How Business Intelligence in Banking Sector Works?

Pranay Agrawal | December 20, 2023 , 8 min read

Table Of Content

- Why is BI important for banks?

How does Business Intelligence Help Banks?

Applications of bi in banking, frequently asked questions, further reading: business intelligence applications across sectors.

Business Intelligence (BI) has revolutionized the banking sector, profoundly impacting data management and decision-making processes. Within the realm of data analytics, BI tools empower banks to efficiently collect, analyze, and utilize data for strategic insights.

BI’s significance in banking is immense, enabling financial institutions to process millions of transactions in seconds. To put this into perspective, these tools can handle data equivalent to around 100,000 hours of continuous banking operations per minute, showcasing their transformative power in decision-making within the financial world.

BI tools have reshaped banking from simply storing customer information to effectively managing data via digital resources, mobile apps, and websites. With a staggering estimated daily data volume of 2.5 quintillion bytes , BI solutions offer a dynamic approach, optimizing operations and driving competitiveness in the banking industry.

Business Intelligence plays a pivotal role in the banking sector, reshaping the way financial institutions operate, strategize, and engage with their customers. In today’s data-driven landscape, BI tools have become integral to banks for reasons including risk reduction, gaining a competitive edge, optimizing marketing strategies, and enhancing operational efficiency.

Here’s a breakdown of key reasons why BI is indispensable for banks:

- Risk Reduction: BI tools track customer behavior, aiding in fraud detection and ensuring regulatory compliance. They also analyze financial data to manage credit portfolios effectively and identify potential delinquencies, addressing the critical need for BI in Banking.

- Competitive Edge: BI enables personalized customer experiences, identifies new investment opportunities, and tailors products to meet individual customer needs, highlighting its essence in banks’ solutions.

- Optimized Marketing: These tools analyze metrics like email performance and advertising spending, optimizing marketing strategies for banks.

- Operational Efficiency: BI solutions automate manual processes, minimizing errors, and streamlining workflows, ultimately reducing costs and enhancing productivity—an essential aspect of BI in banking.

- Enhanced Customer Experience: BI services contribute to improved customer satisfaction and retention by creating targeted campaigns and maximizing upselling opportunities through profitability and sentiment analysis, underscoring its importance in finance.

Also Read: Role of Business Intelligence in Finance

BI significantly benefits banks by leveraging data to enhance operational efficiency, mitigate risks, and facilitate informed decision-making. Key aspects include:

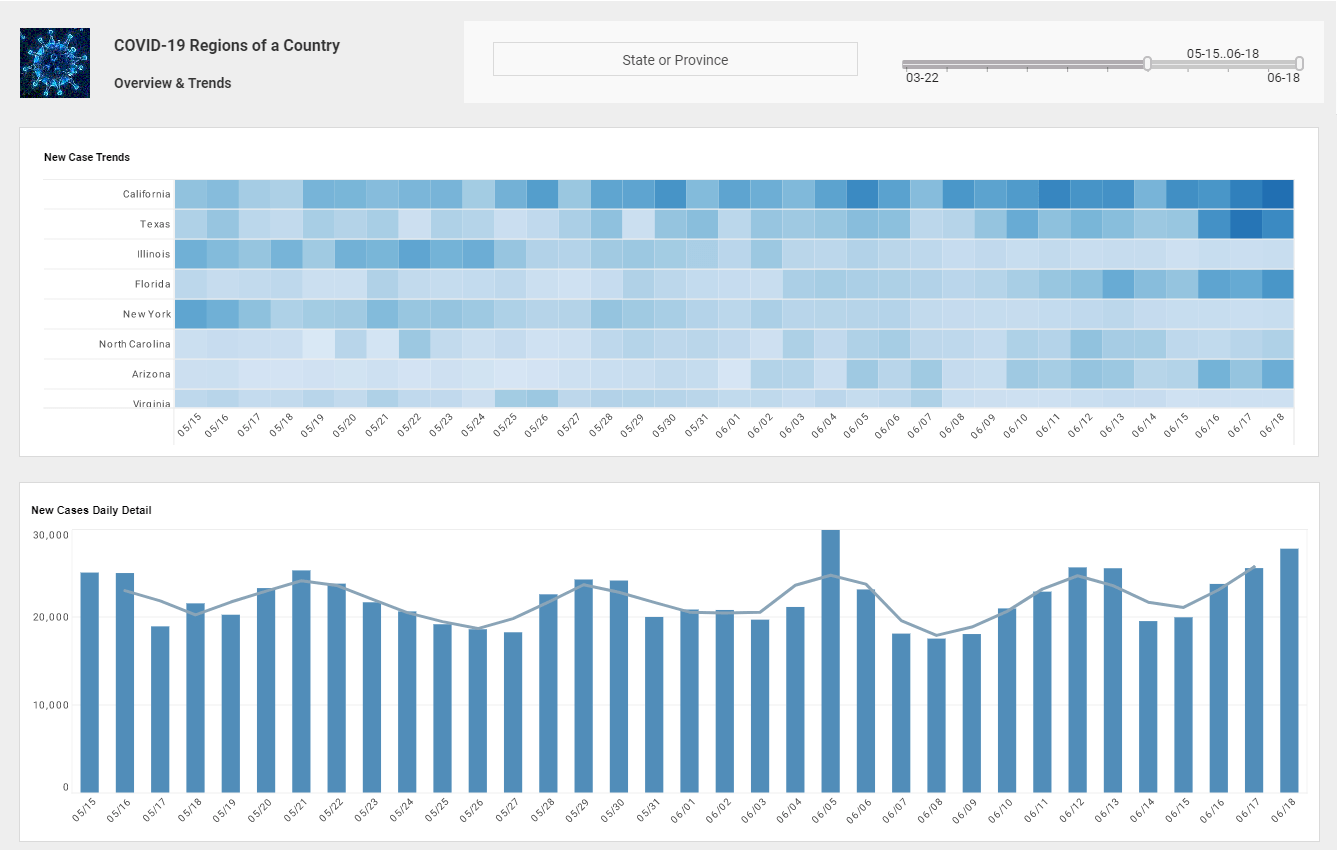

Real-Time Reporting : Business Intelligence enables the visualization of historical and real-time data, uncovering consumer behavior patterns and operational bottlenecks. For instance, they facilitate:

- Live data acquisition for managing various bank branches efficiently.

- Monitoring average wait times in queues to enhance customer service.

- Real-time feedback on the utilization of counters and tellers.

- Snapshot provision for booked or recent appointments, optimizing scheduling.

Data Mining : This crucial BI component cleanses, standardizes, and identifies patterns within vast datasets, used in banking for:

- Reducing Financial Loss with Default Detection: Identifying potential loan repayment defaults and enhancing credit scores.

- Targeted Marketing: Categorizing potential clients based on various attributes and preferences for cross-selling opportunities.

- Improved Anti-Money Laundering Management: Identifying transactional trends and minimizing false patterns.

Cash Flow Management : BI aids effective cash flow management, assisting banks in:

- Identifying areas for cost optimization and ensuring near real-time financial transaction monitoring.

- Streamlining operations, optimizing resource allocation, and maintaining service quality, even during budget shortfalls.

Predictive Analytics : Leveraging historical and current data to forecast future outcomes and identify patterns, banks utilize predictive analytics for:

- Credit Scoring: Assessing creditworthiness for improved lending decisions.

- Customer Retention and Loyalty: Predicting and enhancing customer loyalty.

- Regulatory Compliance: Ensuring adherence to financial regulations.

- Risk Modeling and Fraud Detection: Identifying potential risks and mitigating fraudulent activities.

The integration of predictive analytics enables banks to employ data-driven models, ensuring operational profitability and competitiveness in the market.

Also Read: 11 Key Benefits of Business Intelligence

Business Intelligence (BI) has significantly reshaped the banking sector, revolutionizing operations and decision-making processes. Within this industry, BI serves as a pivotal tool, aiding banks in various crucial aspects, such as fraud detection, customer segmentation, credit risk assessment, and regulatory compliance.

1) Fraud Detection and Prevention:

- Real-time Transaction Analysis: Banks leverage BI to scrutinize vast transactional data instantly, pinpointing irregularities or suspicious activities.

- Pattern Recognition: BI tools identify unusual patterns and anomalies, aiding in detecting potential fraudulent behavior swiftly.

- Risk Mitigation and Customer Trust: By swiftly addressing fraudulent activities, banks minimize financial losses, bolstering customer trust and confidence in their services.

2) Customer Segmentation and Profiling:

- Data-Driven Insights: BI extracts valuable insights from customer data, enabling banks to understand preferences, behaviors, and needs.

- Tailored Services: Utilizing BI, banks customize their offerings, aligning products/services with specific customer requirements, boosting satisfaction.

- Enhanced Marketing Opportunities: BI-driven segmentation identifies opportunities for cross-selling, maximizing the value of customer relationships.

3) Credit Risk Assessment and Management:

- Informed Decision Making: BI analyzes credit-related data points to make informed lending decisions, reducing the risk of defaults.

- Proactive Risk Management: Real-time monitoring helps banks identify potential default risks among existing customers, allowing for timely risk mitigation.

- Improved Portfolio Performance: BI aids in managing credit risk effectively, contributing to better overall portfolio performance and stability.

4) Regulatory Compliance:

- Automated Compliance Processes: BI automates data collection, analysis, and reporting, ensuring banks adhere to regulatory frameworks like AML and KYC.

- Risk Reduction: By streamlining compliance processes, BI minimizes the risk of non-compliance penalties, saving time and resources.

- Efficiency Gains: BI-driven automation enables banks to focus resources on core operations while ensuring adherence to regulatory standards effectively.

In conclusion, the multifaceted applications of Business Intelligence have fundamentally transformed the banking industry. From combating fraud and enhancing customer relationships to minimizing risks and ensuring compliance, BI’s integration with data analytics has empowered banks to operate more efficiently, strengthen customer trust, and maintain a competitive edge in today’s dynamic banking landscape.

