Bookkeeping Business Plan Template

Written by Dave Lavinsky

Bookkeeping Business Plan

Over the past 20+ years, we have helped over 9,000 entrepreneurs create business plans to start and grow their bookkeeping companies. On this page, we will first give you some background information with regards to the importance of business planning. We will then go through a bookkeeping business plan step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What is a Bookkeeping Business Plan?

A business plan provides a snapshot of your business as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategy for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for a Bookkeeping Business

If you’re looking to start your own bookkeeping business or grow an established business, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your bookkeeping business in order to improve your chances of success. Your business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Bookkeeping Startups

With regards to funding, the main sources of funding for a bookkeeping business are personal savings, credit cards, bank loans, and angel investors. With regards to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to confirm that your financials are reasonable. But they will want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business.

The second most common form of funding for a bookkeeping company is angel investors. Angel investors are wealthy individuals who will write you a check. They will either take equity in return for their funding or, like a bank, they will give you a loan.

Finish Your Business Plan Today!

How to Write a Business Plan for a Bookkeeping Company

Your business plan should include 10 sections as follows:

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of business you are operating and the status; for example, are you a startup, do you have a bookkeeping business that you would like to grow, or are you operating a chain of bookkeeping companies.

Next, provide an overview of each of the subsequent sections of your plan. For example, give a brief overview of the bookkeeping business industry. Discuss the type of business you are operating. Detail your direct competitors. Give an overview of your target market. Provide a snapshot of your marketing strategy. Identify the key members of your team. And offer an overview of your financial plan.

Company Analysis

In your company analysis, you will detail the type of bookkeeping business you are operating.

For example, you might operate one of the following types:

- Traditional Bookkeeping and Accounting Business : the traditional bookkeeping and accounting business can provide the entire range of bookkeeping services, including maintaining journals and ledgers, balancing and reconciling accounts, preparing payroll, preparing and filing taxes, and providing billing and collection services.

- Tax Preparation Services : this type of bookkeeping business primarily prepares, reviews, and/or files tax returns and supplementary documents.

- Payroll Services : this type of bookkeeping business typically collects payroll information, processes paychecks, processes withholdings, and files reports.

- Billing Services : this type of bookkeeping business deals with sending bills and collecting payments.

In addition to explaining the type of business you operate, the Company Analysis section of your business plan needs to provide background on the business.

Include answers to question such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include sales goals you’ve reached, new store openings, etc.

- Your legal structure. Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Bookkeeping Company Analysis Example

Welcome to LedgerWise Services, a new bookkeeping service proudly serving customers in Oklahoma City, OK. As a local bookkeeping service, we’ve identified a significant gap in the market – the absence of high-quality local bookkeeping services. Recognizing this, we’ve set out to fill this void by offering unparalleled bookkeeping solutions tailored to the unique needs of our clients in Oklahoma City.

At LedgerWise Services, our offerings are comprehensive and designed to meet a wide array of financial management needs. Our services include generating detailed Monthly Financial Statements, efficient Payroll Processing, managing Accounts Payable and Receivable, conducting thorough Bank Reconciliation, and handling Tax Preparation and Filing. With these services, we aim to be the one-stop solution for businesses looking for meticulous financial management.

Our operation base is in Oklahoma City, OK, which places us in the perfect position to serve the local businesses of Oklahoma City. Being a part of the community we serve ensures that we understand the unique challenges and opportunities our clients face, enabling us to provide more personalized and effective services.

The foundation of LedgerWise Services rests on solid ground, thanks to our founder’s experience in successfully running a previous bookkeeping service. This experience, combined with our commitment to offering superior services, positions us uniquely in the market. We are dedicated to helping businesses maintain accurate financial records, comply with legal requirements, and make informed financial decisions, setting us apart from our competitors.

Since our establishment on January 4, 2024, as a C Corporation, we have achieved several milestones that mark the beginning of our promising journey. We’ve crafted a distinct logo that represents our brand’s values and ethos, developed a unique company name that stands out and resonates with our target audience, and secured a prime location that serves as our operational headquarters. These accomplishments are just the start, as we continue to build our legacy in the bookkeeping industry.

Industry Analysis

In your industry analysis, you need to provide an overview of the bookkeeping business.

While this may seem unnecessary, it serves multiple purposes.

First, researching the bookkeeping industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your strategy particularly if your research identifies market trends. For example, it would be helpful to ensure your plan takes into account the seasonal nature of certain services such as tax preparation.

The following questions should be answered in the industry analysis section:

- How big is the bookkeeping industry (in dollars)?

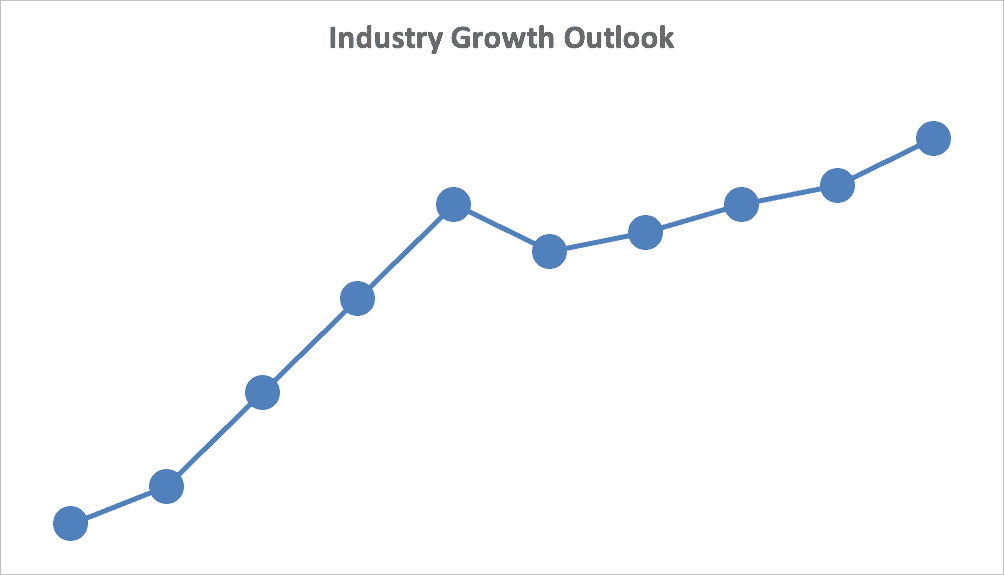

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential market for your bookkeeping business. You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Bookkeeping Industry Analysis Example

The bookkeeping industry in the United States is a significant sector, with a current market size of over $40 billion. This industry has been steadily growing over the past few years, with an expected annual growth rate of 3% to 5%. This growth can be attributed to the increasing complexity of tax laws and regulations, as well as the growing number of small businesses in need of bookkeeping services.

One trend in the bookkeeping industry is the increasing use of technology to streamline processes and improve efficiency. Many bookkeeping firms are investing in software and automation tools to handle tasks such as data entry, reconciliation, and reporting. This trend bodes well for LedgerWise Services, as a new bookkeeping service in Oklahoma City, as they can leverage these technologies to provide more accurate and timely financial information to their clients.

