We use cookies to deliver the best possible experience on our website. To learn more, visit our cookie policy . By continuing to use this site, or closing this box, you consent to our use of cookies.

- CRISIL Ratings Limited (A subsidiary of CRISIL Limited, an S&P Global company)

- Want to get rated?

Log In To Your Account

Forgot Password

Thank you! If email exists, we'll send password reset link

Sorry !! The password change operation failed.

user does not exist

Captcha validation failed. Please try again.

- Step 1 Login Credentials

- Step 2 Personal Information

- Step 3 Company Information

Sucess Dialog

You are successfully Registered. A success message has been sent to your registred email id

Error Dialog

User already exists. Please sign-up with a different email id.

Error while creating the user. Please try again later.

- Key Personnel

- Our Offices

- Corporate Sector

- Financial Sector

- Structured Finance

- Fund Ratings

- Recovery Risk Ratings

- Insurance Hybrids

- Independent Credit Evaluation

- REITs/InvITs

- Understanding Rating

- Rating Lists and Scales

- Latest Rating Rationales

- Press Releases

- Publications

- Ratings Analytica

- Board of Directors

- Board Committees and Policies

- Statutory Documents

- Market Intelligence & Analytics

- CRISIL Global Research and Risk Solutions

- Coalition Greenwich

- Explore our world

- Life @ CRISIL

- Tech @ CRISIL

- Find your place

- Home >

- CRISIL Ratings Limited >

- Criteria and Methodology

Rating Process

- Rating FAQs

- FAQs for Bankers

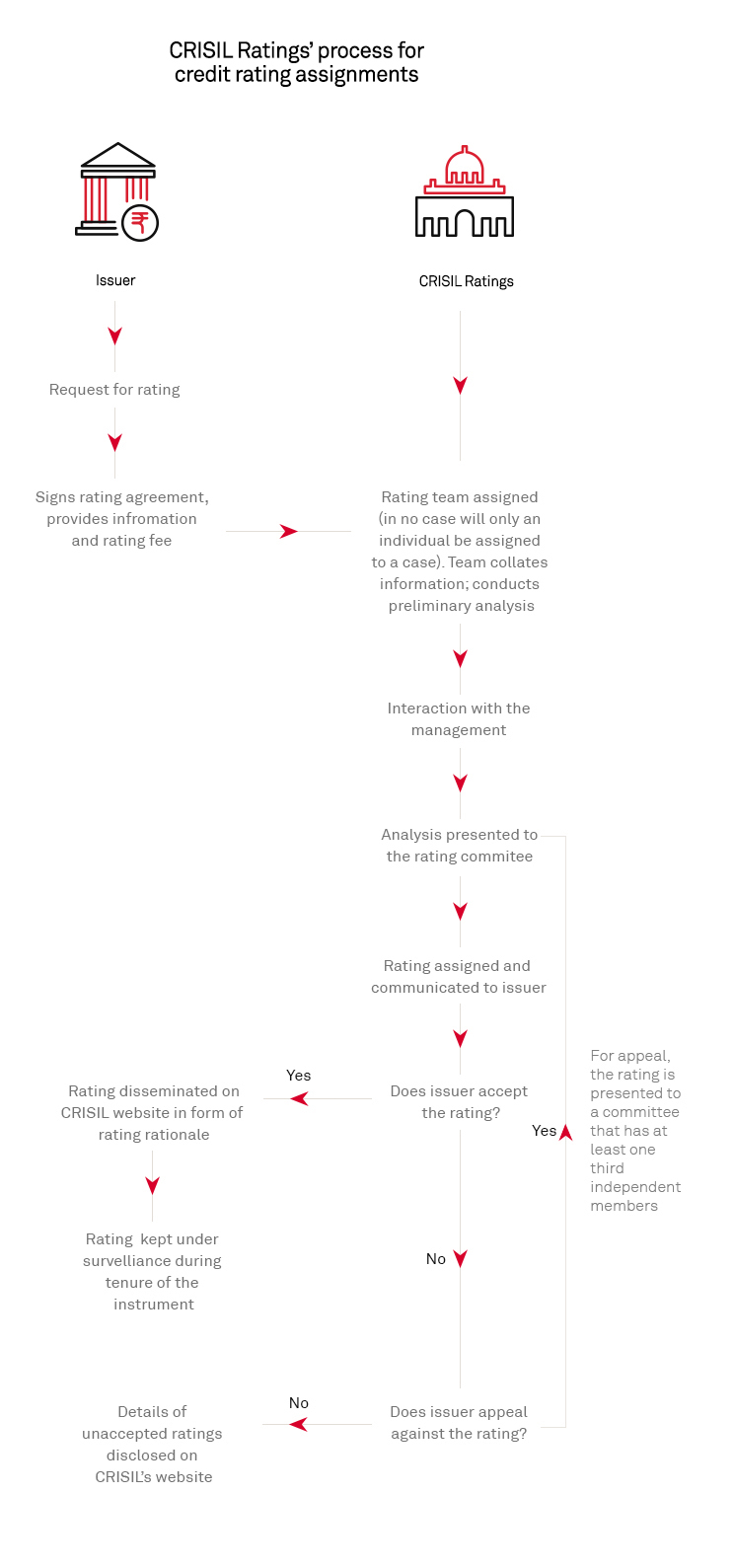

Our process is designed to ensure that all ratings are based on the highest standards of independence and analytical rigour.

From the initial meeting with the management to the assignment of the rating, the process normally takes three to four weeks. however, we sometimes arrive at rating decisions in shorter timeframes to meet urgent requirements. the process of rating starts with a rating request from the issuer, and the signing of a rating agreement. we employ a multi-layered, decision-making process in assigning a rating., a detailed flow chart of our rating process is as following:.

Related links

- Regulatory Disclosures

Our recommendations

Press release.

Leverage to remain below ~2 times for primary steel players in current fiscal

CRISIL Ratings

Positive bias amid cautious clouds

To get a copy of rating reports, please email us at: [email protected]

For analytical queries, please email us at: [email protected]

For any other information, please call or email us at: +1800 267 1301 [email protected]

IMAGES

VIDEO