Empowering Banking Insights: Key BI Tools for Financial Optimization

1. Zoho Analytics:

Zoho Analytics is a self-service BI tool used by over 2 million users in banking. It provides customizable reports, and in-depth financial insights, and tracks financial KPIs. Explore Zoho Analytics

DOMO is a cloud-based BI tool excelling in data integration, offering automated data refresh, rich visualizations, and an alert system. Discover DOMO

3. Trademo Intel:

Trademo Intel aggregates global import-export data, aiding in supply chain analysis, prospecting global companies, and risk modeling for banks. Learn about Trademo Intel

These tools offer diverse functionalities, assisting banks in swift data analysis, operational optimization, and risk management across various banking sectors.

In conclusion, Business Intelligence (BI) has reshaped banking, redefining decision-making with its transformative capabilities. From handling vast transaction volumes to enabling personalized customer experiences, BI tools like Zoho Analytics, DOMO, and Trademo Intel empower banks across risk management, compliance, and customer-centric strategies. BI’s pivotal role in driving operational efficiency and strategic insights remains paramount, ensuring banks adapt to dynamic market shifts.

As banking continues evolving, BI’s integration propels institutions toward agility and competitiveness. The symbiotic relationship between data intelligence and banking not only enhances operations but also fosters a culture of informed decision-making.

Embracing BI’s potential unlocks actionable insights, shaping a future where data empowers sustainable growth and resilience within the banking sector.

Explore scalable BI solutions for your BFSI needs with Scaleupally’s expertise!

Q: How can business intelligence transform the banking industry?

Business intelligence empowers banks to derive valuable insights from customer data, facilitating real-time decisions with accuracy. It propels profitability in banking through streamlined data handling, improved workflows, and enhanced customer retention.

Q: Is Business Intelligence better suited for Finance or IT departments?

Business Intelligence, as a methodology, doesn’t belong exclusively to Finance or IT. Rather, it’s a versatile tool used by anyone leveraging business data to make customer-centric decisions. While it’s broad-based, specialized groups supporting this methodology usually focus on strategic work.

Q: What benefits does business intelligence offer to the financial industry?

Business intelligence tools aid the financial industry by simplifying data collection, visualization, monitoring, and analysis. They enable the measurement of financial performance, uncover improvement opportunities, and facilitate sustained growth by deciphering complex financial data into meaningful insights.

1. Business Intelligence in Ecommerce

2. Business Intelligence in Supply Chain

3. Business Intelligence in Finance

4. Business Intelligence in Travel Industry

5. Business Intelligence in Retail

6. Business Intelligence in Manufacturing

Share this article

Related Blogs

Logistic App Development Cost in 2024

Logistics Mobile App Development Cost: The cost to develop a flutter app can range anywhere from $10,000 to $100,000 depending on the complexity of the app.

Manu Jain Oct 29 , 13 min read

Power BI for Digital Marketing

Learn how to use Power BI for digital marketing. Track key metrics across channels, gain insights into campaign performance and make real-time adjustments for increased ROI.

Tarsem Singh Oct 29 , 14 min read

Excel vs Access: Which One Should You Choose?

Excel vs Access: Explore the top features, pros and cons along with the key differences between these two technologies with ScaleupAlly.

Tarsem Singh Oct 28 , 9 min read

Our Promise

We believe in turning ideas into impactful products.

Ready to Discuss Your Idea?

Connect with our experts, talk to our experts.

- Banking Business Intelligence Case Study

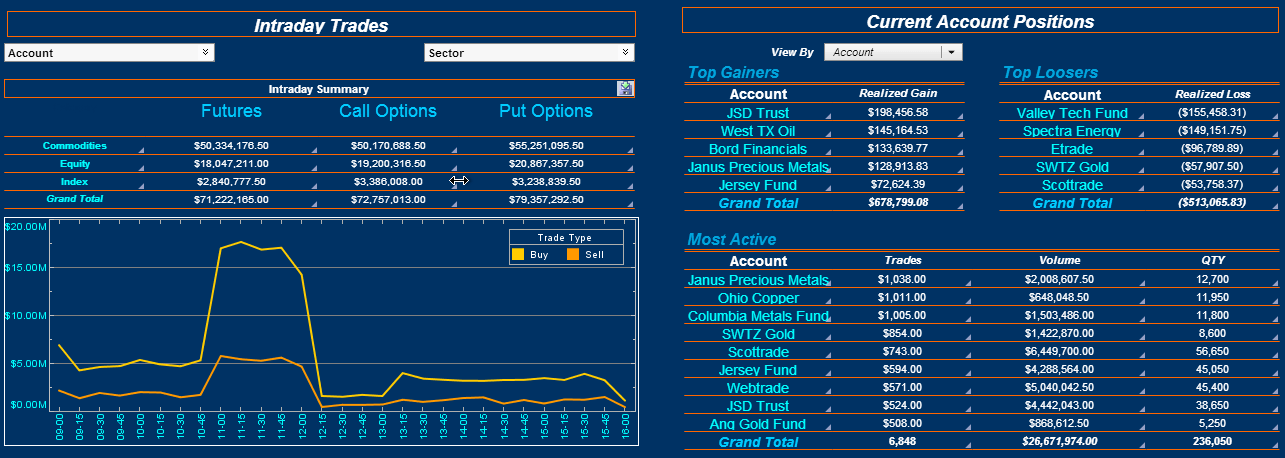

BI Case Study: A Global Capital Markets Bank

A multi-national global bank headquartered in Australia engaged InetSoft for a bank-wide business intelligence initiative to address challenges experienced in their global expansion.

Organization Background

The bank is a global organization with businesses spanning investment banking, institutional trading & sales, corporate financing, asset management and retail banking. The business operates in all continents with major commerce centers in Asia, Europe and North America. Business is conducted around the clock globally. Books and operations are passed among major commerce centers with overlapping time zones. Relationships among business groups are multifaceted and dynamic.

Even with such a linked business model, each locale of operation requires flexibility so that their local market demands can be met in a timely fashion without causing global impacts. Due to the span of their operations, business groups are required to comply with different laws and regulations. For regulatory, legal, business or technical reasons, certain aspects of the business must be segregated and secured.

IT Operations Background

IT operations supporting business groups are dispersed in multiple continents' technical centers. They are responsible for ensuring the architecture and data integrity of all business systems. Security, compliance and compatibility are also important priorities. Many corporate-wide data and computer resources are owned and operated by IT. Business groups must share data and resources for bank wide consistency. With a mixed development model, both in-house IT units and vendor engineering teams are working closely.

After development and implementation, the goal is to hand over finished systems smoothly to in-house IT operations. For business group-owned information technology projects, business groups typically take ownership of the business requirements and processes. IT groups will ensure the project's integrity and compatibility. If no in-house development resource is provided, vendors are expected to work with analysts from business groups with only back-end support provided by IT

Owner Business Group Background

The project owner is a fast growing trading facilitation group in the bank. The main business focus of the group is to provide trading services and financing for institutional clients. The financial products traded are derivatives which consist of complex parameters. Hundreds of clients are scattered throughout the world and trade around the clock.

The group itself has corresponding local operations in major commerce centers to facilitate the business. In this fast paced business, the trading environment can quickly change direction. Both bank and client employees need an accurate understanding of their positions. Furthermore, historical analysis of past trading activities, with the ability to drilldown into the individual trade level, is important.

Business Challenges

The bank employees and clients have been generating reports from the transactional system that records all trades. The system has multiple pain points. First, the conflict of serving transaction needs and business intelligence needs is causing system overload that many times delays trading execution. This can be costly to clients and the bank. Second, the system is designed for transactions. Therefore reporting is very slow. This is not only a pain but causes lost business opportunities. Third, inflexible reports can't be easily customized by users who many times resort to manually produced reports. Manual reporting is not matching trading demands but also is error prone. The fast growing client base really pushed current process to the limits.

Considered Architecture

The first considered solution was to build a data warehouse with associated ETL. After consulting with groups using data warehouses in the bank, it was clear that this solution would have serious shortcomings. Data warehouses are static modeled. This means it has a pre-defined data structured according to current known business needs. Constant reporting requests under current system has clearly demonstrated that needs can't be so well defined statically. This clearly doesn't fit derivative trading which is a quick moving target.

The second issue is the delay introduced by ETL and a data warehouse. Certain reports must be real time to reflect up-to-the-second positions. The challenge is to find a front end tool that can mix reporting against a transactional database and a data warehouse. Also, a data warehouse is normally self-contained which makes data linkage with bank wide data and systems even more challenging.

InetSoft's Architecture

After evaluating these challenges, InetSoft proposed an architecture that dynamically creates a data hub in the place of data warehouse. This data hub is incrementally populated. Instead of a predefined static schema, its creation is driven by visual reports and dashboards. Basically, it is a dynamic data warehouse. The ETL process is baked into the visual design process which produces visual reports as well as reusable data blocks.

Visual reports can be iteratively designed against the transactional database's schema. When it is deployed into production, the system materializes the underlying data queries into analytic-oriented, high performance data blocks residing inside the data hub. These data blocks remove the reporting load of querying the transactional database. The data blocks also deliver high performance because they are optimized for these reports. For real time reports, InetSoft's software can simply materialize, or cache the results of, the underlying queries and retain the live connection to the transactional database.

Other Key Features

Beside architecture considerations, the bank valued the following unique built-in features:

Multi-tenancy

Each client is set up as a tenant and requires total isolation. On the other hand, bank account managers need to able to see across his/her own accounts. Higher level management needs access across different group or all accounts.

Paginated Reports

Visual reports and dashboards are great for interactive use. But they do not replace the need for paginated reports which are suited for client statements and executive summaries.

Cascading Parameters & Wizards

For casual users, these functions are proven to be the easiest entrance points for self-service.

Pure-browser Visualization Design

Power users are from all different client organizations. It is impossible to install and manage desktop design tools in this situation. Only a 100% browser based tool makes power user self-service possible.