Another trend in the bookkeeping industry is the growing demand for specialized services, such as forensic accounting, virtual CFO services, and cloud accounting. This trend presents an opportunity for LedgerWise Services to differentiate themselves in the market by offering tailored solutions to meet the unique needs of their clients. By staying ahead of industry trends and providing high-quality service, LedgerWise Services is well-positioned to succeed in the competitive bookkeeping market.

Customer Analysis

The customer analysis section must detail the customers you serve and/or expect to serve.

The following are examples of customer segments : families, entrepreneurs, businesses, retirees, etc.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of bookkeeping business you operate. Clearly, families would want different pricing and product options and would respond to different marketing promotions than established businesses.

Try to break out your target market in terms of their demographic and psychographic profiles. With regards to demographics, including a discussion of the ages, genders, locations, and income levels of the customers you seek to serve. Because most bookkeeping companies primarily serve customers living in the same city or town, such demographic information is easy to find on government websites.

Psychographic profiles explain the wants and needs of your target customers. The more you can understand and define these needs, the better you will do in attracting and retaining your business clients.

Bookkeeping Customer Analysis Example

Target Customers

Our primary focus will target local residents in Oklahoma City who require personalized bookkeeping solutions. These individuals might include freelancers, independent contractors, and small business owners who need efficient management of their financial records. By providing customized services, we will address the unique financial tracking challenges faced by this segment.

In addition, we will also target small to medium-sized enterprises (SMEs) that are looking for reliable bookkeeping services to enhance their financial operations. These businesses often lack the resources to maintain an in-house accounting team and will benefit from our expertise in maintaining accurate and up-to-date financial records. Our services will help them make informed financial decisions and maintain compliance with local regulations.

We will also tailor our services to meet the needs of startups and new business ventures within the region. As these entities work on establishing their market presence, they will require robust financial management to support growth and sustainability. By offering scalable solutions, we will enable them to focus on expanding their business while we manage their bookkeeping needs.

Moreover, we will engage with non-profit organizations that need meticulous bookkeeping services to manage their funds effectively. These organizations often operate on tight budgets and require transparent financial reporting to their stakeholders. Our expertise will ensure their financial records are precise and compliant, aiding in maintaining trust and credibility with donors and partners.

Customer Needs

Customers seeking bookkeeping services have a fundamental need for the accurate and timely management of their financial records. LedgerWise Services addresses this by offering high-quality service that ensures all financial transactions are correctly recorded, providing clarity and precision in financial reporting. This accuracy not only helps businesses maintain compliance with legal and regulatory requirements but also supports strategic decision-making based on reliable financial data.

Another significant customer need is the assurance of data security and confidentiality. With LedgerWise Services, clients can expect robust data protection measures, safeguarding sensitive financial information from unauthorized access and potential breaches. This focus on security fosters trust and confidence, essential in maintaining long-term client relationships.

Clients also seek efficiency and cost-effectiveness in bookkeeping services. By utilizing the latest technology and streamlined processes, LedgerWise Services enhances productivity and reduces overhead costs, allowing clients to allocate resources more effectively. This approach not only saves time but also enables businesses to focus on their core activities, driving growth and profitability.

Lastly, personalized customer service plays a crucial role in fulfilling client needs. LedgerWise Services offers tailored solutions that adapt to the unique requirements of each client, providing a personalized experience that aligns with their specific financial goals. This customized approach ensures that all clients receive the attention and support necessary to navigate their financial landscapes with confidence and ease.

Finish Your Bookkeeping Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other bookkeeping services and companies.

Indirect competitors are other options that customers have to purchase from that aren’t direct competitors. This includes accountants, companies’ internal accounting departments, professional employer organizations, and entrepreneurs/individuals doing their own bookkeeping. You need to mention such competition to show you understand that not everyone engages in bookkeeping services.

With regards to direct competition, you want to detail the other bookkeeping companies with which you compete. Most likely, your direct competitors will be bookkeeping companies located very close to your location.

For each such competitor, provide an overview of their businesses and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as:

- What types of customers do they serve?

- What services do they offer?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide superior bookkeeping services?

- Will you provide bookkeeping services that your competitors don’t offer?

- Will you make it easier or faster for customers to acquire your services?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

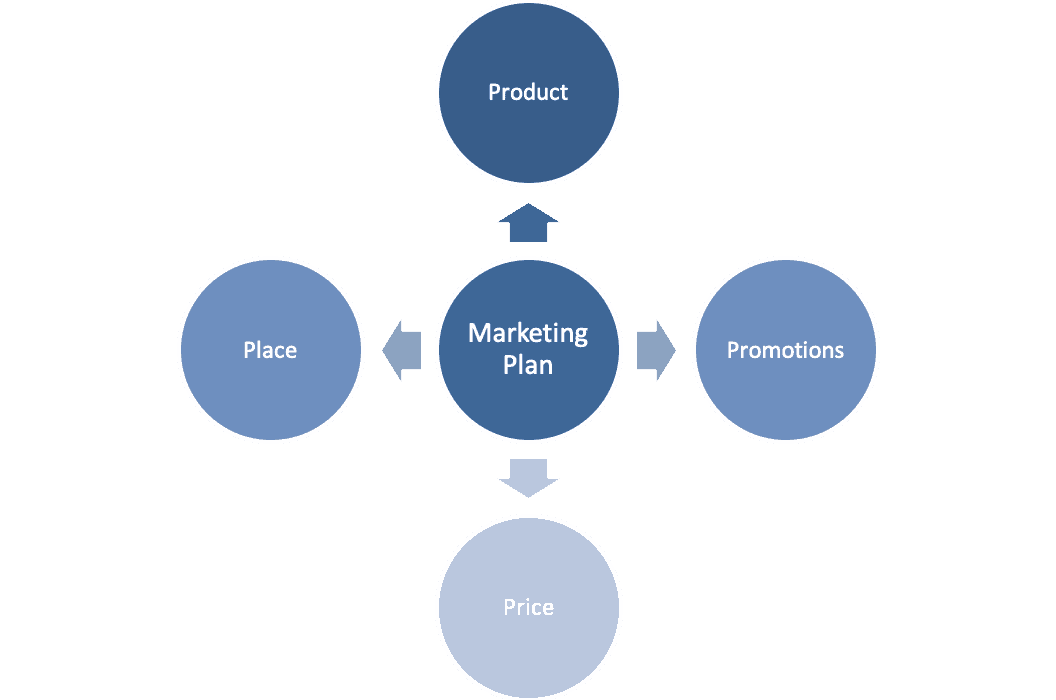

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a bookkeeping business plan, you should include the following:

Product : in the product section, you should reiterate the type of business that you documented in your Company Analysis. Then, detail the specific products you will be offering. For example, in addition to account reconciliation, will you offer services such as tax preparation?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections, you are presenting the services you offer and their prices.

Place : Place refers to the location of your business. Document your location and mention how the location will impact your success. Discuss how your location might provide a steady stream of customers.

