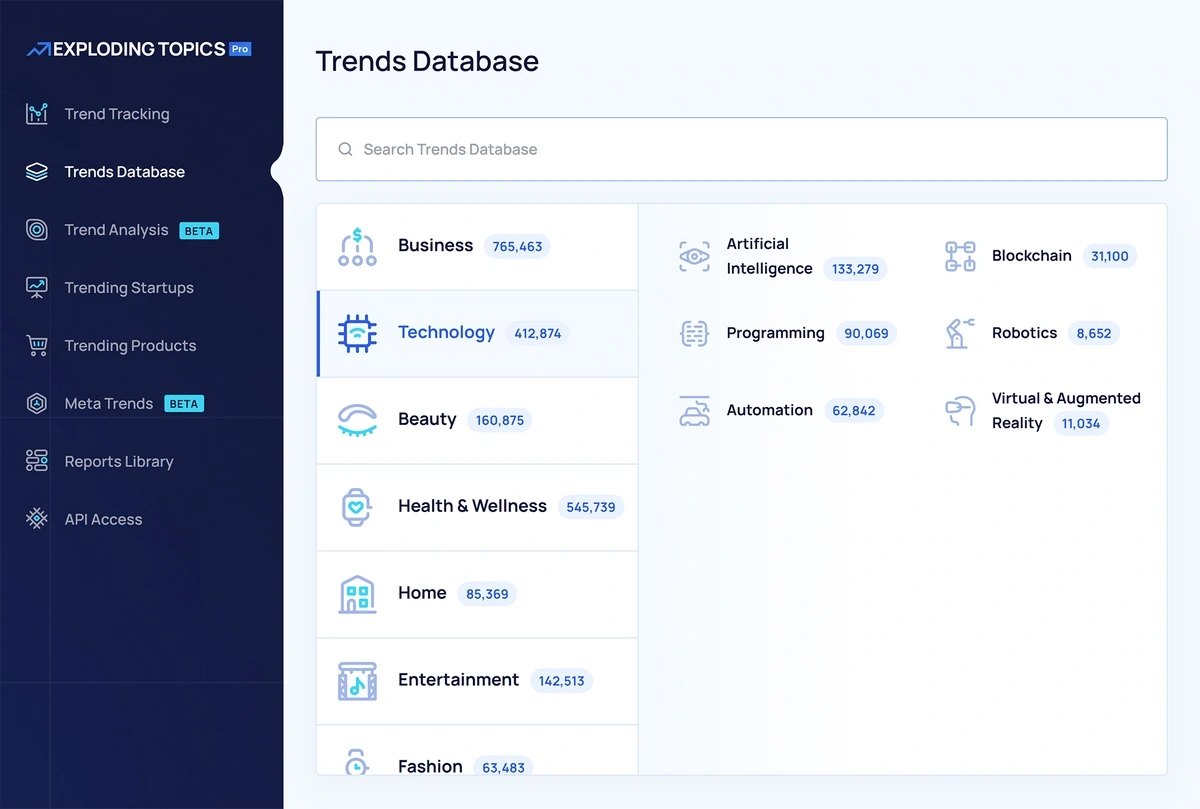

3. Exploding Topics

Exploding Topics is an alternative to traditional market research firms.

Rather than relying on a small panel sample or audience group selected by a firm, you can glean insights from what might be the world’s largest repository of consumer wants, needs, and insights: the internet.

First, we use artificial intelligence (AI) to listen to conversations happening across:

- News outlets

- Social networks

Next, our data analysis experts use this information to help identify the top market trends, topics, brands, and technologies that interest consumers and businesses today.

We enter these findings into our searchable database—and use it as the basis for insightful, actionable reports that break down the top trends you need to know about right now.

Our data stretches back 15 years and covers over 40 industries. Plus, it’s updated every day—so you always have fresh insights to work with.

Whether you rely on our reports or prefer to search the database yourself, you can use Exploding Topics data to support your:

- Entry into new markets

- Product development

- New marketing strategies

- Startup investing

- Competitor acquisition

- New business formation

You can access some of our trend data and reports for free right now. For complete access to every Exploding Topics data point and report—including our Meta Trends feature that shows how trends intersect—you’ll need a paid Exploding Topics Pro plan.

It’s just $1 for the first two weeks of your Exploding Topics Pro membership, and as little as $39 per month (billed annually) after that.

Gartner ’s market research services overlap with those offered by Ipsos, but cover a few additional industries including education, energy, and finance.

As a Gartner customer, you can:

- Review prepared reports

- Engage in personalized consulting services

- Attend industry events

The data gleaned from these reports and activities can help your company enhance its internal business operations as well as improve consumer-facing products or campaigns. Gartner’s information can be useful for:

- Understanding how to best position your brand

- Improving project strategy development and decisions

- Estimating tech lifecycles and improving corporate purchasing

- Evaluating your top market competitors

- Developing a more sustainable business strategy

- Determining how AI may impact your business

- Preparing for economic changes

- Improving your company’s market share

Some of Gartner’s reports are available for free on their website. That way, you can get a taste of what the company offers. If it seems like the right fit for your needs, you’ll need to get in touch with the Gartner team to get a price quote.

5. IMS Marketing

IMS is a full-service marketing agency—but they offer a market research arm to help B2B clients better understand how to position their brand and products.

Their customized services can help with:

- Understanding customer feedback

- Testing the feasibility of a new product or market

- Analyzing the competitor landscape

- Creating market segments

- Researching new audience groups

- Identifying and improving brand perception

- Pinpointing gaps in existing or prior research attempts

IMS Marketing is like Edelman DXI in that its services are entirely bespoke—the company doesn’t offer prepared reports like Gartner or Exploding Topics.

You can only become an IMS client after meeting with the company and allowing them to get a full understanding of your business, market, and objectives.

6. Forrester

Forrester is a market research firm that provides insights for business, government, and technology operations.

While B2C businesses can use Forrester, a lot of the firm's data is especially valuable for B2B markets.

You can use Forrester insights to:

- Explore what business customers need and want

- Develop your tech stack to keep pace with competitors

- Prepare for supply chain and development challenges

- Review prepared sales strategy templates

- Discover competitor weaknesses

Forrester offers advisory services and access to data-rich reports, so you can choose whether you’d like to take a more self-directed approach or have hands-on help.

A single Forrester report may cost $1,000 or more, and advisory services are custom quoted based on your needs. Anyone interested in working with Forrester directly will need to get in touch with their sales team to discuss options.

Kantar offers market research services for a range of B2C industries, including consumer packaged goods (CPG), fashion, hospitality, retail, and technology.

Kantar’s research solutions include:

- Collection of qualitative consumer data in over 80 global markets