Data Hub/Data Blocks

he fact that the visual report design process creates data blocks that are not tied to the single report is very useful. The data hub only contains data blocks proven useful by its first associated report. Data blocks can all be reused and mashed up for other reports which makes it possible for less experienced users to do sophisticated self-service reporting.

Fault Tolerance & Scalability

Unlimited scalability is possible through Apache Spark based Big Data clusters with inherent fault tolerance built-in.

Built-in Auditing

An auditing database and associated reports for usage, load and other analysis helps greatly to maintain a clean and lean system.

Implementation Process

The customer decided to utilize InetSoft's service team to work with business analysts directly. This was a close relationship where our engineers collaborated with business analysts online sharing the same environment. Project planning, management and implementation was jointly administrated. The project went through the following stages:

Status Survey

Understanding transactional database schema and mapping existing reports to the data. Besides gathering knowledge, many existing reports were identified as suspect of being one-use leftover reports.

Gap Analysis

Identifying business need gaps that are not served by current systems. The main focus in this project was to review the reporting request history. It yielded a self-service tool gap and issues related to the lack of data reusability.

Bottleneck Verification

This process helped us discover that shared transactional databases are not the only culprit. Transcontinental data latency also played a significant role that needed to be addressed besides data processing.

Consolidation Proposal

Identifying opportunities to consolidate existing reports and new requirements to reduce needed reports. For the existing static reporting system, many clusters of 5-10 reports could be consolidated into one interactive dashboard.

Architecture Adjustment

Armed with new discovery, InetSoft proposed the best way to adjust the structure. In this case, the client was offered options for public cloud based or on-premises deployment as well as the selection of location for the server.

Incremental Migration

The most in-demand reports identified in previous stages were first addressed to test the architecture with real world data for performance.

Full Implementation

Multiple InetSoft engineers were engaged. This includes designers, test engineers, and system engineers.

Performance Tuning and Monitoring

After implementation, InetSoft's engineering team kept monitoring the system looking for bottleneck and hotspots.

Training and Transitioning

At this stage, InetSoft trained the bank's IT staff to manage the system. Further training was provided to the trainer on how to teach self-service for various users in a train-the-trainer model.

Please note this is not a linear process, it took many quick iterations among the various stages.

The Results

This solution allowed the bank to increase their client base quickly without concern over system limits. Provisioning the service and enhance the system has now become a simple task. Clients not only gained vastly improved performance but also gained self-service ability. Once the system was fully deployed within 6 months, the group only needed one part time administrator/designer. The InetSoft solution and services reduced the number of IT staffing and business resources.

Copyright © 2024, InetSoft Technology Corp.

Analytics in banking: Time to realize the value

Consider three recent examples of the power of analytics in banking:

- To counter a shrinking customer base, a European bank tried a number of retention techniques focusing on inactive customers, but without significant results. Then it turned to machine-learning algorithms that predict which currently active customers are likely to reduce their business with the bank. This new understanding gave rise to a targeted campaign that reduced churn by 15 percent.

- A US bank used machine learning to study the discounts its private bankers were offering to customers. Bankers claimed that they offered them only to valuable ones and more than made up for them with other, high-margin business. The analytics showed something different: patterns of unnecessary discounts that could easily be corrected. After the unit adopted the changes, revenues rose by 8 percent within a few months.

- A top consumer bank in Asia enjoyed a large market share but lagged behind its competitors in products per customer. It used advanced analytics to explore several sets of big data: customer demographics and key characteristics, products held, credit-card statements, transaction and point-of-sale data, online and mobile transfers and payments, and credit-bureau data. The bank discovered unsuspected similarities that allowed it to define 15,000 microsegments in its customer base. It then built a next-product-to-buy model that increased the likelihood to buy three times over.

Results like these are the good news about analytics. But they are also the bad news. While many such projects generate eye-popping returns on investment, banks find it difficult to scale them up; the financial impact from even several great analytics efforts is often insignificant for the enterprise P&L. Some executives are even concluding that while analytics may be a welcome addition to certain activities, the difficulties in scaling it up mean that, at best, it will be only a sideline to the traditional businesses of financing, investments, and transactions and payments.

Stay current on your favorite topics

In our view, that’s shortsighted. Analytics can involve much more than just a set of discrete projects. If banks put their considerable strategic and organizational muscle into analytics , it can and should become a true business discipline. Business leaders today may only faintly remember what banking was like before marketing and sales, for example, became a business discipline, sometime in the 1970s. They can more easily recall the days when information technology was just six guys in the basement with an IBM mainframe. A look around banks today—at all the businesses and processes powered by extraordinary IT—is a strong reminder of the way a new discipline can radically reshape the old patterns of work. Analytics has that potential.

Would you like to learn more about our Financial Services Practice ?

Why? Three factors are coming together to kick off the coming heyday. First, consider advances in technologies . The availability of information is booming: in the past few years, the amount of meaningful data—true signal, not noise—has grown exponentially, while the size and cost of processors decreased. By 2020, about 1.7 megabytes a second of new information will be created for every human being on the planet. Businesses have opened their minds, freely adapting new analytical techniques that in the past might have been dismissed as too impractical and theoretical for the real world.

And those techniques have improved radically. We are well past simple linear regressions—machine learning now features support vector machines, random forests, gradient boosting, and many other astonishing algorithms. Any company’s ability to perform these analytics has been significantly boosted by the exponential increase of computing power (which makes it possible to undertake, in just seconds, an analysis that in the past would have taken weeks) and by new data-storage technologies, such as Hadoop.

Second, banks in many regions are under enormous economic pressure . Our latest research finds that of the top 500 institutions around the world, 54 percent are priced below book value. In 2014 we calculated that just 18 percent of banks captured all the value in the industry. Recognizing this reality, banks have tried all manner of improvements, especially digitization and cost cutting. But these moves have taken them only so far; something new is needed.

Those digitization efforts underlie the third factor pushing analytics. Much of a typical bank is now digitized and throwing off data by the terabyte. A mostly manual bank would have serious difficulty using advanced analytics; at digital banks, the highways are already paved.

Put it all together, and you get advanced analytics: industrial-scale solutions to exploit data for authentic business insights and vastly improved decision making. The tools are there; banks must now carry them forward into actions that can drive meaningful change. The canvas is as broad as a bank itself. Rich real-time data—numbers, yes, but also text, voice, and images—now exist for literally every action that customers make, every product that banks sell, and every process that banks use to deliver those products. In this article, we will explore the vast opportunities, as well as the problems of integration and scaling that keep banks from making analytics a coherent discipline. We will then suggest the strategic and organizational elements that banks need to realize the analytics dream.

Ready for prime time

As the saying goes, “The future is already here. It’s just not evenly distributed.” Banks—and companies in every other industry—are already deploying advanced analytics to move their businesses forward. We see three ways it can generate a meaningful increase in profits (Exhibit 1).

- Advanced analytics can help banks wring small improvements out of almost all their everyday activities, boosting the traditional P&L levers. Potential moves include the following:

- Accelerating growth, even in an anemic environment. Deeper and more detailed profiles of customers, together with transactional and trading analytics, can improve the acquisition and retention of clients, as well as cross- and upselling. For example, one bank used credit-card transactional data (from both its own terminals and those of other banks) to develop offers that gave customers incentives to make regular purchases from one of the bank’s merchants. This boosted the bank’s commissions, added revenue for its merchants, and provided more value to the customer.

- Enhancing productivity. Every banking process can become faster and more effective. Among other things, banks can use advanced analytics to provide faster and more accurate responses to regulatory requests and give teams analytics-enhanced decision support. One bank we know used machine learning to understand the way the characteristics of code affected a mainframe’s running time and the resulting costs; by optimizing the code, it cut them by 15 percent. Another bank used new algorithms to predict the cash required at each of its ATMs across the country, combining this with route-optimization techniques to save money.

- Improving risk control. Banks can lower their risk costs through analytics-aided techniques, such as digital credit assessment, advanced early-warning systems, next-generation stress testing, and credit-collection analytics. The expense of compliance and control has soared in recent years, and banks can use analytics to get economic returns from their considerable investments. We estimate that G-SIBs can take out up to $1 billion a year in costs through a simplified portfolio of data repositories—building on work that most banks have already done—and through new analytics that produce more accurate regulatory reports and deliver them more quickly. D-SIBs can save up to $400 million annually. Further out, banks will be able to use analytics to reduce fraud losses.

- A second vector of impact is the way that analytics can help deliver the promise of digital banks and offer a much better customer experience at a fraction of the current cost. In some regions up to 65 percent of customers now interact with their banks via multiple channels. Their paths through them are extraordinarily complex: they often start in one channel, perform intermediate steps in others, and finish in yet another—with plenty of pauses and information-gathering loops along the way. Successful digital banks deliver a truly seamless multichannel experience by gathering real-time data and using analytics to understand the customer and build the proper (and always consistent) journey view.

- Finally, analytics can help banks find new sources of growth , and even new business models. Banks may be able to reap income from their data—for example, by sharing customer-analytics capabilities with new ecosystem partners, such as telecom companies or retailers. Taken to a logical but not implausible extreme, banks can use data and analytics to shape a new business model and out-fintech the fintechs. The bank as data company can sit at the center of a consumer ecosystem where the revenue pools include not just banking but also many other B2C and B2B businesses. Great analytics isn’t the only requirement here: banks must get many other things right to be relevant to and trusted by customers. But that can be done, and already more than a dozen leading banks are taking positive steps in this direction.

Not without pitfalls

In our recent survey, 1 1. We interviewed executives at 13 global and regional banks based in ten countries across Europe and the Middle East. we found that almost every bank lists advanced analytics among its top five priorities. Most plan to invest further in these techniques. A few banks are already seeing the rewards. These leaders have built substantial foundations by establishing data lakes and centers of excellence and using machine-learning techniques. They and many others have spent hundreds of millions on their data (especially risk data) and on compliance. For them, advanced analytics is becoming a reflex action, with commensurate rewards of about €300 million in additional annual profit, on average.