Promotions : the final part is the promotions section. Here you will document how you will drive customers to your location(s). The following are some promotional methods you might consider:

- Email marketing to prospective clients

- Advertising in local papers and magazines

- Reaching out to local bloggers and websites

- Social media advertising

- Pay per click advertising

- Local radio advertising

- Banner ads at local venues

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your bookkeeping business such as serving customers, procuring supplies, keeping the office clean, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to serve your 1,000th customer, or when you hope to reach $X in sales. It could also be when you expect to hire your Xth employee or launch a new location.

Bookkeeping Operations Plan Example

Key Operational Processes

To ensure the success of LedgerWise Services, there are several key day-to-day operational processes that we will perform:

- Maintain accurate and up-to-date financial records for all clients, ensuring compliance with local, state, and federal regulations.

- Conduct regular data entry of financial transactions, including income, expenses, and other relevant financial data into accounting software.

- Reconcile bank statements with client accounts to ensure accuracy and consistency in financial records.

- Generate and deliver periodic financial reports, such as profit and loss statements, balance sheets, and cash flow statements, tailored to client needs.

- Provide clients with insights and recommendations based on financial data to assist in strategic decision-making.

- Communicate regularly with clients to discuss their financial status, address inquiries, and provide updates on their accounts.

- Ensure timely invoicing and follow-up on outstanding payments to maintain healthy cash flow for clients.

- Stay informed about industry trends and changes in bookkeeping technologies to enhance service offerings and efficiency.

- Implement and monitor internal controls to protect client data and ensure confidentiality and data security.

- Regularly review and update internal processes to improve operational efficiency and service quality.

- Train and develop staff to maintain a high level of expertise and customer service.

- Engage in continuous professional development to stay current with bookkeeping best practices and regulations.

LedgerWise Services expects to complete the following milestones in the coming months in order to ensure its success:

- Obtain Necessary Licenses and Registrations : Secure all required business licenses and register the company with relevant local and state authorities to ensure compliance with regulations.

- Develop a Robust Online Presence : Launch a professional website and create profiles on key social media platforms to increase visibility and attract potential clients.

- Establish a Secure IT Infrastructure : Implement secure accounting software and data protection measures to safeguard client information and build trust with customers.

- Launch Bookkeeping Services : Officially start offering bookkeeping services to clients, ensuring that all systems and processes are in place for smooth operations.

- Build a Strong Referral Network : Connect with local businesses, accountants, and financial advisors to generate referrals and expand the client base.

- Hire and Train Qualified Staff : Recruit skilled bookkeepers and provide training to ensure high-quality service delivery and customer satisfaction.

- Achieve $15,000/Month in Revenue : Focus on client acquisition and retention strategies to reach the target revenue milestone, ensuring the company is on a path to profitability.

- Establish Client Feedback Mechanisms : Implement a system for gathering and analyzing client feedback to continuously improve services and address any concerns promptly.

Management Team

To demonstrate your bookkeeping business’s ability to succeed as a business, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally, you and/or your team members have direct experience in the bookkeeping or accounting business. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act as mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in bookkeeping businesses and/or successfully running small businesses.

Financial Plan

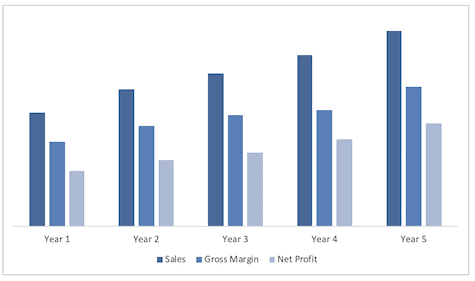

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet, and cash flow statements.

Income Statement An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenues and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you serve 10 customers per week or 20? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets While balance sheets include much information, to simplify them to the key items you need to know about, balance sheets show your assets and liabilities. For instance, if you spend $100,000 on building out your bookkeeping business, that will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a bank writes you a check for $100.000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement Your cash flow statement will help determine how much money you need to start or grow your business and make sure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can turn a profit but run out of money and go bankrupt.

In developing your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a bookkeeping or accounting business:

- Location build-out including design fees, construction, etc.

- Cost of equipment like computers and software

- Cost of maintaining an adequate amount of office supplies

- Payroll or salaries paid to staff

- Business insurance

- Taxes and permits

- Legal expenses

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your office design blueprint or location lease.

Bookkeeping Business Plan Summary

Putting together a business plan for your bookkeeping business is a worthwhile endeavor. If you follow the template above, by the time you are done, you will have an expert bookkeeping business plan; download it to PDF to show banks and investors. You will really understand the bookkeeping business, your competition, and your customers. You will have developed a marketing plan and will really understand what it takes to launch and grow a successful bookkeeping business.

Don’t you wish there was a faster, easier way to finish your Bookkeeping business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. See how a Growthink business plan consultant can create your business plan for you.

Other Helpful Business Plan Articles & Templates

How To Write a Winning Accounting and Bookkeeping Business Plan + Template

Creating a business plan is essential for any business, but it can be especially helpful for accounting and bookkeeping businesses who want to improve their strategy and/or raise funding.

A well-crafted business plan not only outlines the vision for your company, but also documents a step-by-step roadmap of how you are going to accomplish it. In order to create an effective business plan, you must first understand the components that are essential to its success.

This article provides an overview of the key elements that every accounting and bookkeeping business owner should include in their business plan.

Download the Ultimate Business Plan Template

What is an Accounting and Bookkeeping Business Plan?

An accounting and bookkeeping business plan is a formal written document that describes your company’s business strategy and its feasibility. It documents the reasons you will be successful, your areas of competitive advantage, and it includes information about your team members. Your business plan is a key document that will convince investors and lenders (if needed) that you are positioned to become a successful venture.

Why Write an Accounting and Bookkeeping Business Plan?

An accounting and bookkeeping business plan is required for banks and investors. The document is a clear and concise guide of your business idea and the steps you will take to make it profitable.

Entrepreneurs can also use this as a roadmap when starting their new company or venture, especially if they are inexperienced in starting a business.

Writing an Effective Accounting and Bookkeeping Business Plan

The following are the key components of a successful accounting and bookkeeping business plan:

Executive Summary

The executive summary of an accounting and bookkeeping business plan is a one to two page overview of your entire business plan. It should summarize the main points, which will be presented in full in the rest of your business plan.

- Start with a one-line description of your accounting and bookkeeping company

- Provide a short summary of the key points in each section of your business plan, which includes information about your company’s management team, industry analysis, competitive analysis, and financial forecast among others.

Company Description

This section should include a brief history of your company. Include a short description of how your company started, and provide a timeline of milestones your company has achieved.

If you are just starting your accounting and bookkeeping business, you may not have a long company history. Instead, you can include information about your professional experience in this industry and how and why you conceived your new venture. If you have worked for a similar company before or have been involved in an entrepreneurial venture before starting your accounting and bookkeeping firm, mention this.

Industry Analysis

The industry or market analysis is an important component of an accounting and bookkeeping business plan. Conduct thorough market research to determine industry trends and document the size of your market.

Questions to answer include:

- What part of the accounting and bookkeeping industry are you targeting?

- How big is the market?

- What trends are happening in the industry right now (and if applicable, how do these trends support the success of your company)?

You should also include sources for the information you provide, such as published research reports and expert opinions.

Customer Analysis

This section should include a list of your target audience(s) with demographic and psychographic profiles (e.g., age, gender, income level, profession, job titles, interests). You will need to provide a profile of each customer segment separately, including their needs and wants.

For example, the customers of an accounting and bookkeeping business may include small-to-medium sized businesses and individuals.

You can include information about how your customers make the decision to buy from you as well as what keeps them buying from you.

Develop a strategy for targeting those customers who are most likely to buy from you, as well as those that might be influenced to buy your products or accounting and bookkeeping services with the right marketing.

Competitive Analysis

The competitive analysis helps you determine how your product or service will be different from competitors, and what your unique selling proposition (USP) might be that will set you apart in this industry.

For each competitor, list their strengths and weaknesses. Next, determine your areas of competitive differentiation and/or advantage; that is, in what ways are you different from and ideally better than your competitors.

Marketing Plan

This part of the business plan is where you determine and document your marketing plan. . Your plan should be clearly laid out, including the following 4 Ps.

- Product/Service : Detail your product/service offerings here. Document their features and benefits.

- Price : Document your pricing strategy here. In addition to stating the prices for your products/services, mention how your pricing compares to your competition.

- Place : Where will your customers find you? What channels of distribution (e.g., partnerships) will you use to reach them if applicable?

- Promotion : How will you reach your target customers? For example, you may use social media, write blog posts, create an email marketing campaign, use pay-per-click advertising, launch a direct mail campaign. Or, you may promote your accounting and bookkeeping business via word of mouth.

Operations Plan

This part of your accounting and bookkeeping business plan should include the following information:

- How will you deliver your product/service to customers? For example, will you do it in person or over the phone only?

- What infrastructure, equipment, and resources are needed to operate successfully? How can you meet those requirements within budget constraints?

The operations plan is where you also need to include your company’s business policies. You will want to establish policies related to everything from customer service to pricing, to the overall brand image you are trying to present.

Finally, and most importantly, in your Operations Plan, you will lay out the milestones your company hopes to achieve within the next five years. Create a chart that shows the key milestone(s) you hope to achieve each quarter for the next four quarters, and then each year for the following four years. Examples of milestones for an accounting and bookkeeping business include reaching $X in sales. Other examples include signing on a certain number of new clients or increasing your client retention rate by a certain amount.

Management Team

List your team members here including their names and titles, as well as their expertise and experience relevant to your specific accounting and bookkeeping industry. Include brief biography sketches for each team member.

Particularly if you are seeking funding, the goal of this section is to convince investors and lenders that your team has the expertise and experience to execute on your plan. If you are missing key team members, document the roles and responsibilities you plan to hire for in the future.

Financial Plan

Here you will include a summary of your complete and detailed financial plan (your full financial projections go in the Appendix).

This includes the following three financial statements:

Income Statement

Your income statement should include:

- Revenue : how much revenue you generate.

- Cost of Goods Sold : These are your direct costs associated with generating revenue. This includes labor costs, as well as the cost of any equipment and supplies used to deliver the product/service offering.

- Net Income (or loss) : Once expenses and revenue are totaled and deducted from each other, this is the net income or loss.

Sample Income Statement for a Startup Accounting and Bookkeeping Company

Balance sheet.

Include a balance sheet that shows your assets, liabilities, and equity. Your balance sheet should include:

- Assets : All of the things you own (including cash).

- Liabilities : This is what you owe against your company’s assets, such as accounts payable or loans.

- Equity : The worth of your business after all liabilities and assets are totaled and deducted from each other.

Sample Balance Sheet for a Startup Accounting and Bookkeeping Company

Cash flow statement.

Include a cash flow statement showing how much cash comes in, how much cash goes out and a net cash flow for each year. The cash flow statement should include:

- Cash Flow From Operations

- Cash Flow From Investments

- Cash Flow From Financing

Below is a sample of a projected cash flow statement for a startup accounting and bookkeeping business.

Sample Cash Flow Statement for a Startup Accounting and Bookkeeping Company

You will also want to include an appendix section which will include:

- Your complete financial projections

- A complete list of your company’s business policies and procedures related to the rest of the business plan (marketing, operations, etc.)

- Any other documentation which supports what you included in the body of your business plan.

Writing a good business plan gives you the advantage of being fully prepared to launch and/or grow your accounting and bookkeeping company. It not only outlines your business vision but also provides a step-by-step process of how you are going to accomplish it.

A well-written accounting and bookkeeping business plan is a critical document for any new business. If you seek funding or investors, it can help you obtain each successfully.

Finish Your Accounting and Bookkeeping Business Plan in 1 Day!

- Sample Business Plans

Bookkeeping Business Plan

Numerous skilled tasks are required for bookkeeping are management of costs, earnings, tax returns, and payroll. Careful planning is required for each of these services as well as others for a bookkeeping business to operate successfully.

How to Write a Bookkeeping Business Plan?

Writing a bookkeeping business plan is a crucial step toward the success of your business. Here are the key steps to consider when writing a business plan:

Free Business Plan Template

Download our free bookkeeping business plan template now and pave the way to success. Let’s turn your vision into an actionable strategy!

- Fill in the blanks – Outline

- Financial Tables

1. Executive Summary

An executive summary is the first section of the business plan intended to provide an overview of the whole business plan. Generally, it is written after the entire business plan is ready. Here are some components to add to your summary:

- Start with a brief introduction: Start your executive summary by introducing your idea behind starting a bookkeeping business and explaining what it does. Give a brief overview of the idea of how your bookkeeping business will be different.

- Market opportunity: Describe the target market in brief, and explain the demographics, geographic location, and psychographic attributes of your customer. Explain how your accounting business meets its needs. Clearly describe the market that your business will serve.

- Mention your services: Describe in detail what all services your bookkeeping firm will provide as tax returns, payroll services, audit preparation, or others.

- Management team: Name all the key members of your management team with their duties, responsibilities, and qualifications.

- Financial highlights: Provide a summary of your financial projections for the company’s initial years of operation. Include any capital or investment requirements, startup costs, projected revenues, and profits.

- Call to action: After giving a brief about your business plan, end your summary with a call to action, for example; inviting potential investors or readers to the next meeting if they are interested in your business.

Ensure you keep your executive summary concise and clear, use simple language, and avoid jargon.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

2. Business Overview

Depending on what details of your business are important, you’ll need different elements in your business overview, Still, there are some foundational elements like business name, legal structure, location, history, and mission statement that every business overview should include:

- The name of your bookkeeping firm and what type of firm it is: a simple bookkeeping firm, audit firm, virtual bookkeeping firm, tax firm, forensic accounting firm, or some other.

- Company structure of your accounting firm whether it is LLC, partnership firm, or some other.

- Location of your business and the reason why you selected that place.

- Mission statement: Add a mission statement that sums up the objectives and core principles of your firm. This statement needs to be memorable, clear, and brief.

- Business history: Include an outline of the accounting firm’s history and how it came to be in its current position. If you can, add some personality and intriguing details, especially if you got any achievements or recognitions till now for your incredible services.

- Future goals: It’s crucial to convey your aspirations and your vision. Include the vision of where you see your business in the near future and if you have any plans of opening a new franchise of your business in the same city in the future.

This section should provide an in-depth understanding of your accounting business. Also, the business overview section should be engaging and precise.