A digital crack in banking’s business model

Most banks we surveyed, however, are struggling. A good many are “started but stuck”: they have invested significantly in data infrastructure (mostly as a result of regulation) and experimented with advanced-analytics techniques (mostly through specialized teams loosely connected to the corporate center). But the expected results have not arrived. A few banks have yet to begin.

The started-but-stuck ones are running into a number of problems. At the highest level, their efforts remain unconnected and subscale; they have not yet tied together their disparate efforts into a single, unified business discipline. Tactically, we see banks making unforced errors such as these:

- not quantifying the potential of analytics at a detailed level

- not engaging business leaders early and to develop models that really solve their problems and that they trust and will use—not a “black box”

- falling into the “pilot trap”: continually trying new experiments but not following through by fully industrializing and adopting them

- investing too much up front in data infrastructure and data quality, without a clear view of the planned use or the expected returns

- not seeking cooperation from businesses that protect rather than share their data

- undershooting the potential—some banks just put a technical infrastructure in place and hire some data scientists, and then execute analytics on a project-by-project basis

- not asking the right questions, so algorithms don’t deliver actionable insights

Making it happen

A quick take on the cio agenda.

As noted, analytics does not necessarily require a big investment in IT. But banks must provide the technologies and tools that businesses need to access an immense set of high-quality data in real time. That data must be well managed and always available. These technologies include the following:

- Data lakes to scale up and industrialize the development and delivery of use cases. There are good and bad ways to use data lakes; we’ve seen better results when they are developed with agile techniques based on use cases. At all costs, banks should avoid building another enterprise data warehouse or asking data lakes to do more than they really can. Data lakes will not unburden the banks from proper governance and quality-assurance processes, but they do offer an opportunity to get things right from the beginning.

- Machine-learning techniques, which have proved superior in many use cases—the industry will inevitably move toward machine learning supported by open-source languages. Machine-learning tools are already available in most banks but are not used to solve very specific problems. (If they are not available, there is a large market of rapidly moving open-source technologies and commercial software products.) Banks need to keep their options open to the vast innovations taking place in machine learning.

- Google-like search engines provide quick and easy access to all of a bank’s data, including the source, definition, and all other information needed to use the data effectively.

- Modern data-exploration and -visualization tools are helpful to bridge the gap between advanced business users identifying potential use cases, anomalies, or patterns in the data, on the one hand, and data scientists using advanced analytics to predict and optimize, on the other.

- Tools to analyze text, voice, video, and images can help to process new data structures—specifically, unstructured data, such as voice and text. For example, analyzing live-chat data has great business potential for retaining customers or for next-best-product-to-buy analyses.

- Capabilities to leverage real-time data are important. Deploying analytical models in live streams can help embed analytical advice and predictions into customer dialogues. For example, most banks have already added chat capabilities to call centers. Now, banks can add analytics-driven recommendations to the APIs that support chat to insert a “next best” suggestion to customers.

Avoiding the pitfalls and accessing the broad set of opportunities requires CEO leadership as banks develop two assets: a strategy for the transformation and a robust analytics organization to assist and empower the businesses as they learn to use analytics in their everyday work. (New technologies and tools are also necessary; see sidebar, “A quick take on the CIO agenda.”)

Readers may notice something that’s missing from this list: setting the aspiration. That’s because we think every institution, unless its circumstances are extraordinary, should set the same aspiration: to establish analytics as a business discipline—the go-to tool for the thousands of decision makers across the bank. Earlier we mentioned analytics as a reflex. To extend the metaphor, analytics should resemble the human nervous system; every part of the body knows what to do when presented with certain stimuli. The big difference among banks will probably be the pace at which they can build and train their systems. Just as some parts of your brain are trained and some are not, banks will find that some nerve paths are already working well, while others must be laid down and taught how to react.

There’s something else missing from our list of required assets: an additional $100 million or so of spending. Many bank leaders look at analytics and fear an outsized investment. That’s not unreasonable, since in recent years institutions have had to spend billions on things they could not have anticipated, and budgets are very thin. But analytics is not a bet-the-bank investment with no graceful exits; it’s a short-cycle flow of investments with lots of options to kill unsuccessful pilots. The small but immediate payoffs from the initial work can finance the next wave of projects, which in turn finance more and larger efforts. Once the system is built, the investment is over and the margins become enormous—like those of software or tech companies.

A clear strategy centered on high-priority applications

Three elements are essential to the strategy. First, banks need an analytics-ready mind-set . Analytics transforms everyday work in surprising ways, so leaders must open their minds to the possibilities. Our core beliefs about advanced analytics can help. 2 2. For more, see Helen Mayhew, Tamim Saleh, and Simon Williams, “ Making data analytics work for you—instead of the other way around ,” McKinsey Quarterly , October 2016.

- Great analytics starts with high-value questions, not data. To guide the discovery process, ask what problem you want to solve and how much value the solution can create. Do not launch yourself into analysis for the sake of analysis or into intellectually interesting problems whose solutions are not actionable.

- The smallest edge can make the biggest difference. Advanced analytics is not about solving your biggest problems; it’s about solving hundreds of small ones that all add up. Especially in operations, these techniques can help to redefine processes and shorten them by several steps.

- Insights live at the boundaries between data sets. Remember the bank that combined six or seven discrete data sets to build a tool predicting the next product to buy? It realized that lots of relationships become apparent only when it compared widely varying parameters. Banks have massive amounts of data scattered through different departments. Pilots to bring together small samples of information can reveal the potential.

- Loops beat lines every time. Following a process can be a slog, and to do so you sometimes have to put on blinders. But that mentality is exactly wrong for advanced analytics. Banks that use feedback loops can not only be faster to market than competitors but also arrive there with better products. Ultimately, machines learn just as we do: by trial and error.

- Design matters. You want people to use your new tools. A beautiful algorithm deserves an attractive package that catches the eye of your users. Most of them can’t read code or understand the output of a model. To act on these insights, they need easily readied and used dashboards that help them make decisions and test potential scenarios.

- Analytics isn’t enough; adoption is essential. Use whatever means necessary—incentives, role modeling, communication, more communication—to get decision makers to use the new tools. Way too often, best-in-class algorithms sit idle in computers because users do not trust what they regard as a black box, fear the impact it could have on their roles, or simply do not want to go through the discomfort of change. Creating analytics is like putting jet fuel in your car. At the end of the day, if the driver does not develop the skills needed to drive faster, the effort is wasted.

- Analytics is a team sport. The skills banks need to make analytics work cannot be contained within a single person—at least not yet. Your teams must include true experts on data science, engineering, data architecture, and design. Faking it with people who do a little bit of everything won’t work.

A second element of the strategy is a set of prioritized use cases and a mechanism to create a pipeline of them. The scope for analytics is vast. Anywhere a bank uses rules of thumb or something is done “the way we’ve always done it,” analytics can probably make improvements. The CEO must lead the hunt for these issues and help prioritize them. Critically, at the beginning, the chosen use cases should not be limited to applications in which analytics could produce a substantial uptick in results; they should also include areas where scale can be increased quickly, to avoid the “pilot trap.”

Most of the potential use cases are relevant to every banking business. They include commercial applications: cross-selling and upselling, customer acquisition, reducing churn, and winning back customers. Business-improvement levers (such as dynamic and value pricing, credit underwriting, sales-area planning, yield and claims management, fraud detection, call-center routing, and workforce planning) are also relevant for most banks. While the first couple of use cases can be introduced top-down or outside-in, it is just as important to encourage everybody in the bank to become creative and make suggestions—while always ensuring a clear path to creating value. To avoid discouragement, long validation and delivery cycles need to be shortened. Innovation labs can help accelerate the process.

Finally, a strategy should set out a vision for how the bank will use analytics applications. For each use case the bank is considering, it should start by asking what problem holds back the business from having a greater impact. It can then work through a set of five steps: identifying the source of value, considering the available data (easier to do with a data lake, as we describe in the sidebar), identifying the analytics technique that will respond to the problem and probably produce insights, considering how to integrate analytics into the workflow of the business, and anticipating the problems of adoption (Exhibit 2).

Will sellers use the tools? If not, why not? What are their needs, and how can you make the analytical tools responsive to them? Sometimes the answer involves bundling insights from algorithms with useful data for sales managers in an app that they can use on external visits. Other times, a bank will have to change the way it develops campaigns and pushes them to the front line and to customers. Finally, in many other cases the bank will have to develop a group of high-performing champions who embrace this discipline and act as role models.

Embedding analytics in the organization is not simply a matter of getting specific teams to use specific tools, though that’s essential. The CEO and the top team must do much more to communicate clearly that analytics is important to the bank and empower everyone to join the revolution. The classical steps of successful change management will be essential: role modeling the new behavior, clearly explaining why change is needed, building the skills of the businesses so they can succeed with the new tools, and reinforcing the bank’s commitment through formal mechanisms (such as incentives).

A powerful analytics network

The businesses will need help to design analytics systems, to build applications exploiting them, and to promote adoption. Banks will want to establish a central team that supports these needs. But the last thing they should do is build another silo. What they require is a networked structure, a kind of nervous system. More than anything, banks must have open channels and accessibility to make a knowledge of analytics pass freely throughout the enterprise. An analytics center of excellence, the spine of such a system, will probably need some or all of the following components:

- New roles and responsibilities in data management, advanced analytics, and campaign execution. Perhaps the most critical role is that of a chief data officer responsible not only for analytics strategy and its integration into business units but also for defining data management’s roles and responsibilities, monitoring the quality of data, and ensuring regulatory compliance.

- Imaginative channels, such as innovation labs, to bring analytics closer to users.

- A deep pipeline of analytics talent, cited as a top priority by 60 percent of the banks in our recent survey. Banks should typically start with small teams of data scientists, who can work with external partners to absorb the necessary competences and skills, and then scale up gradually.