3. Market Analysis

Market analysis provides a clear understanding of the market in which your bookkeeping business will run along with the target market, competitors, and growth opportunities. Your market analysis should contain the following essential components:

- Target market: Identify your target market and define your ideal customer. Know more about your customers and which services they prefer: bookkeeping, auditing, accounting, tax calculation, payroll, or something else.

- Market size and growth potential: Provide an overview of the bookkeeping industry. It will include market size, trends, growth potential, and regulatory considerations. Highlight the competitive edge and how your business is different from the rest of the businesses.

- Competitive analysis: Identify and analyze all other bookkeeping businesses in the local market, including direct and indirect competitors. Evaluate their strengths and weaknesses, and explain how your business can offer qualitative services.

- Market trends: Analyze current and emerging trends in your industry, such as changes in customer preference or tax regime. Explain how your business will cope with all the changes.

- Regulatory environment: Describe any regulations or licensing requirements that affect the bookkeeping business, such as storing data for 5 years, privacy policy for clients’ data, and others.

Some additional tips for writing the market analysis section of your business plan:

- Use a variety of sources to gather data, including industry reports, market research studies, and surveys.

- Be specific and provide detailed information wherever possible.

- Include charts and graphs to help illustrate your key points.

- Keep your target audience in mind while writing the business plan

4. Products And Services

The product and services section of a virtual bookkeeping business plan should describe the specific services and products that will be offered to customers. To write this section should include the following:

- Create a list of the services: the primary services you provide, such as accounting, payroll, tax preparation, and financial statement production, should be briefly described here.

- Describe each service: For each service, provide a detailed description of what it entails, the time required, and the qualifications of the professionals who will provide the service. For example, the firm needs to hire a chartered accountant.

- Additional services: Make sure to list these in your product and services section if you provide any services beyond basic bookkeeping, such as tax planning or business advising.

Overall, the product and services section of a business plan should be detailed, informative, and customer-focused. By providing a clear and compelling description of your offerings, you can help potential investors and readers understand the value of your business.

5. Sales And Marketing Strategies

Writing the sales and marketing strategies section means a list of strategies you will use to attract and retain your clients. Here are some key elements to include in your sales & marketing plan:

- Develop your unique selling proposition (USP): Determine what makes your bookkeeping services stand out from the crowd – competitive pricing, expert knowledge, or customized service.

- Determine your pricing strategy: Develop a pricing strategy that is competitive and affordable, yet profitable. Consider offering promotions, discounts, or packages for your bookkeeping services to attract new customers.

- Marketing strategies: Develop a marketing strategy that includes a mix of online and offline marketing tactics. Consider social media, email marketing, content marketing, brochures, print marketing, and events.

- Sales strategies: Create a sales plan that explains how you’ll turn leads into paying customers. Offering free consultations, providing references, or creating unique proposals are a few examples of what this could include.

- Customer retention: Describe how your business will retain customers and build loyalty, such as through loyalty programs, special events, or personalized service.

Overall, the sales and marketing strategies section of your business plan should outline your plans to attract and retain customers and generate revenue. Be specific, realistic, and data-driven in your approach, and be prepared to adjust your strategies based on feedback and results.

6. Operations Plan

When writing the operations plan section, it’s important to consider the various aspects of your business processes and procedures involved in operating a business. Here are the components to include in an operations plan:

- Workplace: Make a list of the equipment and physical space you’ll need for your bookkeeping firm. A dedicated workstation, accounting software, and communication tools are a few examples of what this may entail.

By including these key elements in your operations plan section, you can create a comprehensive plan that outlines how you will run your bookkeeping business.

7. Management Team

The management team section provides an overview of the individuals responsible for running the virtual accounting firm. This section should provide a detailed description of the experience and qualifications of each manager, as well as their responsibilities and roles.

- Key managers: Describe the key members of your management team, their roles, and their responsibilities. It should include the owners, senior management, and any other accountants who will be involved in the operation of the business, including their education, professional background, and any relevant experience in the industry.

- Organizational structure: Describe the organizational structure of the management team, including reporting lines and how decisions will be made.

- Compensation plan: Describe your compensation plan for the management team and staff, including salaries, bonuses, and other benefits.

- Board of advisors: If you have a board of advisors for your business, then mention them along with their roles and experience.

Describe the key personnel of your company and highlight why your business has the fittest team.

8. Financial Plan

When writing the financial plan section of a business plan, it’s important to provide a comprehensive overview of your financial projections for the first few years of your business.

- Profit & loss statement: Create a projected profit & loss statement that describes the expected revenue, cost of products sold, and operational costs. Your firm’s anticipated net profit or loss should be computed and included.

- Cash flow statement: Estimate your cash inflows and outflows for the first few years of operation. It should include cash receipts from clients, payments to vendors, loan payments, and any other cash inflows and outflows.

- Balance sheet: Prepare a projected balance sheet, which shows the accounting firm’s assets, liabilities, and equity.

- Break-even point: Determine the point at which your bookkeeping company will break even, or generate enough revenue to cover its operating costs. This will help you understand how much revenue you need to generate to make a profit.

- Financing needs: Estimate how much financing you will need to start and operate your bookkeeping business. It should include both short-term and long-term financing needs, such as loans or investment capital.

Remember to be realistic with your financial projections, and to provide supporting evidence for all of your estimates.

9. Appendix

When writing the appendix section, you should include any additional information that supports the main content of your plan. This may include financial statements, market research data, legal documents, and other relevant information.

- Include a table of contents for the appendix section to make it easy for readers to find specific information.

- Include financial statements such as income statements, balance sheets, and cash flow statements. These should be up-to-date and show your financial projections for at least the first three years of your business.

- Provide market research data, such as statistics on the size of the bookkeeping industry, consumer demographics, and trends in the industry.

- Include any legal documents such as permits, licenses, and contracts.

- Provide any additional documentation related to your business plans, such as marketing materials, product brochures, and operational procedures.

- Use clear headings and labels for each section of the appendix so that readers can easily find the information they need.

Remember, the appendix section of your accounting business should only include relevant and important information that supports the main content of your plan.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

This bookkeeping business plan sample will provide an idea for writing a successful virtual bookkeeping business plan, including all the essential components of your business.

After this, if you are still confused about how to write an investment-ready business plan to impress your audience, then download our bookkeeping business plan pdf .

Related Posts

Sample Business Plan Template

Financial Plans for Small Business

Tips for Creating a Business Plan Presentation

Creative Business Plan Cover Page

Frequently Asked Questions

Why do you need a bookkeeping business plan.

A business plan is an essential tool for anyone looking to start or run a successful accounting firm. It helps to get clarity in your business, secures funding, and identifies potential challenges while starting and growing your business.

Overall, a well-written plan can help you make informed decisions, which can contribute to the long-term success of your bookkeeping success.

How to get funding for your bookkeeping business?

There are several ways to get funding for your business, but one of the most efficient and speedy funding options is self-funding. Other options for funding are!

- Bank loan – You may apply for a loan in government or private banks.

- Small Business Administration (SBA) loan – SBA loans and schemes are available at affordable interest rates, so check the eligibility criteria before applying for it.