- A clear governance plan with a strong center of excellence (headed by the chief data officer) and well-defined responsibilities for the governance and quality of data and for the execution of analytics within the businesses.

- “Gold standard” data-management processes that define clear accountability, maintain the quality of data, and manage metadata, the data life cycle, and controls.

- Bulletproof data-quality controls, starting at the very beginning of the data life cycle. They should be automated wherever possible and monitored by a set of key quality indicators, so that the businesses are accountable for collecting the right data.

More than 90 percent of the top 50 banks around the world are using advanced analytics. Most are having one-off successes but can’t scale up. Nonetheless, some leaders are emerging. Such banks invest in talent through graduate programs. They partner with firms that specialize in analytics and have committed themselves to making strategic investments to bolster their analytics capabilities. Within a couple of years, these leaders may be able develop a critical advantage. Where they go, others must follow—and the sooner the better because success will come, more than anything else, from real-world experience.

Amit Garg is a partner in McKinsey’s New York office, Davide Grande is a partner in the Milan office, Gloria Macías-Lizaso Miranda is a partner in the Madrid office, and Christoph Sporleder is a senior expert in the Frankfurt office, where Eckart Windhagen is a senior partner.

Explore a career with us

Related articles.

Making data analytics work for you—instead of the other way around

The age of analytics: Competing in a data-driven world

The need to lead in data and analytics

- Book a Consultation

- Platform Overview

- Financial Performance

- Banking Performance

- Loan & Deposit Portfolio Analysis

- Regulatory Reporting

- Canadian Credit Unions

- US Community Banks

- US Credit Unions

- Microfinance Networks

- Integrations Overview

- Temenos T24

- Symitar Episys

- Case Studies

- Become a Partner

- Demo Videos

- Contact Sales

An Introduction to Banking Business Intelligence

A Guide to Banking Business Intelligence for Banks, Credit Unions and Microfinance Institutions.

Download PDF

Banking business intelligence is a term used to describe the applications, infrastructure, tools and best practices that enable analysis of key information.

Financial institutions can benefit significantly from the implementation of business intelligence. Whereas management teams can answer a number of key questions as they execute their strategic objectives.

Download our document to learn:

- How self-service analytics can help build business cases

- Why understanding BI can help capitalise on opportunities

- How implementing and utilising BI effectively can lead to business growth

- Why cloud and SaaS business intelligence solutions can benefit financial institutions

Download Our Document

© 2024 BankBI LTD

Privacy Policy

Website by Blend

- Actionable insights

Integrations

Why bankbi.

- Support Helpdesk

About BankBI

Company number: 08791819

Send a Message

Exploring Artificial Intelligence Adoption in the Banking Sector: Multiple Case Studies

- First Online: 16 October 2024

Cite this chapter

- Maryam Adhaen 9 ,

- Weifeng Chen 9 ,

- Rami Abu Wadi 9 , 10 &

- Esra Aldhaen 10

Part of the book series: Studies in Systems, Decision and Control ((SSDC,volume 550))

114 Accesses

We currently inhabit an era dominated by intelligent machines, where AI has seamlessly integrated into our daily lives, manifesting its impact in both subtle and conspicuous ways. In the banking sector, AI is being harnessed to execute transactions, identify potential security threats using facial recognition technologies—as outlined by the Harvard journal in 2016—combat fraudulent activities, enhance customer responses, provide personalized customer service, and enable virtual assistants to deliver real-time solutions. Moreover, AI facilitates digital documentation, problem-solving, planning, reasoning, and learning within the banking industry which leads to achieve sustainable increase in profits and value in this new era. It is important once adopt AI is to create an AI framework, design a targeted application approach, implement and construction and supervise and refine. The research addresses the AI adoption in banks, knows the bank redness of the AI implementation, enables to develop, and implement AI in its business model which shall happen after developing its organizational change and its efficiency to achieve completive advantages.

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

Subscribe and save.

- Get 10 units per month

- Download Article/Chapter or eBook

- 1 Unit = 1 Article or 1 Chapter

- Cancel anytime

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Durable hardcover edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

https://www.cbb.gov.bh/banking/ .

https://www.bahrainedb.com/business-opportunities/financial-services/ .

Abdulla, Y., Ebrahim, R., Kumaraswamy, S.: Artificial Intelligence in Banking sector: evidence from Bahrain. In: 2020 International Conference on Data Analytics for Business and Industry: Way Towards a Sustainable Economy (ICDABI) (2020)

Google Scholar

Abdulquadri, A., Mogaji, E., Kieu, T.A., Nguyen, N.P.: Digital transformation in financial services provision: a Nigerian perspective to the adoption of chatbot. J. Enterprising Communities: People Places Glob. Econ. 15 (2), 1–18 (2021)

Bachinskiy, A. (2019). The growing impact of AI in financial services: six examples. https://towardsdatascience.com/the-growing-impact-of-ai-in-financial-services-six-examples-da386c0301b2

Belanche, D., Casalo, L.V., Flavian, C.: Artificial Intelligence in FinTech: understanding robo-advisors adoption among customers. Ind. Manag. Data Syst. 119 (7), 1411–1430 (2019). https://doi.org/10.1108/IMDS-08-2018-0368

Article Google Scholar

Biswas, S., Carson, B., Chung, V., Singh, S., Thomas, R.: AI -bank of the future: can banks meet the AI challenge? Mckinsy & Company (2020)

Borau, S., Otterbring, T., Laporte, S., Fosso Wamba, S.: The most human bot: female gendering increases humanness perceptions of bots and acceptance of AI. Psychol. Mark. 38 (7), 1052–1068 (2021). https://doi.org/10.1002/mar.21480

Caron, M.S.: The transformative effect of AI on the banking industry. Banking Fin. Law Rev. 34 (2), 169–214 (2019)

Damanpour, F., Schneider, M.: Characteristics of innovation and innovation adoption in public organizations: assessing the role of managers. J. Public Adm. Res. Theory 19 (3), 495–522 (2009). https://doi.org/10.1093/jopart/mun021

Davenport, T.H., Kirby, J.: Only Humans Need Apply Winners and Losers in the Age of Smart Machines. Harper Business New York, NY (2016)

Davenport, T.H., Ronanki, R.: Artificial intelligence for the real world. Harv. Bus. Rev. 96 (1), 108–116 (2018)

Digalaki, E.: The impact of artificial intelligence in the banking sector & how AI is being used in 2022 (2022). https://www.businessinsider.com/ai-in-banking-report?r=US&IR=T

Van Doorn, J., Mende, M., Noble, S.M., Hulland, J., Ostrom, A.L., Grewal, D., Petersen, J.A.: Domo arigato Mr. Roboto: emergence of automated social presence in organizational frontlines and customers’ service experiences. J. Serv. Res. 20 (1), 43–58 (2017). Sage Publications

Duan, Y., Edwards, J.S., Dwivedi, Y.K.: Artificial intelligence for decision making in the era of Big Data–evolution, challenges, and research agenda. Int. J. Inf. Manag. 48 , 63–71 (2019)

Dubey, R., Bryde, D.J., Dwivedi, Y.K., Graham, G., Foropon, C.: Impact of artificial intelligence-driven big data analytics culture on agility and resilience in humanitarian supply chain: a practice-based view. Int. J. Prod. Econ. 250 , 108618 (2022). https://doi.org/10.1016/j.ijpe.2022.108618

Eisenhardt, K.M., Graebner, M.E.: Theory building from cases: opportunities and challenges. Acad. Manag. J. 50 , 25–32 (2007)

Electronics 11 , 1579 (2022)

Van Esch, P., Van Esch, L.J., Cowley, J.C.: The dimensions of religion as underpinning constructs for mass media social marketing campaigns: an emerging concept. Int. J. Mark. Stud. 5 (1) (2013). https://doi.org/10.5539/ijms.v5n1p96

Fadlallah, H.: How information technologies influenced risk management? (2018). https://towardsdatascience.com/how-information-technologies-influenced-risk-management-7eb3a38d253

Fares, O, Butt, I., Lee, S.: Utilization of artificial intelligence in the banking sector: a systematic literature review. J. Financ. Serv. Mark. (2022)

Fountaine, T., McCarthy, B., Saleh, T.: Building the AI-powered organization. Harv. Bus. Rev. 97 , 62–73 (2019)

Gupta, M., Gupta, S.: Influence of national cultures on operations management and supply chain management practices—a research agenda. Prod. Oper. Manag. 28 (11), 2681–2698 (2019). https://doi.org/10.1111/poms.13100

Hameed, M.A., Counsell, S., Swift, S.: A conceptual model for the process of it innovation adoption in organizations. J. Eng. Tech. Manag. 29 (3), 358–390 (2012). https://doi.org/10.1016/j.jengtecman.2012.03.007

Helfat, C.E., Raubitschekb, R.S.: Dynamic and integrative capabilities for profiting from innovation in digital platform-based ecosystems. Res. Policy 47, 1391–1399 (2018)

Hough, J., White, M.: Scanning actions and environmental dynamism: gathering information for strategic decision making (2004)

Jung, D., Dorner, V., Weinhardt, C., Pusmaz, H.: Designing a robo-advisor for risk-averse, low-budget consumers. Electron. Mark. 28 (3), 367–380 (2018). Springer

Kok, J.N., Boers, E.J., Kosters, W.A., Van der Putten, P., Poel, M.: Artificial intelligence: definition, trends, techniques, and cases. Artif. Intell. 1 , 270–299 (2009)

Korzeniowski, P.: Bots should be in your contact center’s future. CRM Mag. (2017). https://www.destinationcrm.com/Articles/Editorial/Magazine-Features/Bots-Should-Be-in-Your-Contact-Centers-Future-117857.aspx?pageNum53

Kvale, S.: Inter Views: An Introduction to Qualitative Research Interviewing. Sage, London (1996)

Liu, Y.: Sustainable competitive advantage in turbulent business environments. Int. J. Prod. Res. 51 , 2821–2841 (2013). https://doi.org/10.1080/00207543.2012.720392