- Crowdfunding – The process of supporting a project or business by getting a lot of people to invest in your bookkeeping firm, usually online.

- Angel investors – Getting funds from angel investors is one of the most sought options for startups.

- Venture capital – Venture capitalists will invest in your business in exchange for a percentage of shares, so this funding option is also viable.

Apart from all these options, there are small business grants available, check for the same in your location and you can apply for it.

Where to find business plan writers for your bookkeeping business?

There are many business plan writers available, but no one knows your business and idea better than you, so we recommend you write your virtual accounting business plan and outline your vision as you have in your mind.

What is the easiest way to write your bookkeeping business plan?

A lot of research is necessary for writing a business plan, but you can write your plan most efficiently with the help of any bookkeeping business plan example and edit it as per your need. You can also quickly finish your plan in just a few hours or less with the help of our business plan software.

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Turn your business idea into a solid business plan

Explore Plan Builder

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

Free Download

Accounting & Bookkeeping Business Plan Template

Download this free accounting & bookkeeping business plan template, with pre-filled examples, to create your own plan..

Or plan with professional support in LivePlan. Save 50% today

Available formats:

What you get with this template

A complete business plan.

Text and financials are already filled out and ready for you to update.

- SBA-lender approved format

Your plan is formatted the way lenders and investors expect.

Edit to your needs

Download as a Word document and edit your business plan right away.

- Detailed instructions

Features clear and simple instructions from expert business plan writers.

All 100% free. We're here to help you succeed in business, no strings attached.

Get the most out of your business plan example

Follow these tips to quickly develop a working business plan from this sample.

1. Don't worry about finding an exact match

We have over 550 sample business plan templates . So, make sure the plan is a close match, but don't get hung up on the details.

Your business is unique and will differ from any example or template you come across. So, use this example as a starting point and customize it to your needs.

2. Remember it's just an example

Our sample business plans are examples of what one business owner did. That doesn't make them perfect or require you to cram your business idea to fit the plan structure.

Use the information, financials, and formatting for inspiration. It will speed up and guide the plan writing process.

3. Know why you're writing a business plan

To create a plan that fits your needs , you need to know what you intend to do with it.

Are you planning to use your plan to apply for a loan or pitch to investors? Then it's worth following the format from your chosen sample plan to ensure you cover all necessary information.

But, if you don't plan to share your plan with anyone outside of your business—you likely don't need everything.

More business planning resources

How to Start a Business With No Money

How to Create a Business Plan Presentation

Business Plan Template

Simple Business Plan Outline

How to Write a Business Plan for Investors

Industry Business Planning Guides

How to Write a Business Plan

10 Qualities of a Good Business Plan

Download your template now

Need to validate your idea, secure funding, or grow your business this template is for you..

- Fill-in-the-blank simplicity

- Expert tips & tricks

We care about your privacy. See our privacy policy .

Not ready to download right now? We'll email you the link so you can download it whenever you're ready.

Download as Docx

Download as PDF

Finish your business plan with confidence

Step-by-step guidance and world-class support from the #1 business planning software

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Accounting | How To

How to Start a Bookkeeping Business [+ Free Checklist]

Published July 11, 2024

Published Jul 11, 2024

REVIEWED BY: Tim Yoder, Ph.D., CPA

WRITTEN BY: Danielle Bauter

This article is part of a larger series on Accounting Software .

- 1. Create a Business Plan

- 2. Earn Your Certifications

- 3. Register & Organize Your Business

- 4. Set Up Operations

- 5. Get the Right Accounting Software

- 6. Fund Your Business

- 7. Set Up a Home Office

- 8. Market Your Business

- Bonus: Stay on Top of Industry Trends for Bookkeepers

Bottom Line

Bookkeeping is a great home-based business that’s easy to start with very little cash. Whether you are looking to make extra money or want to grow a business to support you and your family, our guide on how to start a bookkeeping business will help you achieve your goal. We’ll walk you through the process, from creating a business plan and registering the business to getting the right software and marketing.

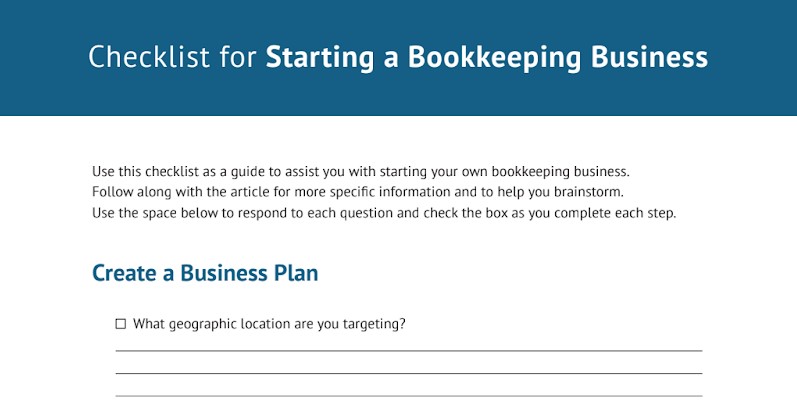

Download your free checklist for starting a bookkeeping business.

FILE TO DOWNLOAD OR INTEGRATE

Start a Bookkeeping Business Checklist

Thank you for downloading!

Step 1: create a business plan.

Writing a business plan is something that everyone should do before starting a business. While it can be used to obtain funding for your business, the real value is the thought that goes into the process of writing a plan.

During the writing process, you should think about every aspect of your business—such as what products and services you will sell, how to market those products and services, and who your competition is. You will also create a financial plan that should include a 12-month profit and loss projection, a projected balance sheet, and the projected cash flow.

Here are the key items that should be included in every business plan:

- Cover page: The cover page of your business plan is your first impression, so it should be professional and informative. If you have a company logo, include it at the top to enhance brand recognition. The document title should include “Business Plan,” and a concise and catchy tagline can introduce your business proposition. It’s also important to include your contact information and a completion date to show that your information is current.

- Executive summary: This is a concise overview of your entire business plan, highlighting the company’s purpose, products or services, target market, and financial projections. It’s essentially an elevator pitch in written form, so it is important to be clear and compelling to attract the reader’s attention.

- Company overview: Dive deeper into the details of your business by explaining what you do, your mission statement, and what makes your company unique.

- Competitive analysis: Demonstrate your understanding of the competitive landscape. This section should identify your target market, its size and demographics, and any trends that might affect your business. Also, take an impartial look at your competitors to determine what sets your business apart from them.

- Marketing plan: Outline how you plan to reach your target market and convert them into customers. This includes your marketing channels, pricing strategy, and sales strategy.

- Financial projections: This section lays out the financial health of your business. It should include your startup costs, projected revenue, expenses, profits, and losses over a specific period. You may also need to include funding requests if you’re seeking an investment.

- Management team: Briefly introduce the key members of your management team. Highlight their experience, skills, and qualifications that demonstrate their ability to lead the business to success.

Our related resources:

- How to Write a Business Plan

- How to Create a Marketing Plan (+ Free Template))

Identify Your Target Market

First, decide whether your target market will be limited to your surrounding area or if you’ll offer online services. While it’s tempting to offer your services online to a worldwide audience, it adds a lot of complexity to your operations. You should plan on paying for help with online advertising, web design, search engine optimization (SEO), and website content management.

The next decision is whether to focus on a particular small business niche or to offer services to all small businesses. It’s much easier to become an expert in accounting for a particular business niche than for all businesses in general.

The best niches to consider are those with unique bookkeeping challenges. For example:

- Construction companies compute their profit by project

- Truck drivers have special tax rules for computing travel expenses

- Restaurants have a very high volume of relatively low-value inventory items to track

Choose What Services You’ll Offer

You should decide what services your bookkeeping business will initially offer. You might add more later, but knowing your initial offerings is important so that you can choose the right certifications and software.

Here are some of the common services offered by bookkeeping businesses:

- Basic bookkeeping: Basic bookkeeping usually includes entering banking transactions, classifying payments, and reconciling bank statements. The result is typically a basic set of financial statements at the end of each month.

- Invoicing: Some bookkeeping businesses will prepare and mail invoices to their client’s customers. Even if you don’t prepare and mail the invoices, you can collect, deposit, and track customer payments.

- Bill payment: You can provide value to your clients by tracking their unpaid bills. You can submit payments to their vendors or simply provide a list of bills that need to be paid.

- Payroll: If your bookkeeping business provides payroll services, you’ll need to not only issue payments to your client’s employees but also track and pay payroll taxes. Be sure to pick a client software package that can easily be expanded to include payroll.

- Tax returns: Only provide tax return preparation to your clients if you have tax expertise. It’s not difficult to learn how to fill out tax forms, but there’s much more to know to adequately advise your clients. If you do decide to prepare tax returns, be sure to get professional liability insurance.

- What Is Bookkeeping and What Does a Bookkeeper Do?

- Accounting vs Bookkeeping

- What Is Payroll? Everything Business Owners Need to Know

Develop a Pricing Structure

Define your service packages and pricing structure so that you can easily communicate this information to your clients. Create tiered service packages with increasing levels of complexity and features.

Here are some common options:

- Basic package: Ideal for startups or freelancers with minimal transactions. This could include bank reconciliation, categorization, and basic reports.

- Standard package: Suitable for growing businesses with moderate transaction volume. This might include everything in the basic package, plus accounts payable/receivable management and payroll processing (if applicable).

- Advanced package: Caters to established businesses with complex bookkeeping needs. This could include everything in the standard package plus tax preparation assistance, financial analysis, and bookkeeping cleanup for neglected accounts.

There are several pricing strategies . These include

- Hourly rate: This is achieved by charging an hourly rate for your time. This is simple but requires good time management to stay profitable.

- Monthly retainer: Clients pay a fixed monthly fee for a predetermined set of services. This provides predictable income for you and budgeting ease for clients.

- Per-transaction fee: Charge a set fee per transaction processed, which can be efficient for high-volume clients but may not be suitable for all businesses.

Step 2: Earn Your Certifications

One of the fastest ways to gain credibility with potential clients is to prove that you have the knowledge necessary to do bookkeeping, payroll, and perhaps tax returns. If you’re a certified public accountant (CPA), you probably won’t benefit from becoming a certified bookkeeper, but you still might consider becoming certified in whatever accounting software you choose to use.

Certified Bookkeeper

Even if you don’t have formal education in accounting or bookkeeping, you can become a certified bookkeeper before starting your own bookkeeping business. Unlike CPAs, these certifications aren’t regulated by the state, so be sure to choose a large, reputable organization so that the certification is meaningful and respected.

There are two professional bookkeeper organizations that we recommend you certify with. There are also other opportunities to earn a bookkeeper specialization, such as through a university like UCLA.

- American Institute of Professional Bookkeepers (AIPB): To become AIPB-certified, you must meet the 3,000-hour work experience requirement and pass a certification exam, which costs $574 for members and $734 for non-members.

This certification is ideal if you don’t have any formal education in the bookkeeping and accounting field. As an AIPB member, you’ll get access to personal help regarding bookkeeping and payroll, as well as membership discounts. Membership comes in three tiers, and a longer membership plan has added benefits compared to a shorter membership plan.

- $60 for one year

- $120 for two years

- $180 for three years

Once certified, you’ll earn the right to put the letters CB (stands for Certified Bookkeeper) behind your name and display this on your resume and business cards, which will give you an edge with potential clients.

- National Association of Certified Public Bookkeepers (NACPB): To earn certification through the NACPB, you must take courses in bookkeeping, payroll, QuickBooks Online, and accounting principles and pass an exam for each course. NACPB Annual membership is $200 for Members and $250 for Pro Members.

You’ll also need one year of experience before applying for the license. If you’ve had college accounting courses, you might be able to substitute them for required courses, but you’ll still need to pass each exam.

Once certified, you’ll earn the credentials CPB (stands for Certified Professional Bookkeeper). You can put these letters after your name on resumes, business cards, and other materials to display your accomplishments to future clients.

- UCLA Extension : The Bookkeeping Specialization program consists of four courses and offers classes both online or in person if you are located in the Los Angeles area. The program costs $3,260 and includes the following courses:

- Bookkeeping and Accounting Essentials (I and II)

- Cloud Based QuickBooks

- Payroll Tax and Accounting

If you maintain a GPA of 2.5 or higher in each course, you’ll receive a certificate upon completion. This option is best for experienced bookkeepers or individuals who are looking to make the transition to a career in bookkeeping or accounting.

Accounting Software Certification

Some of the best small business accounting software offer a certification program so that bookkeepers can demonstrate they’re proficient with the solution. Most of the certifications are free and even come with free accounting software for your firm.

Here are a few of the most popular accounting software and their certification programs:

- QuickBooks ProAdvisor : QuickBooks is by far the most popular small business accounting software in the US, and you’ll very likely have clients using it. QuickBooks offers ProAdvisor certifications for both QuickBooks Online and QuickBooks Desktop. You earn your certification by completing self-paced lessons and taking exams.

The Online certification is free, but the Desktop certification requires the purchase of QuickBooks Desktop Accountant software, which starts at $499.99 per year.

- FreshBooks Partner Program : FreshBooks is a popular accounting software for service-based businesses requiring exceptional invoicing features. It offers a partnership program with accountants that includes FreshBooks certification and skills training.

It’s free to join, and there’s no cost to use the FreshBooks software for accounting professionals. FreshBooks offers a 30% discount for accountants and bookkeepers on the first six months of their clients’ paid subscription to FreshBooks.

- Xero Partner Program : Xero, while not as popular as QuickBooks in the US, is a comparable program at a lower cost. Similar to FreshBooks, Xero offers a partnership program that includes Xero certification. There are three levels to the program:

- Basic is free

- Xero Partner + Payroll costs $5 per month

- Xero Partner + Tax is $29 per month

- Zoho Consulting Partner : Zoho offers a suite of products that include software for accounting, CRM, and inventory tracking. It also provides marketing materials and co-branding opportunities to help you attract more clients. Its Consulting Partner program allows businesses to help clients implement and leverage Zoho’s suite of products.

The Zoho Books Consulting Partner program is free to join and gives you access to Zoho training resources and certifications. You’ll receive a dedicated account manager and free access to the Premium plan when you become a Zoho Advisor.