Makarius, E.E., Mukherjee, D., Fox, J.D., Fox, A.K.: Rising with the machines: a sociotechnical framework for bringing artificial intelligence into the organization. J. Bus. Res. 120 , 262–273 (2020)

Malali, A.B., Gopalakrishnan, S.: Application of artificial intelligence and its powered technologies in the Indian banking and financial industry: an overview. IOSR J. Hum. Soc. Sci. 25 (4), 55–60 (2020)

Mallawaarachchi, C.: The Importance of Artificial Intelligence in Customer’s Perceptions in Services of Interactive Voice Recognition in the Banking Industry in Sri Lanka, vol. 1, no. 13 (2019)

Marshall, B., Cardon, P., Poddar, A., Fontenot, R.: Does sample size matter in qualitative research: a review of qualitative interviews in IS research. J. Comput. Inf. 54 (1), 11–22 (2013)

Mathew, D., Brintha, N.C., Jappes, J.T.W.: Artificial intelligence powered automation for Industry 4.0. In: Nayyar, A., Naved, M., Rameshwar, R. (eds.) New Horizons for Industry 4.0 in Modern Business. Contributions to Environmental Sciences & Innovative Business Technology. Springer, Cham (2023). https://doi.org/10.1007/978-3-031-20443-2_1

Matthew, U.: Regulation artificial intelligence systems: risks, challenges, competencies, and strategies. Harv. J. Law Technol. (2016)

McCarthy, J., Minsky, M.L., Rochester, N.: The Dartmouth summer research project on artificial intelligence. Artificial intelligence: past, present, and future (1956). http://www.dartmouth.edu/*vox/0607/0724/ai50.html

McCracken, G.: The Long Interview. Sage, Beverly Hills, CA (1988)

Book Google Scholar

Mehr, H., Ash, H., Fellow, D.: Artificial Intelligence for Citizen Services and Government. Ash Cent. Democr. Gov. Innov. Harvard Kennedy Sch. (August 19), 1–12 (2017)

Mehrotra, A.: Artificial Intelligence in Financial Services–Need to Blend Automation with Human Touch. In 2019 International Conference on Automation, Computational and Technology Management (ICACTM) (pp. 342–347). IEEE. (2019, April)

Merton, R.K., Fiske, M., Kendall, P.L.: The Focused Interview: A Manual of Problems and Procedures. A Report of the Bureau of Applied Social Research, Columbia University. The Free Press, Glencoe (1956)

Mikalef, P., Gupta, M.: Artificial Intelligence capability: conceptualization, measurement calibration, and empirical study on its impact on organizational creativity and firm performance. Inf. Manag. (2021) https://doi.org/10.1016/j.im.2021.103434

Mikalef, P., Pateli, A.: Information technology-enabled dynamic capabilities and their indirect effect on competitive performance: findings from PLS-SEM and fsQCA. J. Bus. Res. 70 , 1–16 (2017)

Murugesan, R., Manohar, V.: AI in financial sector–a driver to financial literacy. Int. J. Commer. 7 (3), 66–70 (2019)

Nazemi, K., Burkhardt, D., Kock, A.: Visual analytics for technology and innovation management. Multimed. Tools Appl. 81 , 14803–14830 (2022). https://doi.org/10.1007/s11042-021-10972-3

Njegovanovic, A.: Artificial Intelligence: financial trading and Neurology of Decision. Financ. Mark. Inst. Risks 2 , 58–68 (2018)

Pettey, C.: Lessons from artificial intelligence pioneers. Smart Gart. Digit. Bus. (2018) . https://www.gartner.com/smarterwithgartner/lessons-from-artificial-intelligence-pioneers/

Rahman, M., Ming, T., Baigh, T., Sarker, M.: Adoption of artificial intelligence in banking services: an empirical analysis (2020)

Reza Tizhoosh, H., Pantanowitz, L.: Artificial intelligence and digital pathology: challenges and opportunities. J. Pathol. Inform. 9 (1) (2018)

Sandberg, J., Alvesson, M.: Ways of constructing research questions: gap-spotting or problematization? Organization 18 (1), 23–44 (2011)

Saunders, M., Lewis, P., Thornhill, A.: Research Methods for Business Students, 4th ed. (2009)

Schmelzer, R.: 5 benefits of AI in the banking industry (2019). https://searchenterpriseai.techtarget.com/feature/AI-in-banking-industry-brings-operational-improvements

Shan Ho, S., Chow, M.: The Role of Artificial Intelligence in Customers’ Brand Preference for Retail Banks in Hong Kong. PMC PubMed Central, Springer Nature (2023)

Stone, M., Aravopoulou, E., Evans, G., Aldhaen, E., Parnell, B.: From information mismanagement to misinformation: the dark side of information management (2018)

Tarafdar, M., Beath, C.M., Ross, J.W.: Using AI to enhance business operations. MIT Sloan Manag. Rev. 60 (4), 37–44

Teece, D.J.: Explicating dynamic capabilities: the nature and microfoundations of (sustainable) enterprise performance. Strat. Manag. J. 28 (13), 1319e1350 (2007)

Teece, D.J.: Business models and dynamic capabilities. Long. Range Plan. 51 (1), 40–49 (2018). View PDF View article View in Scopus Google Scholar

Teece, D., Peteraf, M., Leih, S.: Dynamic capabilities and organizational agility. Calif. Manag. Rev. 58 (4), 13e35 (2016)

Teece, D.J., Pisano, G., Shuen, A.: Dynamic capabilities, and strategic management. Strateg. Manag. J. 18 , 509–533 (1997)

Thomas, D.R.: A general inductive approach for analyzing qualitative evaluation data. Am. J. Eval. 27 (2), 237–246 (2006)

Thong, J.Y.L., Yap, C.S.: CEO characteristics, organizational characteristics and information technology adoption in small businesses. Omega 23 (4), 429–442 (1995). https://doi.org/10.1016/0305-0483(95)00017-I

Vanneschi, L., Horn, D.M., Castelli, M., Popovic, A.: An artificial intelligence system for predicting customer default in e-commerce. Expert Syst. Appl. 104 , 1–21 (2018)

Wamba, S., Queiroz, M., Trinchera, L.: The role of artificial intelligence-enabled dynamic capability on environmental performance: the meditation effect of a data-driven culture in France and the USA. Int. J. Prod. Econ. (2024)

Wirtz, B.W., Müller, W.M.: An integrated artificial intelligence framework for public management. Public Manag. Rev. 21 (7), 1076–1100 (2019). https://doi.org/10.1080/14719037.2018.1549268

Xu, Y., Shieh, C.H., Van Esch, P., Ling, I.L.: AI customer service: task complexity, problem-solving ability, and usage intention. Australas. Mark. J. 28 (4), 189–199 (2020). https://doi.org/10.1016/j.ausmj.2020.03.005

Yin, R.K.: Doing case study research (2009)

Yin, R.K.: Case Study Research: Design and Methods. Sage, Newbury Park, CA, USA (1984)

Yin, R.K.: Case Study Research: Design and Methods, 3rd edn. Sage, Thousand Oaks, CA (2003)

Yin, R.K.: Case Study Research and Applications: Design and Methods, 6th edn. Sage, Los Angeles (2018)

Zeithaml, V.A., Jaworski, B.J., Kohli, A.K., Tuli, K.R., Ulaga, W., Zaltman, G.: A theories-in-use approach to building marketing theory. J. Mark. 84 (1), 32–51 (2019). https://doi.org/10.1177/0022242919888477

Zoheir, S.: Zoheir Sabeur’s Artificial Intelligence and Knowledge Extraction Lab. Bournemouth University (2019)

Download references

Author information

Authors and affiliations.

Brunel University London, Kingston Ln, London, Uxbridge, UB8 3PH, UK

Maryam Adhaen, Weifeng Chen & Rami Abu Wadi

Ahlia University, Manama, Bahrain

Rami Abu Wadi & Esra Aldhaen

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Maryam Adhaen .

Editor information

Editors and affiliations.

College of Business and Finance, Ahlia University, Manama, Bahrain

Allam Hamdan

IMC University of Applied Sciences Krems, Krems, Austria

Udo Braendle

Rights and permissions

Reprints and permissions

Copyright information

© 2024 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Adhaen, M., Chen, W., Wadi, R.A., Aldhaen, E. (2024). Exploring Artificial Intelligence Adoption in the Banking Sector: Multiple Case Studies. In: Hamdan, A., Braendle, U. (eds) Harnessing AI, Machine Learning, and IoT for Intelligent Business. Studies in Systems, Decision and Control, vol 550. Springer, Cham. https://doi.org/10.1007/978-3-031-66218-8_23

Download citation

DOI : https://doi.org/10.1007/978-3-031-66218-8_23

Published : 16 October 2024

Publisher Name : Springer, Cham

Print ISBN : 978-3-031-66217-1

Online ISBN : 978-3-031-66218-8

eBook Packages : Engineering Engineering (R0)

Share this chapter

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

- Explore AI by Industry PLUS

- Consumer goods

- Heavy industry

- Natural resources

- Professional services

- Transportation

- AI Best Practice Guides PLUS

- AI White Paper Library PLUS

- AI Business Process Explorer PLUS

- Enterprise AI Newsletter

- Emerj Plus Research

- Emerj Solution Summits

- Thought Leadership Series

- Big Idea Report

- AI in Business Podcast

- AI in Financial Services Podcast

- AI in Healthcare and Life Sciences Podcast

- The AI Consulting Podcast

- Precisely – Building Trust in Data

- Shift Technology – How Insurers are Using AI

- Uniphore – The Future of Banking CX in APAC

- Uniphore – The Economic Impact of Conversational AI and Automation

- Uniphore – The Future of Complaints Management

- Uniphore – Conversational AI in Banking

Business Intelligence in Banking – Current Applications

Niccolo is a content writer and Junior Analyst at Emerj, developing both web content and helping with quantitative research. He holds a bachelor's degree in Writing, Literature, and Publishing from Emerson College.