Tax Certification

No certification is required for a paid preparer to sign a client’s tax return, but I highly recommend not preparing returns unless you’re a tax professional or willing to put in the work to become one. Many bookkeeping firms prepare financial statements that their clients take to CPAs or other tax pros to prepare a return. You may find yourself working closely with their tax preparer, and together, you can provide outstanding service to your mutual clients.

If you are not a CPA and want to prepare tax returns, I recommend becoming an Enrolled Agent (EA) through the IRS . EAs must initially pass an examination and then complete annual continuing education to renew their certification every three years. While no formal education or classes are required, the examinations are difficult and will prove you have the knowledge to serve tax clients properly.

Online Bookkeeping Classes

Non-accounting degree holders who would like to pursue a bookkeeping career can take bookkeeping courses online. It’s significantly shorter than a full accounting college course. We recommend choosing courses that provide a certificate so that you can include it on your resume.

You can sign up for online bookkeeping courses from the following providers:

- Accounting Coach : This is a popular website that offers online learning materials related to accounting and bookkeeping. For a one-time fee that ranges from $99 to $159, you’ll receive lifetime access to resources for beginner to advanced learners.

Topics like basic bookkeeping, financial accounting, cost accounting, and financial management are covered. Learning tools include quizzes, flashcards, visual tutorials, and cheat sheets.

- Coursera : This offers a variety of online bookkeeping courses that cater to different needs and experience levels. The Intuit Academy Bookkeeping Professional Certificate is a specialization offered by Intuit. It covers the fundamentals of bookkeeping, including a double-entry system, financial statements, and using accounting software.

Coursera also curates lists of popular courses for beginners. These might include options from various providers alongside Intuit’s offerings.

- LinkedIn Learning : This is a valuable resource for both beginners and those looking to sharpen their skills. It offers courses that cater to different experience levels, from foundational bookkeeping principles to software-specific training.

You’ll find courses on topics like financial statements, journal entries, and analyzing transactions. The Accounting Foundations: Bookkeeping course allows you to earn continuing education units and a certificate upon completion.

Step 3: Register & Organize Your Bookkeeping Business

This step is important because it establishes your business as legitimate and may help to limit your personal liability if your company is ever sued. Whether you’re doing this part-time or full-time, you don’t want to skip this step.

You need to do the following to establish your business at the local, state, and federal levels:

Step 3.1: Select a Business Name

Naming your business can be both a fun and stressful exercise. Your name must convey your brand since that is what a potential customer will see before they sit down with you for that initial consultation. Ensure your business name says exactly what you do; this is not the time to be cute—unless you can also be clear about what it is that you do.

Here are some great tips on how to name your business:

- Aim for clarity: Your name needs to tell people what you do. If you’re focusing your bookkeeping business on a niche, include the niche in your name.

- Use a term with an established brand: For example, you could use the name of the city where you are located, such as Scranton Bookkeeping.

- Get input from others: Ask family and friends for their input. Make it fun, and put it out on your social media that you are looking for suggestions on what to name your business. You could even offer a prize to the winner.

- Test it out: Try your potential business name out on potential customers to see what they think. Compare your name to competitors’ names to see if it stands out enough, but not too much.

Step 3.2: Choose a Business Structure

There are four common business structures: sole proprietorship, partnership, limited liability company (LLC), and corporation. The structure that you choose will determine your personal liability if the company is ever sued, your tax liability, and your ability to raise capital.

To assist you with this decision, I recommend that you get an introduction to the four common business structures by reading our small business structure guide.

Most people operating a part-time bookkeeping business without employees will operate as a sole proprietorship, which works fine. However, if your business grows to the point of hiring employees, you need to consider becoming an LLC or corporation.

In addition to tax consequences, your personal liability in the event of a lawsuit can vary dramatically by business structure, so be sure to consult with an attorney.

Step 3.3: Apply for an EIN

Before your business begins operating, it is important to get an employer identification number (EIN), a unique nine-digit number that identifies your business. You’ll obtain an EIN from the IRS to identify your business for tax purposes.

This is also typically required to open a business bank account or apply for a business loan. There is no cost to obtain an EIN, and the process involves filling out an application and sending it via mail, fax, or online.

Step 3.4: Register Your Business

Once you have received your EIN and have chosen a business structure, it’s now time to register your business with your state. Our guide on how to register a business gives more detailed information and a checklist, but it will involve either doing it yourself through the state’s website or using an online legal service. If you prefer the latter, we recommend that you visit LegalZoom .

It is also a good idea to choose a registered agent, or someone who you choose to represent your business and who will serve as the point of contact if there are legal actions against your business.

Step 4: Set Up Business Operations for Your Bookkeeping Business

Now that you’ve organized your business, you can start setting up operations. For instance, you’ll want to check out one of the best small business insurance companies .

Set Up a Business Telephone Number

Getting a unique phone number for your business is incredibly easy and often free. You can get a free Google Voice number , which includes a local area code, voicemail, texts, and unlimited calling. You can learn more through our guide on VoIP phone systems .

Hire an Answering Service

As a one-person operation, you may find it hard to get back to clients right away, especially during tax season. Sending prospective customers to voicemail when they need your services can cost you business. For our recommendations, see our top-recommended answering services .

Set Up a Business Bank Account

It’s important to separate your business and personal finances . While most think they should wait until the business starts to generate cash flow, it’s important to track expenses immediately so that they can be deducted as startup costs. Our list of the leading small business checking accounts will help you find a provider that fits the bill.

Establish a Business Mailing Address

If you plan to lease office space, then your mailing address will be wherever your office is located. However, if you plan to set up a home office, you’ll need to obtain a business mailing address so that you don’t have to use your home address. This will make your business appear more professional and maintain your privacy.

There are a couple of options.

- Rent a post office box from your local post office: On average, you will pay $60 for six months or $120 for the year. Of course, the price will vary based on your location.

- Rent a UPS mailbox: The UPS Store will give you a real street address to use. A benefit to using a UPS mailbox is some merchants won’t deliver to P.O. boxes and require a street address.

Get Bookkeeper Insurance

As a bookkeeper, you should have liability protection in case you get sued for a mistake on your client’s books. Insurance can cover both the cost of settling a lawsuit and the lawyer fees to defend against a lawsuit.

Step 5: Get the Right Accounting Software

Determining which software to use to manage all of the various aspects of your business can be an overwhelming task. To get you started, the following is a list of the areas of your business for which you’ll need to decide which software tool to use:

Client Software

You need to decide what accounting program you would like your clients to use. This doesn’t necessarily have to be the same platform that you use to manage your bookkeeping business.

A few things to consider when selecting software to recommend to your clients are:

- Can you access the client’s books remotely?

- How much will it cost each client for basic bookkeeping?

- How much will it cost to add client payroll?

- Is it easy for your client to learn to use?

- Does the software offer a certification program or partnership program for bookkeeping firms to help attract clients?

Bookkeeping/Accounting Software

You’ll also need to choose a bookkeeping software for your bookkeeping business. Some accounting solutions offer a bookkeeper or accountant edition specifically designed for bookkeeping companies to use both for their books and as a portal to their client’s books.