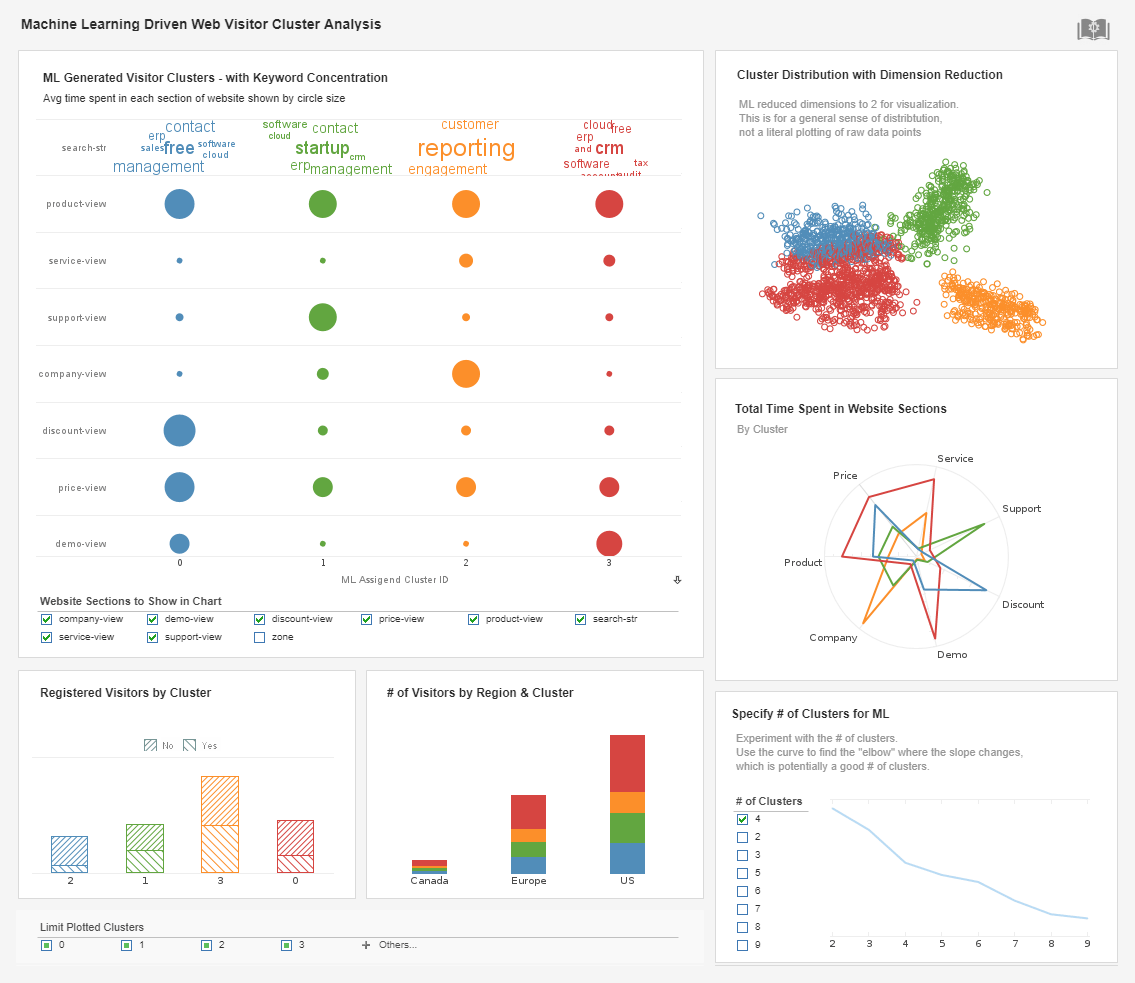

Decision-makers in the banking sector have a unique set of business intelligence needs, and artificial intelligence has been on the radar of banking executives for several years now. It follows that AI and machine learning would find their way into business intelligence applications for the banking sector.

In this report, we discuss AI-driven business intelligence software for the banking sector and their evidence of success. As it turns out, there isn’t much. The companies covered in this report all lack banking case studies for their business intelligence software, which may be indicative of the nascency of AI for this particular application in banking. That said, these companies do offer case studies for other sectors.

Nevertheless, in general, there seem to be two ways in which AI-driven business intelligence software could bring value to banks and financial institutions , including investment firms . These include:

- Report Generation – creating reports with a variety of visualizations that suit the needs of employees at different departments

- Predictive Analytics – correlating enterprise data to find patterns on which executives can take action

In this report, we’ll discuss the uses cases of AI-driven business intelligence applications in the banking sector by taking a look at four vendors that offer AI software to banks. We’ll begin by examining the vendors offering report generation-related AI solutions:

Report Generation

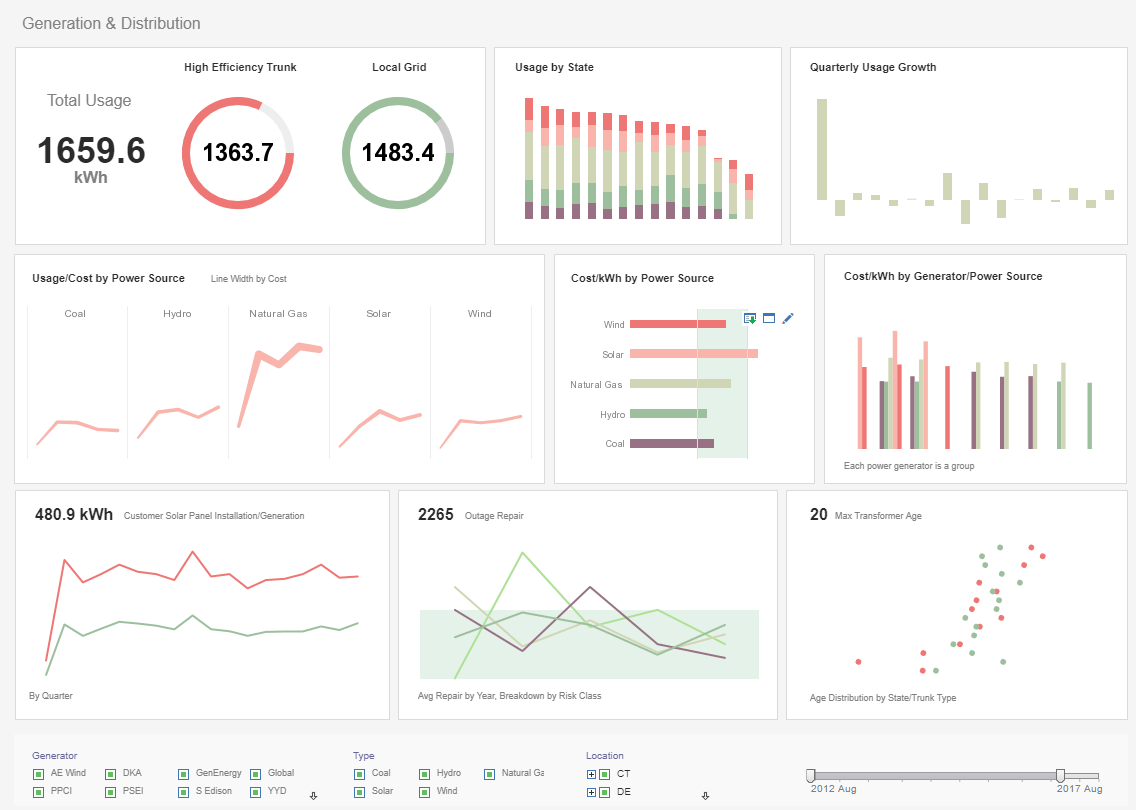

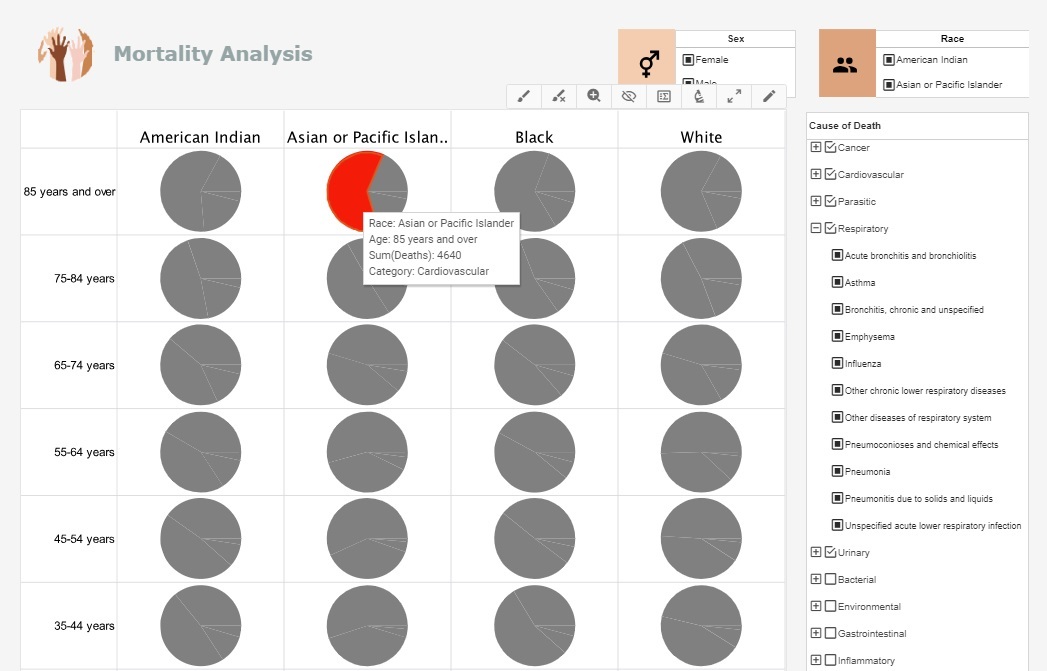

SAS offers software called SAS Visual Analytics , which it claims can help banks provide their lead staff with self-service analytics and interactive reports using what appears to be a combination of predictive analytics and natural language processing . For banks, this analysis and reporting may be related to customer buying patterns, loan payments , or customer experience .

This could be for strategies on gaining customers or to finding customers less likely to default on loans. SAS claims that in addition to the data analytics capabilities of its solution, it can also discern the sentiment behind text data, such as social media posts, and mark it as positive or negative. This is likely accomplished through natural language processing.

Below is an 8 -minute video demonstrating how SAS Visual Analytics can segment customers. In this video, the demonstrator is able to segment the section of his customer base by 4:40:

We can infer the machine learning model behind the predictive analytics portion of the software needs to be trained on the client’s data related to banking transactions, customer profiles, and geolocation. For example, if a customer made an ATM withdrawal, the relevant data from that transaction would be the customer’s age, what gender they are, and where the ATM is relative to their bank. Customer segments could become more specific than this, however. The data would then be run through the software’s machine learning algorithm.

This would have trained the algorithm to discern which data points correlate to changes in behavior or new patterns forming within a bank’s customer base. This could be across the entire customer base or focused into a segment of customers based on age, gender, or geolocation .

The software would then be able to predict, report on, and visualize these changes or patterns. As a result, business leaders can provide organized information to other departments. Users can create various types of graphs and charts to depict the data in a more organized fashion, and these models can be shared between staff through the software. This may or may not require the user to upload information about their future plans or banking protocol into the software beforehand.

If the SAS Visual Analytics solution does leverage natural language processing to analyze text data, it would have to be trained on thousands of social media posts or other text data samples, such as emails. This data would involve customer experiences in financial aspects such as banking and loans. The data would be labeled as a negative or positive experience.

SAS would then expose the machine learning model to the labeled text data. This would train the algorithm to discern the chains of text that, to the human brain, might be interpreted as a positive or negative sentiment as conveyed by a social media post.

SAS Visual Analytics would then be able to run through public social media posts or any other text data in need of sentiment analysis, and the software’s algorithm would be able to determine if the customer’s experience was positive or negative. This may require the users to upload data about their future changes to banking operations into the software beforehand.

It’s likely that users in banking can integrate the software into existing databases for banking and customer information, as well as systems that would allow the transfer of text data from social media.

SAS does not make available any case studies showing a bank or financial institution’s success with their software, but it lists Royal Bank of Scotland, Cosmos Bank, and Erste Bank Croatia as some of their past clients.

Jim Goodnight is CEO at SAS . He holds a PhD in Statistics from North Carolina State University . Goodnight has spent the last 42 years of his career at SAS.

Thoughtspot

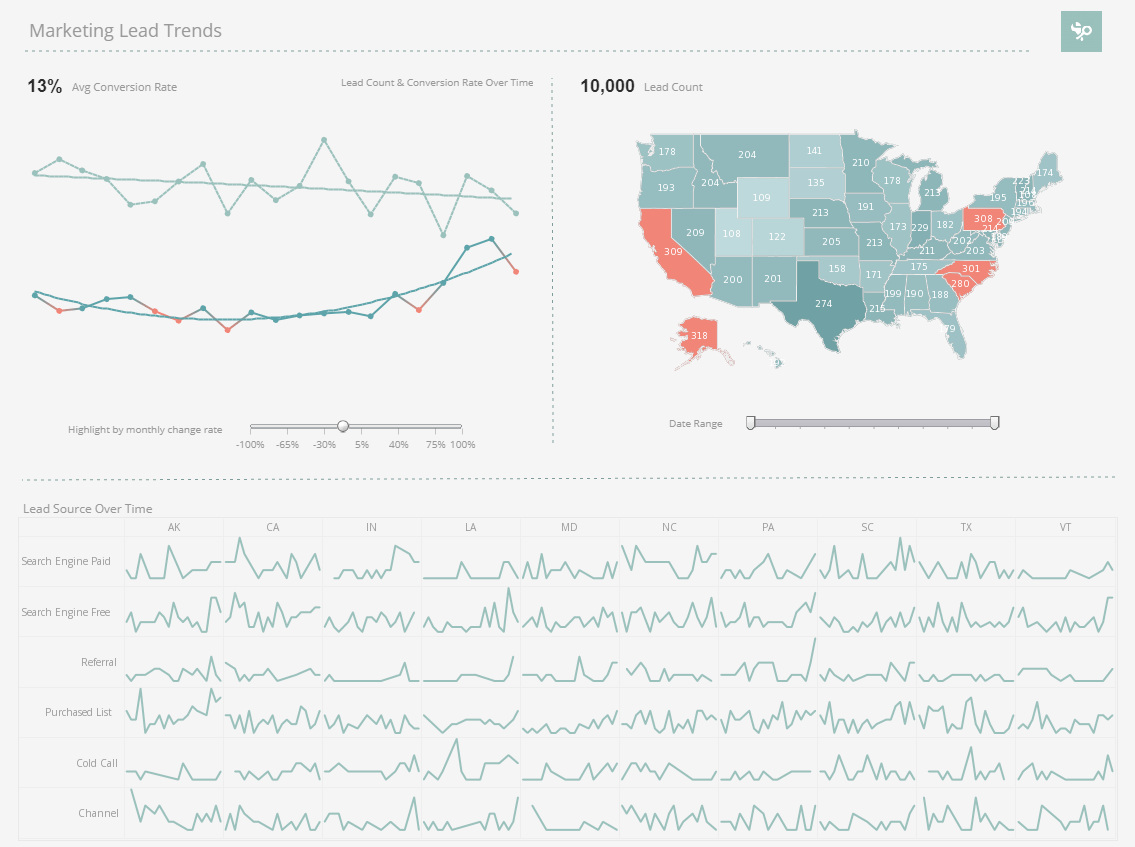

Thoughtspot offers software called Thoughtspot Embedded Analytics , which it claims can help banks and financial institutions easily search through large stores of data. A user can purportedly start typing in a search term into the software’s search function, such as “New York,” and the search bar creates a drop-down menu of possible insights the user may want to generate a graph out of.

The software also purportedly allows users to type questions into the search bar using everyday language, which likely indicates that the system uses natural language processing. The company claims that the insights its software generates for users are powered by machine learning. Generating correlations out of large volumes of data is a classic use case for machine learning.

The software starts generating a graph before the user has selected the kind of visualization that they prefer at the moment. It is unclear if the graph is generated based on the user’s own history of chosen visualizations or if there is a default of some sort.

The video below demonstrates the software’s search function and shows how graphs are generated as the user types:

For example, a user might want to figure out if a certain age demographic, say millennials, were more or less likely to default on their loans within a given location, say New York. They could type relevant search terms (millennials, New York, loan default) into the search function and be presented with several options for visualizing several different correlations, including one between millennials, New York, and loan default status.

Thoughtspot claims banks can integrate their stores of data into Thoughtspot within a relatively short timeframe in comparison to other data visualization tools, although they do not present a case study to verify this claim.

Thoughtspot does not make available any case studies that show a bank’s success with the software, but they list Scotiabank and Sterling National Bank as some of their past clients.

Amit Prakash is co-founder and CTO at Thoughtspot . He holds a PhD in Computer Engineering from The University of Texas at Austin . Previously, Prakash served as Software Engineer at Microsoft .

Aithent offers software called Aithent Analytics for Business Intelligence (AABI) , which it claims can help banks and financial institutions transform data from multiple and disparate sources into actionable knowledge for their management using predictive analytics . Such knowledge involves profit and loss, return on investment, and customer information.

The software is reported to create templates from detected patterns to help business leaders in their decision making. The templates serve as visualizations of current trends, which is helpful in communicating technical changes to other departments and for planning ahead. Aithent claims their software’s reporting and templating of data can be scaled widely or acutely to find insights for more specific business areas.

In addition, they advertise the ability for users to generate custom alerts for patterns they want to monitor closely. With this feature, users can eliminate false positive alerts by indicating to the software that the alert was not helpful or did not accurately reflect what is likely to happen.

The company states their software’s machine learning model would need to be trained on their client’s own company data, which likely consists of transaction data, customer profiles, and loan contracts. Aithent would then expose the machine learning algorithm behind their software to the client’s data.

This would train the algorithm to discern which data points correlate to patterns in customer banking or buying behavior, such as a customer who has defaulted on multiple loans within a certain period. The algorithm could also discern the data that correlates to customer behavior changes across segments, as well as fraud or attempts at fraud.

The software could then predict and report on various customer patterns a bank manager would want to know about when making decisions for their company. These could include behavioral patterns that usually precede fraud and customers with a high risk of defaulting on a loan.

These patterns can also be found within specific customer segments, such as men aged 30-50 years old. This may or may not require the user to upload information about their recent loan contracts or future business plans into the software beforehand.

Aithent claims bank managers can integrate the software into existing databases for bank and customer information.

We could not find a video demonstrating how Aithent’s AABI software works. Aithent does not make available any case studies showing success with their software, and they do not list any major banks as clients for this solution.

Gourish Hosangady is Executive Vice President of Business Analytics at DataRobot . He holds an MS in Engineering from the University of Missouri . Previously, Hosangady served as Vice President of Business Intelligence Solutions at Inforeem .

Predictive Analytics

DataRobot offers a namesake software which it claims can help banks and financial institutions gain insights from business data and create tables and models from company data. Each predictive model is a visualized representation of the predictions the software makes to organize the results for clarity and communicability. They do this using predictive analytics .

DataRobot states their software’s machine learning model is trained on their client’s company data, which is likely hundreds of thousands of customer profiles and transaction records. For example, a predictive model could display all of a given customer’s late payments and loan defaults in a visualized chart by accessing the banking data associated with that customer. To do this, the software would need to have been trained on loan and customer data relating to prepayment risk, credit risk, and late payments.

The bank or data scientist would then expose the machine learning algorithm to this data. This would have trained the algorithm to discern which data points correlate to the desired search term or terms that narrow down data results and could be used to create a predictive model in the form of a graph or table.